PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913393

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913393

Automotive Night Vision System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

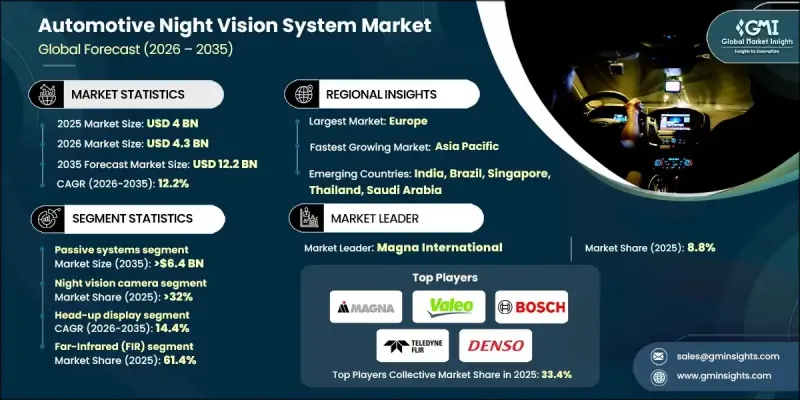

The Global Automotive Night Vision System Market was valued at USD 4 billion in 2025 and is estimated to grow at a CAGR of 12.2% to reach USD 12.2 billion by 2035.

Market expansion is driven by increasing focus on accident prevention, along with the growing integration of intelligent safety technologies in modern vehicles. Advancements in electric and autonomous vehicle platforms are further accelerating adoption, as night vision systems complement broader safety architectures. Heightened awareness of visibility challenges during low-light driving conditions has strengthened demand across both premium and mid-priced vehicles. Regulatory encouragement for advanced safety technologies is indirectly reinforcing adoption as manufacturers package night vision capabilities within comprehensive driver assistance offerings. Ongoing progress in infrared sensing, thermal imaging accuracy, and real-time data processing is enhancing reliability and usability, making these systems increasingly attractive for original equipment integration. Together, these factors are establishing night vision systems as a critical component in next-generation automotive safety strategies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 12.2% |

The passive night vision systems segment held 46% share in 2025 and is projected to reach USD 6.4 billion in value by 2035. This segment continues to lead due to its ability to detect heat patterns without relying on external light sources, delivering consistent performance in challenging visibility environments and supporting safety-oriented vehicle applications.

The night vision camera segment represented 32% share in 2025, with an estimated valuation of USD 1.3 billion. Continuous improvements in image clarity, sensing precision, and system durability are enhancing performance reliability across a wide range of driving conditions, supporting broader adoption by vehicle manufacturers.

US Automotive Night Vision System Market reached USD 761 million in 2025 and is expected to show strong growth between 2026 and 2035. Market momentum in the United States is supported by consumer preference for advanced safety features and increasing deployment of intelligent vehicle technologies across higher-value vehicle categories.

Key companies operating in the Global Automotive Night Vision System Market include Bosch, Continental, Valeo, Autoliv, Magna International, DENSO, Harman, Gentex, Teledyne Flir, Omnivision, and Delphi Technologies. Companies active in the automotive night vision system market are reinforcing their market position through continuous innovation, strategic collaborations, and deeper integration with vehicle safety platforms. Leading players are investing in enhanced sensor performance, advanced image processing software, and compact system designs to improve reliability and cost efficiency. Close collaboration with automakers enables early-stage integration into new vehicle architectures. Firms are also expanding production capabilities and focusing on scalable solutions to support broader adoption beyond luxury segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Component

- 2.2.4 Display

- 2.2.5 Technology

- 2.2.6 Vehicle

- 2.2.7 Application

- 2.2.8 Sales channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growing focus on road safety and accident reduction

- 3.2.1.3 Increasing regulatory support for advanced driver assistance systems

- 3.2.1.4 Advancements in infrared sensor and processing technologies

- 3.2.1.5 Rising demand for premium safety features in vehicles

- 3.2.1.6 Expansion of digital cockpits and head-up displays

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of night vision system components

- 3.2.2.2 Complexity of system integration and calibration

- 3.2.3 Market opportunities

- 3.2.3.1 Penetration into mid-range passenger vehicles

- 3.2.3.2 Integration with autonomous and semi-autonomous driving systems

- 3.2.3.3 Growth of electric and software-defined vehicles

- 3.2.3.4 Emerging demand in developing automotive markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - FMVSS

- 3.4.1.2 Canada - CMVSS

- 3.4.2 Europe

- 3.4.2.1 UK - UNECE Vehicle Regulations

- 3.4.2.2 Germany - ISO 26262 Functional Safety

- 3.4.2.3 France - UNECE R152

- 3.4.2.4 Italy - ISO 14001 Environmental Management Systems

- 3.4.2.5 Spain - ISO 9001 Quality Management Systems

- 3.4.3 Asia Pacific

- 3.4.3.1 China - GB Automotive Standards

- 3.4.3.2 Japan - ISO 26262 Functional Safety

- 3.4.3.3 India - AIS Automotive Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil - CONTRAN Automotive Regulations

- 3.4.4.2 Mexico - NOM Automotive Standards

- 3.4.4.3 Argentina - ISO 14001 Environmental Management Systems

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - UNECE Vehicle Regulations

- 3.4.5.2 South Africa - ISO 26262 Functional Safety

- 3.4.5.3 Saudi Arabia - SASO Automotive Standards

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Future market outlook & opportunities

- 3.12 OEM & Tier-1 Procurement and Adoption Criteria

- 3.12.1 OEM decision drivers for night vision adoption

- 3.12.2 Cost vs safety value assessment

- 3.12.3 Regional OEM adoption differences

- 3.12.4 Tier-1 supplier selection criteria

- 3.13 ADAS stack integration & system architecture role

- 3.14 Performance, accuracy & false-detection trade-offs

- 3.15 Liability, safety validation & regulatory risk

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Active system

- 5.3 Passive system

- 5.4 Calibration and alignment system

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Night vision camera

- 6.3 Infrared sensors

- 6.4 Image processing and controlling unit

- 6.5 Display module

- 6.6 Illumination unit

- 6.7 Software and algorithms

Chapter 7 Market Estimates & Forecast, By Display, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Head-up display

- 7.3 Instrument cluster

- 7.4 Navigation display

- 7.5 Combined Display System

Chapter 8 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Far-Infrared (FIR)

- 8.3 Near-Infrared (NIR)

Chapter 9 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger vehicle

- 9.2.1 Sedan

- 9.2.2 SUV

- 9.2.3 Hatchback

- 9.3 Commercial Vehicle

- 9.3.1 LCV

- 9.3.2 MCV

- 9.3.3 HCV

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Pedestrian detection

- 10.3 Animal detection

- 10.4 Obstacle and object detection

- 10.5 Collision warning and avoidance

- 10.6 Driver assistance and enhanced visibility

Chapter 11 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 OEM

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.3.8 Portugal

- 12.3.9 Croatia

- 12.3.10 Benelux

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Singapore

- 12.4.7 Thailand

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

- 12.6.4 Turkey

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Bosch

- 13.1.2 Continental

- 13.1.3 Magna International

- 13.1.4 Valeo

- 13.1.5 DENSO

- 13.1.6 ZF Friedrichshafen

- 13.1.7 Teledyne FLIR

- 13.1.8 Autoliv

- 13.1.9 Veoneer

- 13.1.10 Panasonic

- 13.2 Regional Players

- 13.2.1 Hella

- 13.2.2 Gentex

- 13.2.3 Harman International

- 13.2.4 Visteon

- 13.2.5 Hitachi Astemo

- 13.2.6 Mobileye

- 13.2.7 Ficosa International

- 13.2.8 Hyundai Mobis

- 13.2.9 Mitsubishi Electric

- 13.2.10 Aptiv

- 13.3 Emerging / Disruptor Players

- 13.3.1 Omnivision Technologies

- 13.3.2 Infineon Technologies

- 13.3.3 Omron

- 13.3.4 Texas Instruments

- 13.3.5 Luminar Technologies

- 13.3.6 Hikvision Automotive

- 13.3.7 Raytron Technology