PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913420

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913420

Space lander and Rover Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

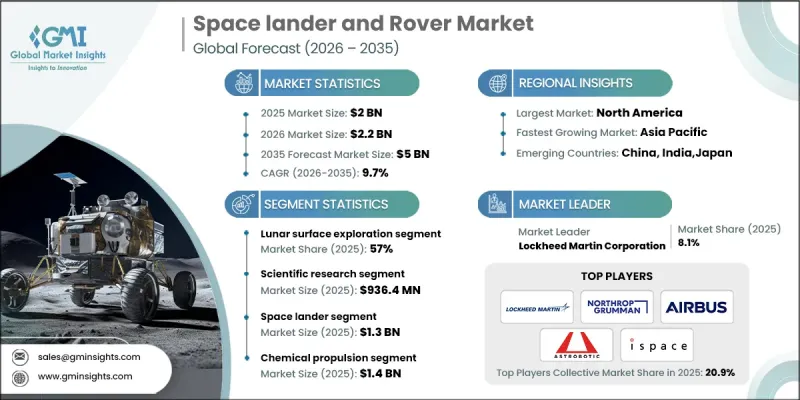

The Global Space lander and Rover Market was valued at USD 2 billion in 2025 and is estimated to grow at a CAGR of 9.7% to reach USD 5 billion by 2035.

Growth is supported by rising worldwide focus on planetary exploration missions and continuous progress in autonomous mobility, navigation, and robotic systems. Governments and private organizations are increasingly committing long-term funding toward off-Earth exploration goals, which is driving demand for advanced surface exploration platforms. Expanding private sector participation is accelerating innovation cycles, encouraging the development of lighter, more capable, and cost-efficient landers and rovers. Technological improvements in onboard intelligence, durability, and energy efficiency are further strengthening market momentum. As exploration ambitions extend beyond short-term missions, the need for reliable systems capable of operating in extreme environments continues to increase. This evolving landscape is pushing manufacturers to develop adaptable platforms that support extended missions and future infrastructure development, reinforcing steady growth across the global market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2 Billion |

| Forecast Value | $5 Billion |

| CAGR | 9.7% |

The lunar surface exploration segment accounted for 57% share in 2025. This segment benefits from the growing demand for autonomous systems capable of operating efficiently in harsh surface conditions. Manufacturers are prioritizing advanced mobility platforms and resource utilization technologies designed to support sustained lunar missions while maintaining cost efficiency and operational reliability.

The scientific research segment generated USD 936.4 million in 2025. Growth in this segment is driven by increased investment in exploration missions and the expanding need for accurate scientific data from planetary surfaces. Manufacturers are focusing on high-precision instruments, robust data collection systems, and adaptable mission architectures to meet evolving research objectives.

North America Space lander and Rover Market held a 48% share in 2025. Regional dominance is supported by strong public funding, increasing collaboration with private space companies, and rapid development of autonomous technologies aimed at improving mission performance and lowering operational expenses.

Key players operating in the Global Space lander and Rover Market include Lockheed Martin Corporation, Airbus SE, Northrop Grumman Corporation, Blue Origin, Roscosmos, ISRO, European Space Agency, Canadian Space Agency, Japan Aerospace Exploration Agency (JAXA), China Academy of Space Technology, Spacebit Technologies, Astrobotic Technology, ispace, inc., and NASA. Companies in the Global Space lander and Rover Market strengthen their competitive position through sustained investment in advanced robotics, autonomous navigation, and modular spacecraft design. Manufacturers focus on developing versatile platforms that can support multiple mission profiles while reducing overall system weight and complexity. Strategic collaboration with government agencies and private partners helps secure long-term project pipelines. Firms also prioritize durability and reliability to ensure performance in extreme extraterrestrial environments.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Mission type trends

- 2.2.2 Vehicle type trends

- 2.2.3 Propulsion type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging global interest in lunar and martian exploration missions

- 3.2.1.2 Technological advancements in autonomous navigation and mobility systems

- 3.2.1.3 Private sector investment and expansion in space exploration technologies

- 3.2.1.4 Governmental commitments to long-term lunar and mars colonization plans

- 3.2.1.5 Development of In-Situ resource utilization (isru) capabilities for space exploration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development costs and technological complexity

- 3.2.2.2 Risks of mission failures due to harsh extraterrestrial environments

- 3.2.3 Market opportunities

- 3.2.3.1 Development of sustainable space habitats

- 3.2.3.2 Advancements in autonomous technology for exploration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense Budget Analysis

- 3.11 Global Defense Spending Trends

- 3.12 Regional Defense Budget Allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key Defense Modernization Programs

- 3.14 Budget Forecast (2026-2035)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.14.3 Defense Budget Allocation by Segment

- 3.14.3.1 Personnel

- 3.14.3.2 Operations and Maintenance

- 3.14.3.3 Procurement

- 3.14.3.4 Research, Development, Test and Evaluation

- 3.14.3.5 Infrastructure and Construction

- 3.14.3.6 Technology and Innovation

- 3.15 Supply Chain Resilience

- 3.16 Geopolitical Analysis

- 3.17 Workforce Analysis

- 3.18 Digital Transformation

- 3.19 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.20 Risk Assessment and Management

- 3.21 Major Contract Awards (2022-2025)

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Mission Type, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Lunar surface exploration

- 5.3 Mars surface exploration

- 5.4 Asteroids and comet exploration

Chapter 6 Market Estimates and Forecast, By Vehicle Type, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Space landers

- 6.3 Space rovers

Chapter 7 Market Estimates and Forecast, By Propulsion Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Chemical propulsion

- 7.3 Electric/Ion propulsion

- 7.4 Hybrid propulsion systems

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Chemical propulsion

- 8.3 Electric/Ion propulsion

- 8.4 Hybrid propulsion systems

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Government and defense

- 9.3 Space exploration organizations

- 9.4 Private aerospace companies

- 9.5 Research institutions

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Lockheed Martin Corporation

- 11.1.2 Northrop Grumman Corporation

- 11.1.3 NASA

- 11.1.4 Roscosmos

- 11.1.5 Airbus SE

- 11.2 Regional key players

- 11.2.1 North America

- 11.2.1.1 Blue Origin

- 11.2.1.2 Canadian Space Agency

- 11.2.2 Asia Pacific

- 11.2.2.1 ISRO

- 11.2.2.2 Japan Aerospace Exploration Agency (JAXA)

- 11.2.2.3 China Academy of Space Technology

- 11.2.3 Europe

- 11.2.3.1 European Space Agency

- 11.2.3.2 Spacebit Technologies

- 11.2.1 North America

- 11.3 Niche Players/Disruptors

- 11.3.1 Astrobotic Technology

- 11.3.2 ispace, inc.