PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833676

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833676

Iron Ore Pellets Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

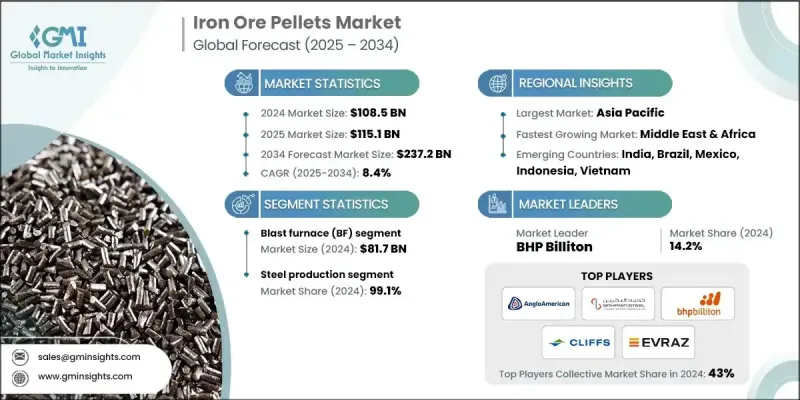

The global iron ore pellets market was estimated at USD 108.5 billion in 2024 and is expected to grow from USD 115.1 billion in 2025 to USD 237.2 billion in 2034 at a CAGR of 8.4%, according to the latest report published by Global Market Insights Inc.

Iron ore pellets are a critical raw material in steelmaking, particularly in blast furnaces and direct reduced iron (DRI) processes. As global infrastructure projects, automotive production, and construction activities continue to expand, the demand for high-grade iron ore pellets rises in parallel.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $108.5 Billion |

| Forecast Value | $237.2 Billion |

| CAGR | 8.4% |

Rising Adoption of Blast Furnace (BF)

The blast furnace (BF) segment held a notable share in 2024, driven by its critical role in large-scale steelmaking operations. Iron ore pellets are preferred in BF processes due to their consistent size, high iron content, and lower gangue levels, which improve furnace efficiency and reduce energy consumption. As integrated steel plants aim to increase productivity while meeting stricter emission norms, the demand for high-quality pellets continues to rise.

Growing Steel Production

The steel production segment generated a significant share in 2024, as pellets offer superior performance over lump ore and sinter in terms of metallurgical properties and furnace efficiency. The consistent quality of pellets ensures stable production and helps reduce the overall carbon footprint, making them vital for both traditional blast furnaces and emerging direct reduced iron (DRI) processes.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific iron ore pellets market will grow at a decent CAGR through 2034, bolstered by rapid industrialization, urban development, and massive steel production capacity across China, India, and Southeast Asia. As infrastructure investments continue to surge and environmental regulations become more stringent, the region is witnessing a strong shift toward high-grade pellets to support sustainable steelmaking. Countries like India are also expanding their domestic pellet production to reduce dependence on imported sinter feed. Regional players are scaling up capacity, investing in beneficiation and pelletizing technologies, and forming joint ventures to secure raw material access and meet growing demand efficiently.

Major players involved in the iron ore pellets market are Cleveland-Cliffs, FERREXPO, METALLOINVEST, BHP Billiton, Jindal SAW, Evraz, LKAB Koncernkontor, Anglo American, Iron Ore Company of Canada, and Bahrain Steel.

To strengthen their position, companies in the iron ore pellets industry are adopting a blend of vertical integration, technological innovation, and strategic partnerships. Many are investing in beneficiation plants and low-grade ore processing to enhance pellet quality and optimize resource utilization. Vertical integration-from mining to pellet production-ensures better cost control and consistent feedstock supply. Additionally, firms are focusing on low-carbon pellet production processes and engaging in sustainability initiatives to align with ESG goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Grade

- 2.2.2 Balling Technologies

- 2.2.3 Application

- 2.2.4 Technology

- 2.2.5 Product Source

- 2.2.6 Pelletizing Process

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Blast furnace (BF)

- 5.3 Direct reduction (DR)

Chapter 6 Market Size and Forecast, By Balling Technologies, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Balling disc

- 6.3 Balling drum

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Steel production

- 7.3 Iron based chemicals

Chapter 8 Market Size and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electric arc furnace

- 8.3 Electric induction furnace

- 8.4 Oxygen based/blast furnace

Chapter 9 Market Size and Forecast, By Product Source, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Hematite

- 9.3 Magnetite

- 9.4 Others

Chapter 10 Market Size and Forecast, By Pelletizing Process, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Travelling grate (TG)

- 10.3 Grate kiln (GK)

- 10.4 Others

Chapter 11 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Anglo American

- 12.2 Bahrain Steel

- 12.3 BHP Billiton

- 12.4 Cleveland-Cliffs

- 12.5 Evraz

- 12.6 FERREXPO

- 12.7 Iron Ore Company of Canada

- 12.8 Jindal SAW

- 12.9 LKAB Koncernkontor

- 12.10 METALLOINVEST