PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844377

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844377

Heavy Lifting Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

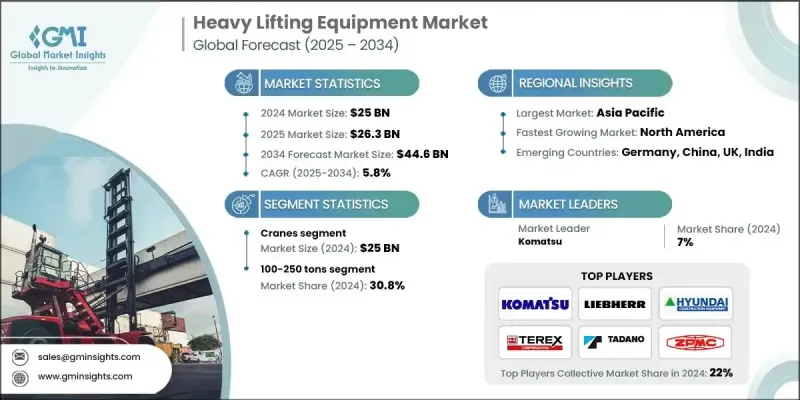

The Global Heavy Lifting Equipment Market was valued at USD 25 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 44.6 billion by 2034.

Market growth is driven by rapid urbanization, industrial expansion, and increasing infrastructure investments worldwide. Heavy lifting equipment plays a critical role in enabling the construction of large-scale projects, efficient mining operations, power generation, and seamless shipping and logistics management. The demand for heavy lifting equipment such as cranes, hoists, and transporters has seen significant growth due to advances in automation, electrification, and digital technologies like IoT and telematics, which enhance operational safety, efficiency, and maintenance. In addition, the adoption of electric and hybrid-powered heavy lifting equipment is accelerating as industries aim to reduce emissions and comply with stricter environmental regulations. This shift is particularly evident in regions with aggressive sustainability targets, such as Europe and North America, where government policies and corporate ESG commitments are pushing the transition away from diesel-powered machinery. The integration of advanced battery systems, regenerative braking, and energy-efficient hydraulics is enabling companies to lower operational costs while enhancing environmental performance. Furthermore, innovations such as remote diagnostics, predictive maintenance, and telematics-enabled monitoring are making these machines safer and more productive, even in complex industrial settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25 Billion |

| Forecast Value | $44.6 Billion |

| CAGR | 5.8% |

The 100-250 tons crane segment held a 30.8% share in 2024. Cranes in this weight class play a vital role in medium to heavy lifting applications and are widely used in infrastructure expansion, mining operations, and large-scale industrial projects. With their strong balance between mobility and lifting strength, these cranes are ideal for complex tasks such as positioning bridge sections, installing wind turbines, and transporting oversized industrial equipment. Their adaptability to function in both densely populated urban zones and remote locations adds to their growing demand across a wide range of operational environments.

In 2024, the cranes segment generated USD 25 billion, underscoring its significance within the heavy lifting equipment sector. This segment includes a variety of specialized machines, such as crawler cranes, tower cranes, mobile cranes, gantry cranes, and overhead cranes, each tailored to serve distinct needs in industries like manufacturing, shipping, energy, and construction. These machines are engineered to deliver precise lifting capabilities, ensuring safe and efficient handling of heavy loads in demanding project conditions.

Asia-Pacific Heavy Lifting Equipment Market will grow at a CAGR of 6.5% through 2034, attributed to massive infrastructure development projects in China, India, and Southeast Asia, alongside increasing adoption of automation and semi-autonomous equipment to address labor shortages. The presence of both global and local players, combined with cost-efficient innovations, is accelerating market penetration in the region.

Key players shaping the Heavy Lifting Equipment Market include Tadano, Konecranes, Shanghai Zhenhua Heavy Industries (ZPMC), Sarens, Palfinger, SANY, Manitowoc Company, Sennebogen, Komatsu, Liebherr, Terex, Cargotec, Mammoet, JASO Industrial Cranes, and Demag Cranes & Components. These companies are investing in the development of smarter, safer, and greener lifting solutions to meet the evolving demands of industries worldwide. As digital transformation and environmental awareness continue to influence equipment purchasing decisions, the heavy lifting equipment market is poised for robust and sustained growth throughout the next decade.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Weight Capacity

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing infrastructure development

- 3.2.1.2 Growth in mining and oil & gas sectors

- 3.2.1.3 Expansion of wind energy projects

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Skilled labour shortage

- 3.2.3 Opportunities

- 3.2.3.1 Infrastructure development in emerging economies

- 3.2.3.2 Automation and smart equipment integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 8428)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Cranes

- 5.2.1 Mobile cranes

- 5.2.1.1 All-terrain cranes

- 5.2.1.2 Crawler cranes

- 5.2.1.3 Rough terrain cranes

- 5.2.1.4 Truck-mounted cranes

- 5.2.2 Fixed cranes

- 5.2.2.1 Tower cranes

- 5.2.2.2 Overhead cranes

- 5.2.2.3 Gantry cranes

- 5.2.2.4 Monorail cranes

- 5.2.3 Marine & port cranes

- 5.2.1 Mobile cranes

- 5.3 Hoists

- 5.3.1 Electric hoists

- 5.3.2 Hydraulic hoists

- 5.3.3 Manual hoists

- 5.4 Transporters

- 5.4.1 Self-propelled modular transporters (SPMTS)

- 5.4.2 Heavy haul trailers

- 5.4.3 Specialized transport vehicles

Chapter 6 Market Estimates and Forecast, By Weight Capacity, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 100-250 Tons

- 6.3 251-500 Tons

- 6.4 501-1000 Tons

- 6.5 Above 1000 Tons

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Oil & gas

- 7.4 Mining

- 7.5 Shipping & port operations

- 7.6 Marine and Shipbuilding

- 7.6.1 Shipyard Operations

- 7.6.2 Offshore Construction

- 7.6.3 Vessel Maintenance and Repair

- 7.6.4 Naval Construction

- 7.7 Power generation

- 7.7.1 Conventional power

- 7.7.2 Renewable energy

- 7.8 Manufacturing

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Cargotec

- 10.2 Demag Cranes & Components

- 10.3 JASO Industrial Cranes

- 10.4 Komatsu

- 10.5 Konecranes

- 10.6 Liebherr

- 10.7 Mammoet

- 10.8 Manitowoc Company

- 10.9 Palfinger

- 10.10 SANY

- 10.11 Sarens

- 10.12 Sennebogen

- 10.13 Shanghai Zhenhua Heavy Industries (ZPMC)

- 10.14 Tadano

- 10.15 Terex