PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913401

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913401

Stilbene Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

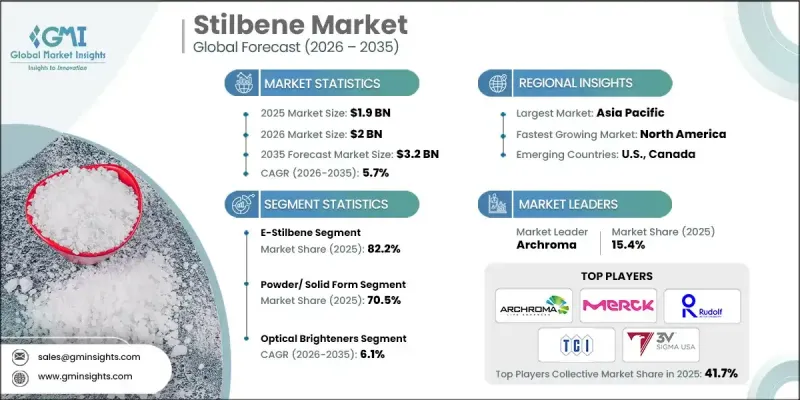

The Global Stilbene Market was valued at USD 1.9 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 3.2 billion by 2035.

Stilbene remains a highly active segment within the broader chemicals and polymers landscape due to its strong functional performance and wide industrial relevance. Its optical efficiency, structural stability, and luminescent behavior make it an attractive material for advanced chemical formulations and performance-driven applications. High fluorescence efficiency supports its role in detection and imaging-related technologies, while chemical durability and visual enhancement characteristics continue to support demand across manufacturing industries. The compound's ability to be synthesized into multiple derivative forms further enhances its commercial flexibility and application scope. Continuous improvements in material processing and purity control are strengthening adoption across both established and emerging use cases. Growing emphasis on performance optimization, material reliability, and innovation in downstream industries continues to reinforce market growth globally, positioning stilbene as a valuable compound across a diverse range of industrial and research-driven environments.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.7% |

Stilbene applications are primarily associated with advanced material development for radiation response, optical enhancement, and electronic performance. Its luminescent behavior supports adoption in next-generation electronic components, while derivative forms are increasingly utilized to enhance durability, brightness, and stability in manufactured goods. These characteristics continue to elevate the compound's relevance in value-added chemical solutions.

The E-stilbene segment held 82.2% share in 2025 and is expected to grow at a CAGR of 5.8% through 2035. This isomer leads due to its superior optical and electronic performance, making it suitable for high-precision and purity-sensitive applications. Rising interest in energy-efficient and flexible electronic technologies is supporting sustained demand, while its chemical stability continues to favor adoption across high-performance material segments.

The powder or solid form accounted for 70.5% share in 2025 and is projected to grow at a CAGR of 5.9% from 2026 to 2035. Strong demand is driven by its handling efficiency, storage stability, and compatibility with standardized production processes. Advancements in particle processing and surface treatment techniques are further improving functionality and expanding application potential.

North America Stilbene Market represented 23.1% share in 2025 and continues to experience steady growth. Market expansion is supported by rising demand for advanced optical materials, specialty chemical intermediates, and performance-enhancing compounds across industrial and consumer-focused sectors.

Key companies operating in the Global Stilbene Market include Merck KGaA, Archroma, TCI, Rudolf, Luxium Solutions, LLC, 3V Sigma USA, Santa Cruz Biotechnology Inc., Biosynth, Clearsynth, Hairui Chemical, and Paramount Minerals & Chemicals (India). Companies in the Global Stilbene Market are strengthening their competitive position through focused investment in high-purity production, advanced synthesis methods, and expanded derivative portfolios. Many players are prioritizing process optimization to improve yield consistency and material performance. Strategic collaborations with downstream manufacturers are helping align product development with evolving application requirements. Firms are also expanding regional distribution networks to improve supply reliability and customer reach. Emphasis on research-driven innovation, customized formulations, and compliance with global quality standards is enabling companies to differentiate offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 E Stilbene

- 5.3 Z Stilbene

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder / solid form

- 6.3 Aqueous solution / liquid

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Optical brighteners

- 7.3 Paper brightening

- 7.4 Textile brightening & finishing

- 7.5 Detergent & cleaning product additives

- 7.6 Plastics & polymer additives

- 7.7 Dye intermediates & pigments

- 7.8 Scintillators & radiation detection

- 7.9 Cosmetics & personal care

- 7.10 Nutraceuticals & dietary supplements

- 7.11 Functional foods & natural products

- 7.12 Chemical intermediates & synthesis

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 3V Sigma USA

- 9.2 Archroma

- 9.3 Biosynth

- 9.4 Clearsynth

- 9.5 Hairui Chemical

- 9.6 Luxium Solutions, LLC

- 9.7 Merck KGaA

- 9.8 Paramount Minerals & Chemicals (India)

- 9.9 Rudolf

- 9.10 Santa Cruz Biotechnology Inc.

- 9.11 TCI