PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913437

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913437

Satellite Communication (SATCOM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

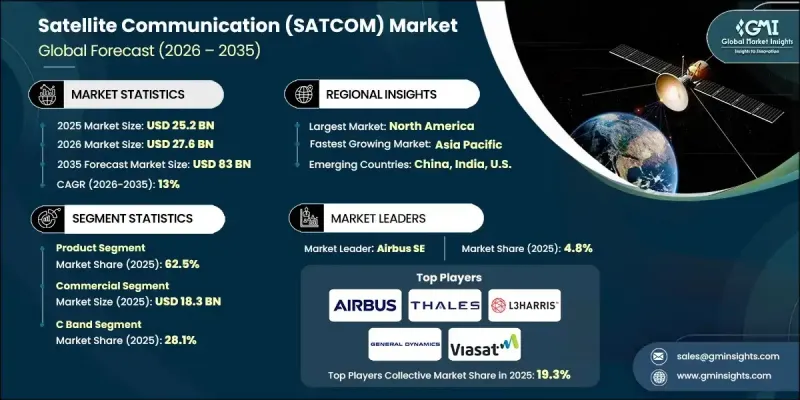

The Global Satellite Communication (SATCOM) Market was valued at USD 25.2 billion in 2025 and is estimated to grow at a CAGR of 13% to reach USD 83 billion by 2035.

Market momentum is supported by the accelerating need for uninterrupted connectivity, the rapid deployment of compact satellite networks, and rising demand for communication access in geographically challenging regions. Increasing adoption of connected devices and machine-based communication continues to elevate demand for secure, real-time data transmission across multiple sectors. Satellite communication is becoming a critical component of global digital infrastructure as terrestrial networks alone are unable to provide consistent coverage. Integration between satellite platforms and next-generation mobile networks is gaining traction, enabling seamless connectivity where traditional networks remain limited. Ongoing innovation within satellite architecture and ground systems is improving capacity, resilience, and transmission efficiency. The industry is also witnessing heightened focus on secure and high-throughput communication capabilities, particularly to meet the evolving requirements of institutional and enterprise users. These combined factors continue to reinforce satellite communication as a foundational technology for global connectivity expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.2 Billion |

| Forecast Value | $83 Billion |

| CAGR | 13% |

The services segment was valued at USD 9.5 billion in 2025 and is expected to grow at a CAGR of 13.5% during 2026-2035. Rising dependence on continuous, high-speed communication and broader accessibility of satellite-enabled services are increasing reliance on satellite-based solutions across commercial and institutional users. Advancements in satellite technology have expanded global reach, strengthening demand for service-based offerings.

The C-band segment held a 28.1% share in 2025. Its strong performance is supported by stable signal transmission, long-range coverage, and reduced sensitivity to environmental interference. Established adoption across communication networks continues to support its dominance as demand rises for dependable satellite broadcasting and connectivity solutions.

North America Satellite Communication (SATCOM) Market accounted for 45.6% share in 2025. Regional growth is driven by sustained government investment, expanding satellite broadband demand in underserved areas, increasing reliance on satellite-enabled emergency systems, and growing integration between satellite platforms and advanced wireless technologies. Continued investment in space infrastructure supports long-term regional leadership.

Key companies operating in the Global Satellite Communication (SATCOM) Market include Viasat, Thales, SES S.A., Iridium Communications, Airbus SE, Honeywell, Intelsat S.A., L3Harris Technologies, Space Exploration Technologies Corp., Telesat Corporation, Gilat Satellite Networks, Maxar Technologies Inc., General Dynamics Mission Systems, Intellian Technologies, Cobham Satcom, SKY Perfect JSAT Holdings Inc., Thuraya Telecommunications Company (Yashat), Viking Satcom, AvL Technologies, EchoStar Mobile, ASELSAN, Holkirk Communications, and China Aerospace Science and Technology Corporation (CASC). Companies in the Global Satellite Communication (SATCOM) Market strengthen their market position through continuous investment in advanced satellite architectures and next-generation network integration. Firms focus on expanding high-capacity satellite constellations to improve coverage, resilience, and data throughput. Strategic partnerships with network operators and government agencies support long-term contract stability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Solution trends

- 2.2.2 Platform trends

- 2.2.3 Frequency trends

- 2.2.4 Industrial vertical trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of internet connectivity demand

- 3.2.1.2 Development of small satellite constellations to enhance communication systems

- 3.2.1.3 Increase demand for connectivity in remote areas

- 3.2.1.4 Rising demand for IoT and M2M connectivity

- 3.2.1.5 Growing integration with 5G networks

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs and long development cycles

- 3.2.2.2 Space debris and orbital congestion

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging demand for global connectivity

- 3.2.3.2 Advancements in satellite miniaturization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense Budget Analysis

- 3.11 Global Defense Spending Trends

- 3.12 Regional Defense Budget Allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key Defense Modernization Programs

- 3.14 Budget Forecast (2026-2035)

- 3.14.1 Impact on Industry Growth

- 3.14.2 Defense Budgets by Country

- 3.14.3 Defense Budget Allocation by Segment

- 3.14.3.1 Personnel

- 3.14.3.2 Operations and Maintenance

- 3.14.3.3 Procurement

- 3.14.3.4 Research, Development, Test and Evaluation

- 3.14.3.5 Infrastructure and Construction

- 3.14.3.6 Technology and Innovation

- 3.15 Supply Chain Resilience

- 3.16 Geopolitical Analysis

- 3.17 Workforce Analysis

- 3.18 Digital Transformation

- 3.19 Mergers, Acquisitions, and Strategic Partnerships Landscape

- 3.20 Risk Assessment and Management

- 3.21 Major Contract Awards (2022-2025)

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Solution, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Antennas

- 5.2.1.1 Phased arrays

- 5.2.1.2 Active electronically scanned array (AESA)

- 5.2.1.3 Digital beam forming (DBF) array

- 5.2.1.4 Others

- 5.2.2 Transceivers

- 5.2.2.1 Transmitters

- 5.2.2.2 Receivers

- 5.2.2.3 Power amplifiers

- 5.2.2.4 Converters

- 5.2.2.5 Modem & routers

- 5.2.2.6 Other component

- 5.2.1 Antennas

- 5.3 Services

- 5.3.1 Engineering & integration

- 5.3.2 Installation

- 5.3.3 Logistics & maintenance

Chapter 6 Market Estimates and Forecast, By Platform, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Portable

- 6.2.1 Manpack

- 6.2.2 Handheld

- 6.2.3 Deployable/flyaway

- 6.3 Land mobile

- 6.3.1 Commercial vehicles/transport

- 6.3.2 Military vehicles

- 6.3.3 Unmanned ground vehicles

- 6.4 Land fixed

- 6.4.1 Command & control centers

- 6.4.2 Earth stations/ground station

- 6.4.3 Direct to home (DTH)/satellite tv

- 6.4.4 Enterprise Systems

- 6.5 Airborne

- 6.5.1 Commercial aircraft

- 6.5.2 Military aircraft

- 6.5.3 Unmanned aerial vehicles (UAVs)

- 6.6 Maritime

- 6.6.1 Commercial ships

- 6.6.2 Military ships

Chapter 7 Market Estimates and Forecast, By Frequency, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 C Band

- 7.3 S Band

- 7.4 L Band

- 7.5 X Band

- 7.6 Ka Band

- 7.7 Ku Band

- 7.8 VHF/UHF Band

- 7.9 EHF/SHF Band

- 7.10 Others

Chapter 8 Market Estimates and Forecast, By Industry Vertical, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Commercial

- 8.2.1 Telecommunication & cellular backhaul

- 8.2.2 Media & entertainment

- 8.2.3 Transportation & logistics

- 8.2.4 Scientific research & development

- 8.2.5 Aviation

- 8.2.6 Marine

- 8.2.7 Retail & consumer

- 8.2.8 Others

- 8.3 Government & defense

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Airbus SE

- 10.1.2 Intelsat S.A.

- 10.1.3 Space Exploration Technologies Corp.

- 10.1.4 SES S.A.

- 10.2 Regional key players

- 10.2.1 North America

- 10.2.1.1 General Dynamics Mission Systems

- 10.2.1.2 L3Harris Technologies

- 10.2.1.3 Viasat

- 10.2.1.4 EchoStar Mobile

- 10.2.2 Asia Pacific

- 10.2.2.1 China Aerospace Science and Technology Corporation (CASC)

- 10.2.2.2 SKY Perfect JSAT Holdings Inc.

- 10.2.2.3 Intellian Technologies

- 10.2.3 Europe

- 10.2.3.1 Thales

- 10.2.3.2 Gilat Satellite Networks

- 10.2.3.3 SES S.A.

- 10.2.1 North America

- 10.3 Niche Players/Disruptors

- 10.3.1 AvL Technologies

- 10.3.2 Cobham Satcom

- 10.3.3 Maxar Technologies Inc.

- 10.3.4 Honeywell

- 10.3.5 Viking Satcom

- 10.3.6 Thuraya Telecommunications Company (Yashat)

- 10.3.7 Iridium Communications

- 10.3.8 Telesat Corporation

- 10.3.9 Holkirk Communications