PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876783

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876783

Recycled Metal Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

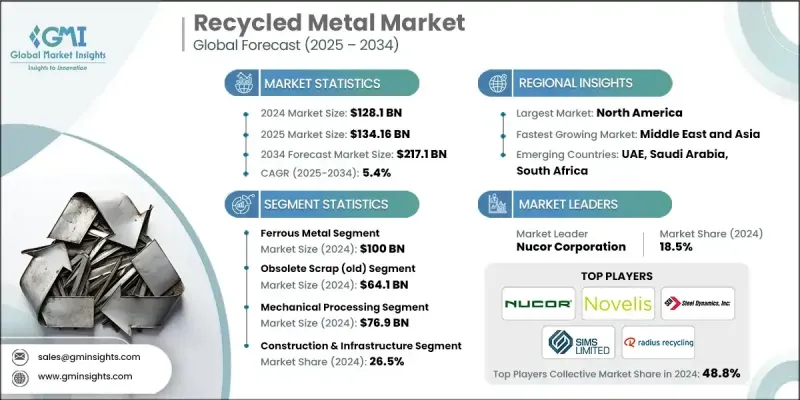

The Global Recycled Metal Market was valued at USD 128.1 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 217.1 billion by 2034.

The market focuses on collecting, processing, and repurposing used metals into new raw materials, reducing the need for mining virgin ores. Metals recovered from end-of-life products such as vehicles, buildings, electronics, and packaging play a crucial role in environmental sustainability, energy conservation, and greenhouse gas reduction. Aluminium, steel, copper, and zinc can be recycled repeatedly without losing quality, making them key contributors to a circular economy. Technological advancements, including AI-driven sorting, robotics, sensor-based separation, and low-emission furnaces, have significantly enhanced recovery efficiency. Digital tracking and blockchain applications are increasingly being adopted to ensure transparency, traceability, and authenticity of recycled metals, enabling manufacturers and consumers to verify supply chain integrity and sustainable sourcing practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128.1 Billion |

| Forecast Value | $217.1 Billion |

| CAGR | 5.4% |

The mechanical processing segment generated USD 76.9 billion in 2024, as it efficiently shreds, cuts, and prepares scrap metals for reuse. Thermal processing follows, excelling in recovering metals from complex or contaminated scrap by melting and separating them at high temperatures to achieve high-purity outputs suitable for industrial use.

The construction and infrastructure segment held a 26.5% share in 2024, driven by high demand for steel and aluminium in building and civil engineering projects. The automotive and transportation sector is experiencing rapid growth due to the adoption of electric and lightweight vehicles. Industrial machinery, electronics, electrical equipment, packaging, and energy utilities also rely heavily on recycled metals for cost-effective and sustainable production, ranging from circuits and wiring to renewable energy systems.

U.S. Recycled Metal Market reached USD 26.6 billion in 2024, driven by increasing demand from the automotive and construction sectors. In North America, the growth is fueled by the shift toward electric vehicles, energy-efficient infrastructure, and sustainable manufacturing practices. Canada is investing in recovery from industrial and obsolete scrap to support circular economy initiatives.

Key companies operating in the Global Recycled Metal Market include: Metaloop GmbH, Redwood Materials Inc., Kuusakoski Group, Steel Dynamics Inc., Radius Recycling Inc., Sims Metal Management Limited, Lohum Cleantech Pvt Ltd, Ace Green Recycling Inc., Nucor Corporation, European Metal Recycling Limited, Asahi Holdings Inc., Befesa S.A., Batx Energies Private Limited, GFG Alliance, Hensel Recycling GmbH, Novelis Inc., ScrapBees GmbH, Sortera Technologies Inc., Triple M Metal LP. Companies in the recycled metal market are employing several strategies to strengthen their position, including expanding processing capacities, investing in advanced sorting and smelting technologies, and integrating automation to improve efficiency. They are also forming strategic partnerships and joint ventures to enhance supply chain capabilities and secure raw material sources. Many players are focusing on digitalization, blockchain-based traceability, and sustainability certifications to appeal to environmentally conscious customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Metal Type

- 2.2.2 Scrap Source

- 2.2.3 Processing Method

- 2.2.4 End use Industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing industrial and construction activities

- 3.2.1.2 Technological advancements in recycling processes

- 3.2.1.3 Increasing demand from automotive and electronics sectors

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 Fluctuating scrap metal prices

- 3.3.2 Lack of efficient collection and segregation systems

- 3.4 Market opportunities

- 3.4.1 Integration of digital technologies and automation

- 3.4.2 Rising demand for secondary raw materials in green industries

- 3.4.3 Product innovation and recycled metal-based manufacturing

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By metal type

- 3.11 Future market trends

- 3.12 Technology and innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Patent landscape

- 3.14 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.14.1 Major importing countries

- 3.14.2 Major exporting countries

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.16 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Metal Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ferrous metals

- 5.2.1 Steel scrap

- 5.2.2 Iron scrap

- 5.2.3 Cast iron

- 5.3 Non-ferrous metals

- 5.3.1 Aluminum

- 5.3.1.1 Primary aluminum scrap

- 5.3.1.2 Secondary aluminum alloys

- 5.3.2 Copper

- 5.3.2.1 Copper wire & cable

- 5.3.2.2 Copper tubing & pipe

- 5.3.3 Lead

- 5.3.3.1 Battery lead

- 5.3.3.2 Sheet lead

- 5.3.4 Precious metals

- 5.3.4.1 Gold recovery

- 5.3.4.2 Silver recovery

- 5.3.4.3 Platinum group metals

- 5.3.5 Specialty metals

- 5.3.5.1 Titanium

- 5.3.5.2 Nickel

- 5.3.5.3 Rare earth elements

- 5.3.1 Aluminum

Chapter 6 Market Estimates and Forecast, By Scrap Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Industrial scrap (Prompt scrap)

- 6.2.1 Manufacturing waste streams

- 6.2.2 Processing facility byproducts

- 6.3 Obsolete scrap (Old scrap)

- 6.3.1 End-of-life vehicles

- 6.3.2 Demolished buildings & infrastructure

- 6.3.3 Electronic waste (E-waste)

- 6.3.4 Appliances & consumer goods

- 6.4 Home scrap (New scrap)

- 6.4.1 Steel mill revert

- 6.4.2 Foundry returns

Chapter 7 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical processing

- 7.2.1 Shredding & size reduction

- 7.2.2 Magnetic separation

- 7.2.3 Density separation

- 7.3 Thermal processing

- 7.3.1 Electric arc furnace (EAF)

- 7.3.2 Induction furnace

- 7.3.3 Pyrometallurgical processing

- 7.4 Chemical processing

- 7.4.1 Hydrometallurgical extraction

- 7.4.2 Electrorefining

- 7.4.3 Solvent extraction

- 7.5 Advanced sorting technologies

- 7.5.1 AI-powered optical sorting

- 7.5.2 Sensor-based separation

- 7.5.3 Laser-induced breakdown spectroscopy (LIBS)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction & infrastructure

- 8.2.1 Structural steel applications

- 8.2.2 Reinforcement materials

- 8.2.3 Government infrastructure projects

- 8.3 Automotive & transportation

- 8.3.1 Body & frame components

- 8.3.2 Engine & drivetrain parts

- 8.3.3 Electric vehicle components

- 8.4 Manufacturing & industrial machinery

- 8.4.1 Heavy equipment

- 8.4.2 Industrial tools & components

- 8.5 Electrical & electronics

- 8.5.1 Wiring & conductors

- 8.5.2 Electronic components

- 8.5.3 Battery applications

- 8.6 Packaging & containers

- 8.6.1 Food & beverage packaging

- 8.6.2 Industrial packaging

- 8.7 Energy & utilities

- 8.7.1 Power generation equipment

- 8.7.2 Renewable energy infrastructure

- 8.7.3 Grid & transmission systems

- 8.8 Aerospace & defense

- 8.8.1 Aircraft components

- 8.8.2 Defense applications

- 8.9 Consumer products & appliances

- 8.10 Chemical & process industries

- 8.11 Marine & shipbuilding

- 8.12 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Ace Green Recycling Inc.

- 10.2 Asahi Holdings Inc.

- 10.3 Batx Energies Private Limited

- 10.4 Befesa S.A.

- 10.5 European Metal Recycling Limited

- 10.6 GFG Alliance

- 10.7 Hensel Recycling GmbH

- 10.8 Kuusakoski Group

- 10.9 Lohum Cleantech Pvt Ltd

- 10.10 Metaloop GmbH

- 10.11 Nucor Corporation

- 10.12 Novelis Inc

- 10.13 Redwood Materials Inc.

- 10.14 ScrapBees GmbH

- 10.15 Radius Recycling Inc.

- 10.16 Sims Metal Management Limited

- 10.17 Sortera Technologies Inc

- 10.18 Steel Dynamics Inc.

- 10.19 Triple M Metal LP