PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928999

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928999

Event Logistics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

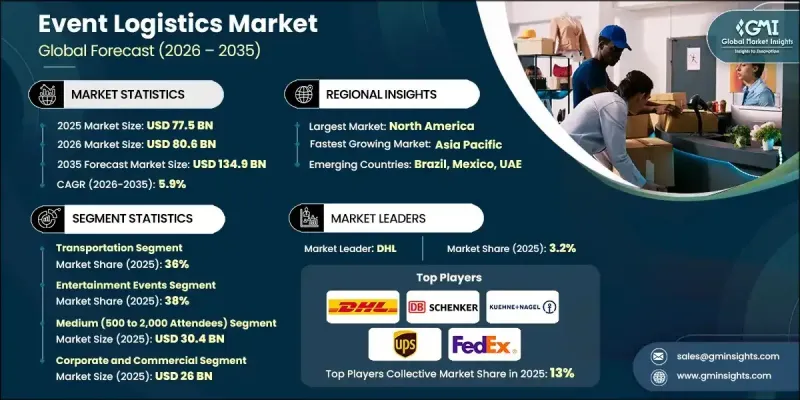

The Global Event Logistics Market was valued at USD 77.5 billion in 2025 and is estimated to grow at a CAGR of 5.9% to reach USD 134.9 billion by 2035.

Market expansion is supported by the rising frequency of large-scale events worldwide and the growing need for highly coordinated, time-sensitive logistics services. Event organizers are increasingly prioritizing precision, reliability, and cost control across complex supply chains to ensure smooth execution and positive participant experiences. As events become more sophisticated and geographically dispersed, demand is increasing for logistics solutions that can manage tight schedules, minimize operational risks, and deliver seamless coordination from planning through post-event operations. The market is also benefiting from widespread digital transformation, as logistics providers adopt advanced technologies to enhance transparency, accuracy, and responsiveness. Real-time visibility and data-driven decision-making are becoming essential to meet evolving client expectations. The shift toward integrated, end-to-end logistics models is enabling better resource utilization, scalability, and consistency across multiple event locations. These developments are reinforcing the role of specialized event logistics providers as strategic partners rather than basic service vendors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $77.5 Billion |

| Forecast Value | $134.9 Billion |

| CAGR | 5.9% |

The transportation segment held 36% share in 2025 and is expected to grow at a CAGR of 4.6% from 2026 to 2035. This segment holds a central position due to its responsibility for ensuring the timely movement of event-related assets. Increased use of digital tracking, connected monitoring systems, and intelligent routing platforms is improving delivery accuracy and schedule adherence.

The entertainment events segment accounted for 38% share in 2025 and is projected to grow at a CAGR of 7.1% from 2026 to 2035. High operational intensity and complex coordination requirements are driving strong reliance on technology-enabled logistics solutions within this segment, supporting its leading position.

United States Event Logistics Market held 83% share and generated USD 23 billion in 2025. Regional leadership is supported by advanced infrastructure and early adoption of digital logistics platforms that enhance efficiency, monitoring, and coordination.

Key companies operating in the Global Event Logistics Market include DHL, UPS, FedEx, Kuehne + Nagel, DB Schenker, C.H. Robinson, XPO Logistics, CEVA Logistics, Nippon Express, and DSV Panalpina. Companies in the Global Event Logistics Market are strengthening their competitive position through technology integration, service diversification, and global network expansion. Many providers are investing in digital platforms that enable real-time visibility, predictive planning, and centralized coordination across event supply chains. Expanding end-to-end service offerings allows companies to manage transportation, storage, on-site handling, and reverse logistics more efficiently. Strategic partnerships with event organizers and venue operators help secure long-term contracts. Firms are also enhancing sustainability initiatives by optimizing routes and reducing emissions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Event Size

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Number of Global Events

- 3.2.1.2 Need for Time-Critical & Reliable Delivery

- 3.2.1.3 Adoption of Digital & Smart Logistics Technologies

- 3.2.1.4 Growth of Corporate Branding & Experiential Marketing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Operational Complexity & Risk

- 3.2.2.2 Limited Margins & High-Cost Sensitivity

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of hybrid, virtual & global events

- 3.2.3.2 Sustainable & green event logistics solutions

- 3.2.3.3 Expansion of cloud-based and integrated platforms

- 3.2.3.4 Adoption of AI- and ML-driven logistics solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.: OSHA & Federal Event Safety Guidelines

- 3.4.1.2 Canada: Transport Canada & WorkSafe Guidelines

- 3.4.2 Europe

- 3.4.2.1 Germany: BMVI & DGUV Regulations

- 3.4.2.2 France: DGME & CNES Guidelines

- 3.4.2.3 UK: MCA & HSE Regulations

- 3.4.2.4 Italy: ENAC & INAIL Guidelines

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Ministry of Transport & Event Safety Regulations

- 3.4.3.2 Japan: JCAB & MLIT Guidelines

- 3.4.3.3 South Korea: MOLIT & Safety Guidelines

- 3.4.3.4 India: Ministry of Shipping & Dock Safety Rules

- 3.4.4 Latin America

- 3.4.4.1 Brazil: ANTAQ & Ministry of Infrastructure Guidelines

- 3.4.4.2 Mexico: SEMAR & DGPM Regulations

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE: Ministry of Energy & Infrastructure Regulations

- 3.4.5.2 Saudi Arabia: Saudi Ports Authority Guidelines

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

- 3.13 Pricing, Commercial & Revenue Model Analysis

- 3.14 Demand-Side Buying Behavior & Decision Framework

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Transportation

- 5.3 Warehousing and storage

- 5.4 Inventory management

- 5.5 On-site setup and dismantling

- 5.6 Logistics planning and Coordination

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Event Size, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Small (up to 500 attendees)

- 6.3 Medium (500 to 2,000 attendees)

- 6.4 Large (2,000 to 10,000 attendees)

- 6.5 Mega (over 10,000 attendees)

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 Corporate Events

- 7.3 Sports Events

- 7.4 Entertainment Events

- 7.5 Public Events

- 7.6 Private Events

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 Corporate and commercial

- 8.3 Entertainment & media

- 8.4 Sports

- 8.5 Government & public sector

- 8.6 Educational institutions

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 C.H. Robinson

- 10.1.2 CEVA Logistics

- 10.1.3 DB Schenker

- 10.1.4 DHL

- 10.1.5 DSV Panalpina

- 10.1.6 FedEx

- 10.1.7 Kuehne + Nagel

- 10.1.8 Nippon Express

- 10.1.9 UPS

- 10.1.10 XPO Logistics

- 10.2 Regional Player

- 10.2.1 Agility Logistics

- 10.2.2 Bollore Logistics

- 10.2.3 DB Cargo Logistics

- 10.2.4 GEFCO

- 10.2.5 Geodis

- 10.2.6 Hellmann Worldwide Logistics

- 10.2.7 Kerry Logistics

- 10.2.8 Mainfreight

- 10.2.9 Rhenus Logistics

- 10.2.10 TVS Supply Chain Solutions

- 10.3 Emerging Players

- 10.3.1 Flexport

- 10.3.2 Locus Logistics

- 10.3.3 OnTime Logistics

- 10.3.4 Senpex

- 10.3.5 ShipMonk