PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871321

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871321

Conductive Polymers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

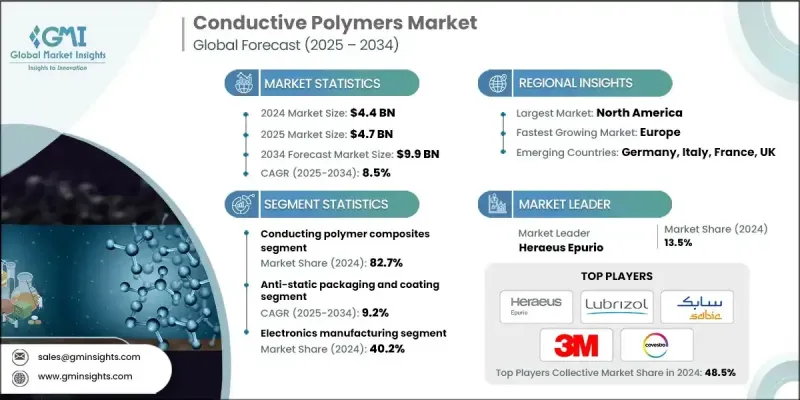

The Global Conductive Polymers Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 9.9 billion by 2034.

The rapid growth of this market is driven by rising demand across multiple industries that seek advanced materials combining electrical conductivity with lightweight and flexible characteristics. Conductive polymers are emerging as one of the most versatile solutions for industries striving for innovation and sustainability. Their ability to offer both mechanical flexibility and efficient conductivity makes them indispensable in automotive, healthcare, and consumer goods applications. Increasing environmental awareness and the growing preference for recyclable, non-toxic materials further amplify their adoption. The market continues to evolve as companies explore their potential in next-generation applications, including sensors, energy storage, and smart textiles. The widespread movement toward sustainable materials, coupled with rapid advancements in electronics and green manufacturing, is expected to continue driving demand for conductive polymers over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 8.5% |

In the healthcare sector, conductive polymers are increasingly used in bioelectronics, sensors, and medical devices due to their biocompatibility and adaptability. Their growing role in automotive manufacturing is attributed to their lightweight yet durable nature, which enhances fuel efficiency and reduces emissions. These materials are gaining favor in industries focused on sustainability, as they align with global environmental objectives and enable the production of flexible, efficient, and recyclable components.

The inherently conductive polymers segment held 17.3% share in 2024, underscoring their increasing technological maturity and expanding range of industrial applications. These polymers are widely used in areas such as advanced electronics, electromagnetic interference shielding, and anti-static coatings. Continuous innovation and R&D efforts are enhancing their conductivity, stability, and durability, further strengthening their position as superior alternatives to conventional conductive materials.

The anti-static packaging and coating segment held 27.8% share in 2024, growing at a CAGR of 9.2%. The rising integration of electronic components across various industries has heightened the need for effective static control solutions. Conductive polymers offer a cost-efficient and lightweight option, making them a preferred choice for global manufacturers. Similarly, the use of conductive polymers in capacitors is expanding rapidly due to their superior electrical conductivity, chemical stability, and reliability. The increasing demand for compact and high-performance electronics across both consumer and industrial sectors continues to boost innovation in this area.

North America Conductive Polymers Market held a 43.3% share in 2024 and will grow at a CAGR of 8.6% through 2034. The region's growth is driven by technological advancements, strong industrial infrastructure, and widespread use of conductive materials across healthcare, automotive, aerospace, and electronics applications. The emphasis on lightweight, flexible, and sustainable materials is propelling demand, particularly in the U.S. and Canada, where innovation in smart devices and eco-friendly manufacturing is on the rise.

Key players in the Global Conductive Polymers Market include DuPont de Nemours, SABIC, RTP Company, Westlake Plastics, The Lubrizol Corporation, Henkel AG, Heraeus Epurio, 3M, Celanese Corporation, KEMET Corporation, Agfa Gevaert, Covestro AG, Kenner Material & System, Premix Oy, and Avient Corporation. Leading companies in the conductive polymers market are implementing strategic measures to enhance their market presence through innovation, partnerships, and capacity expansion. Many are investing heavily in R&D to improve the electrical performance, processability, and environmental compatibility of conductive polymers. Collaborations with electronics, automotive, and healthcare manufacturers enable the co-development of customized materials for advanced applications. Firms are also expanding production facilities and establishing regional distribution networks to meet growing demand across key global markets. Sustainability remains a major focus, with companies developing recyclable and bio-based conductive materials to align with eco-friendly regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Conduction mechanism

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Conduction Mechanism, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Conducting polymer composites

- 5.2.1 ABS

- 5.2.2 Polycarbonates

- 5.2.3 PVC

- 5.2.4 PP

- 5.2.5 Nylon

- 5.2.6 Others

- 5.3 Inherently conductive polymers

- 5.3.1 Polyaniline (PANI)

- 5.3.2 Polypyrrole (PPy)

- 5.3.3 Polyphenylene vinylenes (PPV)

- 5.3.4 PEDOT

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Anti-static packaging & coating

- 6.3 Capacitors

- 6.4 Actuators & Sensors

- 6.5 Batteries

- 6.6 Solar cells

- 6.7 Electroluminescence

- 6.8 Printed circuit board

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trend

- 7.2 Electronics manufacturing

- 7.3 Healthcare & life sciences

- 7.4 Automotive & aerospace

- 7.5 Chemical & materials

- 7.6 Energy & utilities

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Agfa Gevaert

- 9.3 Avient Corporation

- 9.4 Celanese Corporation

- 9.5 Covestro AG

- 9.6 DuPont de Nemours

- 9.7 Henkel Ag

- 9.8 Heraeus Epurio

- 9.9 KEMET Corporation

- 9.10 Kenner Material & System

- 9.11 Premix Oy

- 9.12 RTP Company

- 9.13 SABIC

- 9.14 The Lubrizol Corporation

- 9.15 Westlake Plastics