PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741037

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1741037

Sodium Bicarbonate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

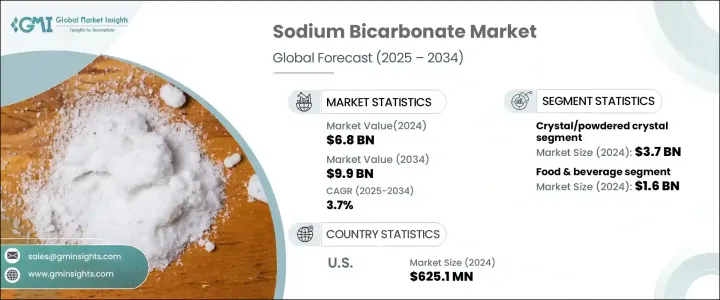

The Global Sodium Bicarbonate Market was valued at USD 6.8 billion in 2024 and is estimated to grow at a CAGR of 3.7% to reach USD 9.9 billion by 2034, driven by a combination of expanding industrial applications and rising regulatory compliance across various sectors. Historically, sodium bicarbonate has remained a staple across numerous industries, including pharmaceuticals, food processing, and environmental solutions. Despite facing disruptions due to global supply chain instability, the demand for sodium bicarbonate displayed significant resilience, largely due to its indispensable role in diverse manufacturing and processing operations.

The increasing demand in regions such as Asia Pacific, North America, and Europe has primarily been driven by rapid industrialization and growing environmental awareness. These regions are taking proactive steps to align with evolving environmental standards, resulting in sustained demand for sodium bicarbonate. Additionally, the compound's use in healthcare formulations and as a pH control agent in medications continues to fuel its relevance. There has also been notable growth in the agriculture and animal feed sectors, where sodium bicarbonate is used both as a fungicide and nutritional additive. These dynamics collectively ensure that the product retains a strong foothold in global supply chains and consumption cycles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 3.7% |

The crystal and powdered crystal forms of sodium bicarbonate continue to dominate the market landscape. Valued at USD 3.7 billion in 2024, this segment is projected to grow at a CAGR of 4.2% between 2025 and 2034. The powdered crystal form stands out for its chemical stability, ease of storage, and longer shelf life. This format is particularly advantageous in sectors like food production, pharmaceuticals, and personal care, where consistent quality and reliable formulation are key. Powdered sodium bicarbonate is preferred for its fine, free-flowing texture, which makes it suitable for direct blending, efficient packaging, and precise formulation. Furthermore, it offers excellent solubility and consistent particle size, which simplifies dosing in tightly regulated industries. Its utility in flue gas desulfurization also strengthens its demand across industrial applications.

Within the food and beverage sector, sodium bicarbonate held a valuation of USD 1.6 billion in 2024, with expectations to grow at a 4.1% CAGR from 2025 to 2034. This segment accounts for approximately 22.9% of the total market share. The increasing incorporation of sodium bicarbonate in baking, processed foods, and beverages underscores its role as a vital leavening and pH-regulating agent. Rising consumer inclination toward convenient, ready-to-eat, and health-oriented food options is pushing manufacturers to use ingredients that enhance product quality without compromising health. Sodium bicarbonate aligns well with these preferences due to its clean-label appeal and functional versatility.

In the United States, the sodium bicarbonate market was valued at USD 625.1 million in 2024 and is projected to expand at a CAGR of 3.5% through 2034. Growth in the U.S. market is largely shaped by industrial activity, evolving regulations, and ongoing economic developments. Supportive government policies, an established industrial infrastructure, and stringent environmental and food safety regulations are contributing to steady demand. Post-pandemic shifts in consumer behavior, alongside new industrial investments, have further bolstered growth. There is an observable uptick in demand across both healthcare and convenience-focused consumer goods sectors, reinforcing the country's stronghold in the global landscape.

The competitive landscape is dominated by key players aiming to secure larger market shares through innovation and strategic expansion. Companies are diversifying product lines, investing in sustainable solutions, and strengthening their global presence to meet rising demand. Continuous efforts in research and development, particularly toward enhancing product functionality and sustainability, are reshaping how these companies position themselves. In particular, there is a noticeable emphasis on product innovation, eco-conscious manufacturing practices, and tapping into high-demand regions through production optimization and mergers. With market dynamics increasingly shaped by consumer trends and regulatory shifts, businesses are adjusting strategies to stay competitive and responsive to global needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Manufacturing process and supply chain analysis

- 3.4.1 Raw materials analysis

- 3.4.1.1 Key raw materials

- 3.4.1.2 Raw material sourcing

- 3.4.1.3 Raw material price trends

- 3.4.1.4 Raw material suppliers

- 3.4.2 Manufacturing process analysis

- 3.4.2.1 Solvay process

- 3.4.2.2 Trona process

- 3.4.2.3 Sodium carbonate method

- 3.4.2.4 Sodium hydroxide method

- 3.4.2.5 Nahcolite extraction

- 3.4.2.6 Emerging production technologies

- 3.4.2.7 Cost structure analysis

- 3.4.3 Supply chain analysis

- 3.4.3.1 Supply chain structure and mapping

- 3.4.3.2 Distribution channels analysis

- 3.4.3.3 Key logistics providers

- 3.4.3.4 Supply chain challenges

- 3.4.3.5 Supply chain optimization strategies

- 3.4.4 Production capacity analysis

- 3.4.4.1 Global production capacity

- 3.4.4.2 Capacity utilization rates

- 3.4.4.3 Planned capacity expansions

- 3.4.5 Inventory management and warehousing

- 3.4.6 Quality control and certification standards

- 3.4.1 Raw materials analysis

- 3.5 Supplier landscape

- 3.6 Profit margin analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.8.1 Global regulatory landscape

- 3.8.1.1 Food grade regulations

- 3.8.1.2 Pharmaceutical grade regulations

- 3.8.1.3 Industrial grade regulations

- 3.8.2 Regional regulatory analysis

- 3.8.2.1 North America

- 3.8.2.2 Europe

- 3.8.2.3 Asia pacific

- 3.8.2.4 Rest of the world

- 3.8.3 Import-export regulations

- 3.8.4 Product labeling and packaging regulations

- 3.8.5 Safety and handling guidelines

- 3.8.6 Environmental regulations

- 3.8.6.1 Emission control regulations

- 3.8.6.2 Waste management regulations

- 3.8.7 Regulatory impact assessment

- 3.8.7.1 Impact on production costs

- 3.8.7.2 Impact on market entry barriers

- 3.8.7.3 Impact on product development

- 3.8.1 Global regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing demand in the pharmaceutical industry.

- 3.9.1.2 Expanding applications in food and beverage sectors.

- 3.9.1.3 Rising environmental concerns and demand for eco-friendly products.

- 3.9.1.4 Growth in the personal care and cosmetics industry.

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Price volatility of raw materials.

- 3.9.2.2 Stringent environmental regulations on production processes.

- 3.9.1 Growth drivers

- 3.10 Future market outlook and strategic opportunities

- 3.10.1 Market forecast 2025–2034

- 3.10.1.1 Short-term forecast (1–3 years)

- 3.10.1.2 Medium-term forecast (4–7 years)

- 3.10.1.3 Long-term forecast (8–10 years)

- 3.10.2 Emerging market opportunities

- 3.10.2.1 High-growth application areas

- 3.10.2.2 Untapped regional markets

- 3.10.2.3 Niche segment opportunities

- 3.10.3 Strategic growth opportunities

- 3.10.3.1 Product development opportunities

- 3.10.3.2 Market expansion opportunities

- 3.10.3.3 Value-added services opportunities

- 3.10.4 Technology adoption and innovation roadmap

- 3.10.5 Sustainability-driven opportunities

- 3.10.6 Strategic recommendations

- 3.10.7 For manufacturers

- 3.10.8 For distributors and suppliers

- 3.10.9 For end use

- 3.10.10 For investors

- 3.10.11 Future scenario planning

- 3.10.11.1 Optimistic scenario

- 3.10.11.2 Realistic scenario

- 3.10.11.3 Pessimistic scenario

- 3.10.1 Market forecast 2025–2034

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Risk analysis and mitigation strategies

- 4.5.1 Market risks assessment

- 4.5.1.1 Demand fluctuation risks

- 4.5.1.2 Price volatility risks

- 4.5.1.3 Competitive risks

- 4.5.1.4 Substitution risks

- 4.5.2 Operational risks

- 4.5.2.1 Supply chain disruptions

- 4.5.2.2 Production risks

- 4.5.2.3 Quality control risks

- 4.5.3 Regulatory and compliance risks

- 4.5.4 Environmental and sustainability risks

- 4.5.5 Geopolitical risks

- 4.5.6 Risk mitigation strategies

- 4.5.6.1 Diversification strategies

- 4.5.6.2 Hedging strategies

- 4.5.6.3 Insurance and risk transfer mechanisms

- 4.5.6.4 Contingency planning

- 4.5.7 Risk management framework for industry stakeholders

- 4.5.1 Market risks assessment

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Crystal/powdered crystal

- 5.3 Liquid

- 5.4 Slurry

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage

- 6.3 Industrial

- 6.4 Pharmaceutical

- 6.5 Personal care

- 6.6 Agrochemical

- 6.7 Animal feed

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Akshar Chemical India Private Limited

- 8.2 Ciner Group

- 8.3 Church & Dwight

- 8.4 Crystal Mark

- 8.5 FMC

- 8.6 GHCL

- 8.7 Haohua Honghe Chemical

- 8.8 Natural Soda

- 8.9 Opta Minerals

- 8.10 Sisecam

- 8.11 Solvay

- 8.12 Tata Chemicals

- 8.13 Tosoh