PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928919

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928919

Forestry Lubricants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

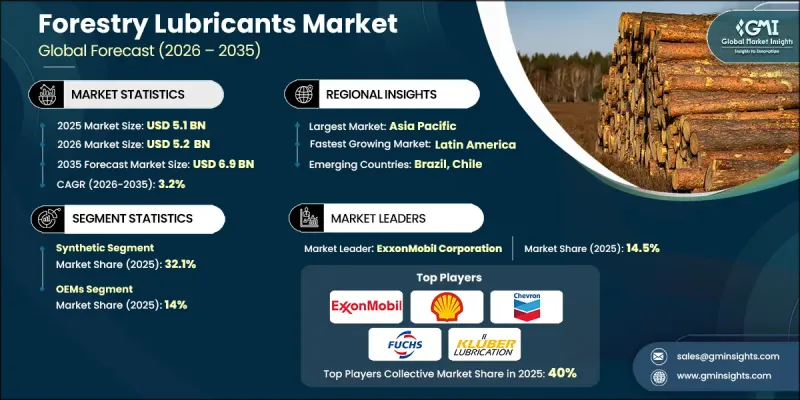

The Global Forestry Lubricants Market was valued at USD 5.1 billion in 2025 and is estimated to grow at a CAGR of 3.2% to reach USD 6.9 billion by 2035.

Market expansion is supported by the increasing deployment of advanced, highly mechanized equipment across forestry operations, which requires specialized lubricants to ensure reliable performance under demanding conditions. As forestry machinery is often operated in remote locations, the financial impact of unplanned equipment stoppages has encouraged the use of premium lubricant formulations that offer extended service life and improved wear protection. Operators consistently seek solutions that can withstand heavy mechanical stress, elevated operating temperatures, and high moisture exposure commonly encountered in extreme climatic regions. Regulatory frameworks are also shaping market demand, particularly through policies promoting the use of environmentally acceptable lubricants. These regulations are expected to support commercial adoption while contributing to employment growth within sustainable industries. Demand for such lubricants is being driven by compliance requirements and growing environmental awareness. Products with high renewable content are gaining traction, aligning with broader shifts toward sustainable materials and production practices, which is reinforcing long-term market momentum.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.1 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 3.2% |

The synthetic lubricants segment accounted for 32.1% share in 2025 and is expected to grow at a CAGR of 3.3% through 2035. Their leading position is attributed to superior performance in harsh forestry environments, where equipment is exposed to continuous stress, contamination, and extended operating cycles. Enhanced resistance to thermal breakdown and oxidation compared to conventional alternatives has accelerated adoption across forestry operations.

The OEM segment held 14% share in 2025 and is forecast to grow at a CAGR of 3.2% between 2026 and 2035. High lubricant consumption across multiple machinery systems used in core harvesting activities is driving demand in this segment. Forestry operations depend heavily on reliable lubrication to maintain the uninterrupted functionality of essential mechanical and hydraulic systems in challenging environments.

North America Forestry Lubricants Market accounted for 31% share in 2025. High levels of mechanization, widespread use of advanced lubricant formulations, and environmental regulations are supporting regional demand. Climatic conditions and close collaboration between equipment manufacturers and lubricant suppliers further contribute to extended machinery life and operational efficiency.

Key companies operating in the Global Forestry Lubricants Market include Shell plc, Exxon Mobil Corporation, BP plc (Castrol), TotalEnergies SE, Fuchs Petrolub SE, Chevron Corporation, Petro-Canada Lubricants, Amsoil Inc., Lubrizol Corporation, Phillips 66 Company, Kluber Lubrication, Petronas Lubricants International (PLI), Repsol S.A., Sinopec Corp, Rymax Lubricants, Klondike Lubricants Corporation, Frontier Performance Lubricants, Bioblend Renewable Resources, Pennine Lubricants, and Elba Lubrication Inc. Companies operating in the Global Forestry Lubricants Market are strengthening their market positions through aggressive technology development, pilot programs, and ecosystem partnerships. Many players are investing in artificial intelligence, autonomous navigation, and fleet optimization software to improve reliability and scalability. Strategic collaborations with retailers, logistics firms, and municipalities help accelerate deployment and regulatory acceptance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Synthetic blend oil

- 5.4 Bio-based

- 5.5 Mineral

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Engine Lubrication

- 6.3 Transmission & Gear Oils

- 6.4 Hydraulic Fluids

- 6.5 Greases

- 6.5.1 Pin & Bushing Greases

- 6.5.2 Bearing Greases

- 6.6 Chain Oils / Saw Guide Oils

- 6.7 Paper Machine Oils

- 6.7.1 Circulating Oils

- 6.7.2 Specialty Paper Machine Oils

- 6.8 Compressor Oils

- 6.9 Coolants / Antifreeze

- 6.10 Others

- 6.10.1 Slideway Oils

- 6.10.2 Rust Preventives

- 6.10.3 Open Gear Lubricants

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 OEMs

- 7.3 Sawmills

- 7.4 Paper & Paperboard Mills

- 7.5 Wood Products Manufacturing Units

- 7.6 Logging / Harvesting Companies

- 7.7 Biomass Pellet Mills

- 7.8 Pulp Mills

- 7.9 Forest Contractors / Operators

- 7.10 Timber Transport Services

- 7.11 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Amsoil Inc.

- 9.2 Bioblend Renewable Resources

- 9.3 BP plc (Castrol)

- 9.4 Chevron Corporation

- 9.5 China Petroleum & Chemical Corporation (Sinopec Corp)

- 9.6 Elba Lubrication Inc.

- 9.7 Exxon Mobil Corporation

- 9.8 Frontier Performance Lubricants

- 9.9 Fuchs Petrolub SE

- 9.10 Klondike Lubricants Corporation

- 9.11 Kluber Lubrication

- 9.12 Lubrizol Corporation

- 9.13 Pennine Lubricants

- 9.14 Petro-Canada Lubricants

- 9.15 Petronas Lubricants International (PLI)

- 9.16 Phillips 66 Company

- 9.17 Repsol S.A.

- 9.18 Rymax Lubricants

- 9.19 Shell plc

- 9.20 TotalEnergies SE

- 9.21 Others