PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859016

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859016

Orthopedic Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

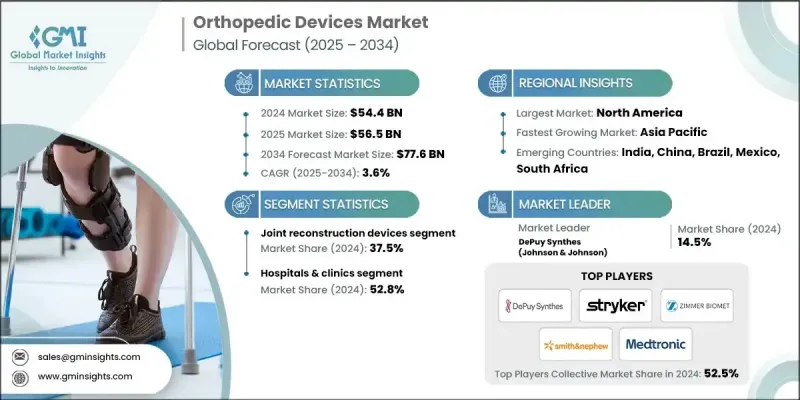

The Global Orthopedic Devices Market was valued at USD 54.4 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 77.6 billion by 2034.

The growth is powered by the increasing global burden of musculoskeletal conditions, an aging population, and continual innovations in orthopedic technology. Orthopedic devices are becoming essential in improving mobility, reducing pain, and enhancing patients' quality of life. The industry supports healthcare providers, life sciences firms, and digital health platforms by delivering advanced solutions such as joint implants, spinal systems, trauma devices, and digital tools that elevate surgical precision and post-operative care. Growing awareness around early interventions, increased spending on healthcare, and the emergence of minimally invasive techniques have further elevated demand. In both developed and emerging markets, these devices are reshaping orthopedic care by providing faster recovery, personalized treatment, and improved clinical efficiency. Demand is also being supported by rising accident rates, sports-related injuries, and patient preference for technologically advanced procedures that reduce downtime. As hospitals and surgical centers adopt digital and robotic surgical systems, the role of orthopedic devices continues to expand across diverse care settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $54.4 Billion |

| Forecast Value | $77.6 Billion |

| CAGR | 3.6% |

The joint reconstruction devices segment held a 37.5% share in 2024. Increasing diagnoses of degenerative joint diseases and the growing volume of hip and knee replacement surgeries, especially among older adults, are primary factors boosting this segment. These devices are essential in managing conditions that impair mobility and require surgical intervention to restore joint functionality and relieve chronic discomfort.

The spinal devices segment generated USD 11.7 billion in 2024 and is forecasted to grow at a steady CAGR of 2.8% through 2034. Market expansion in this segment is largely attributed to the growing number of people affected by spinal conditions, often driven by aging demographics and sedentary lifestyles. The preference for less invasive surgical procedures has fueled demand for advanced spine technologies. Recent innovations in motion-preserving implants, bioresorbable components, and image-guided systems are improving outcomes and helping reduce post-operative complications, making spinal procedures more accessible and effective.

North America Orthopedic Devices Market held a 55.6% share in 2024. The region's strong healthcare infrastructure, along with significant investments in new medical technologies, has supported the wide adoption of orthopedic solutions. An aging population, coupled with high incidences of arthritis, obesity, and joint-related disorders, continues to drive high demand. The region's preference for early diagnosis and intervention, as well as the increasing rate of sports-related trauma, has further fueled the use of orthopedic implants and devices across clinical environments.

Major industry players involved in the Global Orthopedic Devices Market include Enovis, ATEC, MicroPort Scientific, DePuy Synthes (J&J), Stryker, Waldemar, Zimmer Biomet, Arthrex, TriMed, ConforMIS, Integra, CONMED, Globus Medical, aap Implantate, B. Braun, Smith & Nephew, Medtronic, and Medacta. Leading companies in the Global Orthopedic Devices Market are focused on strengthening their presence through innovation, global expansion, and strategic acquisitions. Continuous R&D investments allow them to develop next-generation implants, robotics-assisted systems, and patient-specific devices. Expanding into emerging markets through partnerships and localized manufacturing helps meet growing demand and regulatory needs. Companies are also investing in digital technologies like AI-driven surgical planning tools and remote patient monitoring to elevate clinical outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing base of geriatric population

- 3.2.1.2 Augmented incidence of orthopedic diseases

- 3.2.1.3 Technological advancements

- 3.2.1.4 Escalating rate of orthopedic surgeries in developed nations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Excessive cost of orthopedic devices

- 3.2.2.2 Stringent FDA regulations and biocompatibility issues

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of minimally invasive orthopedic procedures

- 3.2.3.2 Expanding healthcare infrastructure in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Portable home-based orthopedic devices

- 3.5.1.2 Digital health remote monitoring

- 3.5.1.3 Patient-friendly oscillatory systems

- 3.5.2 Emerging technologies

- 3.5.2.1 AI respiratory predictive analytics

- 3.5.2.2 Wearable connected orthopedic devices

- 3.5.2.3 Smart adaptive therapy devices

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of IoT systems

- 3.9.2 Personalized orthopedic solutions

- 3.9.3 Robotics-assisted device applications

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Joint reconstruction devices

- 5.2.1 Knee replacement

- 5.2.2 Hip replacement

- 5.2.3 Shoulder replacement

- 5.2.4 Ankle replacement

- 5.2.5 Other joint reconstruction devices

- 5.3 Spinal devices

- 5.4 Trauma fixation devices

- 5.5 Orthobiologics

- 5.6 Arthroscopic devices

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals & clinics

- 6.3 Ambulatory surgical centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 aap Implantate

- 8.2 Arthrex

- 8.3 ATEC

- 8.4 B. Braun

- 8.5 ConforMIS

- 8.6 CONMED

- 8.7 DePuy Synthes (J&J)

- 8.8 Enovis

- 8.9 Globus Medical

- 8.10 Integra

- 8.11 Medacta

- 8.12 Medtronic

- 8.13 MicroPort Scientific

- 8.14 Smith & Nephew

- 8.15 Stryker

- 8.16 TriMed

- 8.17 Waldemar

- 8.18 Zimmer Biomet