PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755357

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1755357

White Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

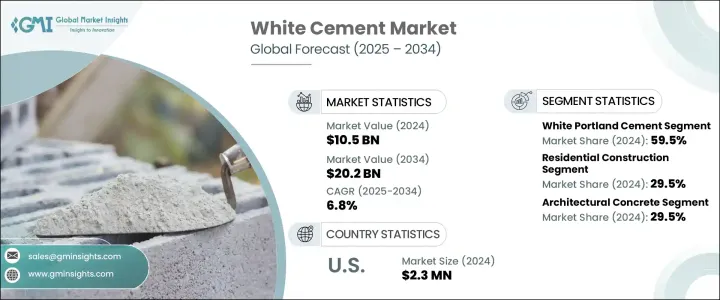

The Global White Cement Market was valued at USD 10.5 billion in 2024 and is estimated to grow at 6.8% CAGR to reach USD 20.2 billion by 2034, driven by the surge in global infrastructure development. With urbanization progressing rapidly, governments are investing significantly in constructing roads, bridges, and public buildings, increasing the demand for high-quality, visually appealing building materials such as white cement.

Sustainability has become another key factor propelling the white cement market forward. Its heat-reflective properties make it an excellent choice for energy-efficient construction, aligning with the increasing demand for eco-friendly building materials. As architects and builders seek to reduce carbon footprints in their designs, white cement's benefits in contributing to energy savings and environmental sustainability have positioned it as a preferred material in the construction industry. In response to evolving market needs, manufacturers are introducing new formulations of white cement that offer enhanced performance characteristics, such as improved strength and faster setting times. These innovations are expanding the scope of white cement applications, making them more viable and cost-effective for large-scale construction projects. As urban growth continues and construction trends evolve, the market is expected to maintain its positive momentum, offering significant opportunities for established companies and new entrants in the building materials sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 6.8% |

In 2024, white Portland cement represented a 59.5% share. This segment is the most widely used due to its high strength, superior finish, and aesthetic appeal. It is predominantly employed in architectural and decorative applications, such as walls, flooring, and sculptures, where uniformity in color and brightness is essential. The demand for this segment is largely driven by the growing development of premium construction projects and an increasing preference for visually appealing structures in residential and commercial spaces.

The residential construction sector held a market share of 29.5% in 2024. White cement is highly favored in residential construction due to its exceptional finishing, durability, and aesthetic value, making it a popular choice for interior and exterior walls, flooring, and decorative elements. The rise in housing demand, fueled by urbanization and population growth, has been a key factor in the sector's growth. As homeowners seek materials that offer elegance and longevity, white cement has become a preferred option for creating high-end, lasting residential spaces.

U.S. White Cement Market held an 85% share valued at USD 2.3 million in 2024. The country is set to experience rapid growth in white cement consumption, driven by an expansion in construction activities, technological advancements, and a strong focus on sustainable building practices. The high demand for durable and aesthetically pleasing building materials, combined with a surge in infrastructure development, is significantly boosting the consumption of white cement in the U.S.

Key players such as J.K. Cement, Aalborg Portland, UltraTech Cement, Cemex, and Cimsa are capitalizing on these strategies to meet the growing demand for white cement and stay ahead in the highly competitive market. Companies in the white cement market have implemented several key strategies to bolster their presence and strengthen their market position. These include focusing on product innovation, expanding production capacities, and building strategic partnerships. By developing specialized white cement variants that cater to specific needs like high-strength formulations, aesthetic finishes, or sustainability, companies ensure they meet the growing demand from both residential and commercial sectors. Investment in cutting-edge technologies that improve production efficiency and quality is also a crucial strategy. This allows companies to meet the rising demand while ensuring superior product consistency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Methodology

- 1.2 Research Objectives

- 1.3 Market Definition and Scope

- 1.4 Market Segmentation

- 1.5 Data Sources

- 1.5.1 Primary Research

- 1.5.2 Secondary Research

- 1.6 Market Estimation Approach

- 1.7 Research Assumptions and Limitations

- 1.8 Base Year and Forecast Period

Chapter 2 Executive Summary

- 2.1 Market Snapshot

- 2.2 Global White Cement Market Highlights

- 2.3 Regional Market Highlights

- 2.4 Segmental Market Highlights

- 2.5 Competitive Landscape Snapshot

- 2.6 Investment Highlights and Strategic Recommendations

- 2.7 Key Market Trends and Future Growth Indicators

- 2.8 Analyst Perspective and Critical Insights

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Manufacturing process analysis

- 3.1.2 Raw material analysis and sourcing strategies

- 3.1.3 White cement vs. gray cement: comparative analysis

- 3.1.4 Profit margin analysis

- 3.1.5 Value chain analysis

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.5.1 Technology landscape

- 3.5.2 Traditional manufacturing technologies

- 3.5.3 Advanced manufacturing technologies

- 3.5.4 Emerging technologies

- 3.5.5 Patent analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Market dynamics

- 3.7.1 Market drivers

- 3.7.1.1 Growing demand for aesthetic construction materials

- 3.7.1.2 Increasing urbanization and infrastructure development

- 3.7.1.3 Rising adoption in architectural applications

- 3.7.1.4 Growth in precast and prefabricated construction

- 3.7.2 Market Restraints

- 3.7.2.1 Higher production costs compared to gray cement

- 3.7.2.2 Environmental concerns and carbon emissions

- 3.7.2.3 Raw material price volatility

- 3.7.2.4 Limited availability of high-quality raw materials

- 3.7.3 Market Opportunities

- 3.7.3.1 Technological advancements in production processes

- 3.7.3.2 Growing demand in emerging economies

- 3.7.3.3 Development of eco-friendly white cement variants

- 3.7.3.4 Expansion of application areas

- 3.7.4 Market Challenges

- 3.7.4.1 Stringent Environmental Regulations

- 3.7.4.2 High energy consumption in production

- 3.7.4.3 Transportation and logistics challenges

- 3.7.4.4 Competition from alternative materials

- 3.7.5 Regulatory Framework Analysis

- 3.7.5.1. International standards (ASTM C989/C989 M, EN 197-1)

- 3.7.5.2 Regional regulations and standards

- 3.7.5.3 Environmental compliance requirements

- 3.7.5.4 Quality certification systems

- 3.7.6 Technology Landscape

- 3.7.6.1 Current technological trends

- 3.7.6.2 Emerging technologies in slag cement production

- 3.7.6.3 Digitalization and industry 4.0 impact

- 3.7.6.4 R&d initiatives and innovation pipeline

- 3.7.7 Pricing Analysis

- 3.7.7.1 Price trend analysis

- 3.7.7.2 Cost structure analysis

- 3.7.7.3 Factors affecting pricing

- 3.7.7.4 Regional price variations

- 3.7.1 Market drivers

- 3.8 PESTLE Analysis

- 3.9 Porter's five forces analysis

- 3.10 Regulatory framework and government initiatives

- 3.11 Impact of covid-19 on white cement market

- 3.12 Impact of Russia Ukraine conflict on supply chain

- 3.13 Market entry strategies for new players

- 3.14 Pricing analysis and trends

- 3.15 Trade analysis: import-export scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis, 2024

- 4.2 Strategic dashboard

- 4.3 Key stakeholders and market positioning

- 4.4 Competitive benchmarking

- 4.5 Competitive positioning matrix

- 4.6 Competitive strategies

- 4.6.1 new product developments

- 4.6.2 mergers and acquisitions

- 4.6.3 partnerships and collaborations

- 4.6.4 capacity expansions

- 4.7 SWOT analysis of key players

- 4.8 competitive intensity - Porter's five forces analysis

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 White Portland Cement

- 5.3 White Masonry Cement

- 5.4 White Portland Limestone Cement (PLC)

- 5.5 Others (White Calcium Aluminate Cement, etc.)

Chapter 6 Market Estimates and Forecast, By Grade, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Type 52.5

- 6.3 Type 42.5

- 6.4 Type 32.5

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential Construction

- 7.3 Commercial Construction

- 7.4 Infrastructure Development

- 7.5 Decorative Applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Architectural Concrete

- 8.3 Precast Products

- 8.4 Terrazzo Flooring

- 8.5 Swimming Pools

- 8.6 Countertops and Decorative Elements

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Aalborg Portland A/S

- 10.2 Adana Cimento Sanayii T.A.S.

- 10.3 Aditya Birla Group (UltraTech Cement Ltd. - Birla White)

- 10.4 Cementir Holding N.V.

- 10.5 Cemex S.A.B. de C.V.

- 10.6 Cimsa Cimento Sanayi ve Ticaret A.S..

- 10.7 Federal White Cement Ltd.

- 10.8 Holcim Group

- 10.9 J.K. Cement Ltd.

- 10.10 Lehigh White Cement Company

- 10.11 OYAK Cement

- 10.12 Ras Al Khaimah Cement Company (RAKCC)

- 10.13 Royal White Cement Inc.

- 10.14 Saveh White Cement Co.

- 10.15 Shargh White Cement Co.