PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913471

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913471

Aircraft Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

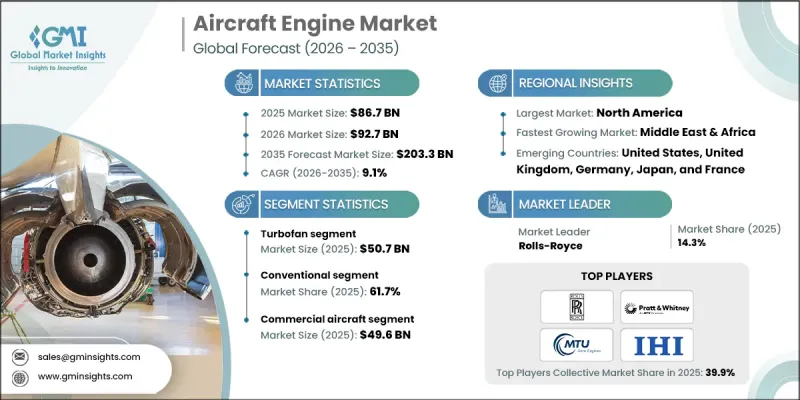

The Global Aircraft Engine Market was valued at USD 86.7 billion in 2025 and is estimated to grow at a CAGR of 9.1% to reach USD 203.3 billion by 2035.

Market expansion is driven by increasing global passenger traffic, rising aircraft utilization rates, and a growing need for advanced propulsion systems. Airlines are prioritizing fleet renewal programs, which directly increases demand for modern engines and long-term maintenance solutions. At the same time, rising investments in next-generation aviation technologies and sustained growth in aftermarket and maintenance services are reinforcing revenue streams. Defense aviation upgrades are also contributing to market strength as governments invest in high-performance aircraft platforms. The overall market outlook remains positive as efficiency, reliability, and sustainability become central priorities across commercial and military aviation, encouraging continuous innovation and long-term engine procurement programs worldwide.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $86.7 Billion |

| Forecast Value | $203.3 Billion |

| CAGR | 9.1% |

Rising air travel volumes continue to place upward pressure on aircraft engine demand, as higher passenger movement leads to increased aircraft operations and accelerated engine usage cycles. Airlines expanding their fleets require new-generation engines that offer improved fuel efficiency and operational reliability, while aging aircraft replacements further stimulate engine sales and aftermarket demand. In parallel, military aviation modernization programs are reinforcing market growth as defense forces transition toward more capable aircraft platforms. These modernization efforts require engines that deliver consistent performance under demanding operational conditions, while maintaining efficiency and durability.

The turbofan engine segment generated USD 50.7 billion in 2025, supported by the increasing adoption of advanced propulsion technologies across commercial aviation fleets. Demand for engines that reduce fuel consumption and emissions is accelerating replacement cycles, driving sustained investment in turbofan development and deployment.

The conventional engine category accounted for 61.7% share in 2025. Continued fleet modernization initiatives are supporting steady demand for conventional propulsion systems, as newer aircraft designs offer lower fuel burn and reduced environmental impact, allowing operators to align with evolving regulatory standards in a cost-effective manner.

North America Aircraft Engine Market held a 43.4% share in 2025. Ongoing recovery in air transport activity and sustained defense spending are driving demand for new engines and propulsion system upgrades. Fleet renewal programs and long-term military investments continue to support regional market dominance.

Key companies operating in the Global Aircraft Engine Market include General Electric Company, Rolls-Royce, Pratt & Whitney (RTX), Safran Group, CFM International, MTU Aero Engines AG, Mitsubishi Heavy Industries Aero Engines, Ltd., IHI Corporation, ITP Aero, Engine Alliance, Enjet Aero, and Textron Inc. These companies play a central role in shaping technological advancements and global supply dynamics. Companies in the Aircraft Engine Market are reinforcing their competitive position through continuous investment in research and development focused on efficiency, durability, and emissions reduction. Strategic collaborations with airframe manufacturers and long-term service agreements are being used to secure recurring revenue and customer loyalty. Many players are expanding aftermarket capabilities to capture lifecycle value through maintenance, repair, and overhaul services. Capacity expansion and digital engine monitoring solutions are also being prioritized to improve performance optimization and predictive maintenance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2026-2035 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising air travel demand

- 3.2.1.2 Technological advancements in engine efficiency

- 3.2.1.3 Expansion of Engine Aftermarket and MRO Services

- 3.2.1.4 Increased investment in emerging aircraft technologies

- 3.2.1.5 Increasing Defense and Military Aviation Modernization

- 3.2.2 Pitfalls and challenges

- 3.2.2.1 High Research and Development (R&D) costs

- 3.2.2.2 Supply Chain and Manufacturing Constraints

- 3.2.3 Opportunities

- 3.2.3.1 Growth of hybrid-electric and sustainable propulsion technologies

- 3.2.3.2 Expansion of engine aftermarket and predictive maintenance services

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Defense Budget Analysis

- 3.11 Global Defense Spending Trends

- 3.12 Regional Defense Budget Allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key Defense Modernization Programs

- 3.14 Budget Forecast (2026-2035)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.14.3 Defense Budget Allocation by Segment

- 3.14.3.1 Personnel

- 3.14.3.2 Operations and Maintenance

- 3.14.3.3 Procurement

- 3.14.3.4 Research, Development, Test and Evaluation

- 3.14.3.5 Infrastructure and Construction

- 3.14.3.6 Technology and Innovation

- 3.15 Sustainability Initiatives

- 3.16 Supply Chain Resilience

- 3.17 Geopolitical Analysis

- 3.18 Workforce Analysis

- 3.19 Digital Transformation

- 3.20 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.21 Risk Assessment and Management

- 3.22 Major Contract Awards (2022-2025)

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Product portfolio comparison

- 4.3.1.1 Product range breadth

- 4.3.1.2 Technology

- 4.3.1.3 Innovation

- 4.3.2 Geographic presence comparison

- 4.3.2.1 Global footprint analysis

- 4.3.2.2 Service network coverage

- 4.3.2.3 Market penetration by region

- 4.3.3 Competitive positioning matrix

- 4.3.3.1 Leaders

- 4.3.3.2 Challengers

- 4.3.3.3 Followers

- 4.3.3.4 Niche players

- 4.3.4 Strategic outlook matrix

- 4.3.1 Product portfolio comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 (USD Billion)

- 5.1 Key trends

- 5.2 Turboprop

- 5.3 Turbofan

- 5.4 Turboshaft

- 5.5 Piston engine

Chapter 6 Market Estimates and Forecast, By Component, 2022 - 2035 (USD Billion)

- 6.1 Key trends

- 6.2 Turbine

- 6.3 Compressor

- 6.4 Gearbox

- 6.5 Exhaust system

- 6.6 Fuel system

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Technology, 2022 - 2035 (USD Billion)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Hybrid

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion)

- 8.1 Key trends

- 8.2 Commercial aircrafts

- 8.2.1 Narrow-body

- 8.2.2 Wide-body

- 8.2.3 Regional jets

- 8.2.4 Turboprop/helicopters

- 8.3 Military aircrafts

- 8.3.1 Fighter aircraft

- 8.3.2 Transport aircraft

- 8.3.3 Special mission aircraft

- 8.3.4 Military helicopters

- 8.3.5 Unmanned aerial vehicle

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 General Electric Company

- 10.1.2 Rolls-Royce

- 10.1.3 Pratt & Whitney (RTX)

- 10.1.4 Safran Group

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 Engine Alliance

- 10.2.1.2 Textron Inc.

- 10.2.2 Europe

- 10.2.2.1 MTU Aero Engines AG

- 10.2.2.2 ITP Aero

- 10.2.3 Asia Pacific

- 10.2.3.1 IHI Corporation

- 10.2.3.2 Mitsubishi Heavy Industries Aero Engines, Ltd.

- 10.2.1 North America

- 10.3 Niche / Disruptors

- 10.3.1 CFM International

- 10.3.2 Enjet Aero