PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801930

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801930

Frozen Cooked Ready Meals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

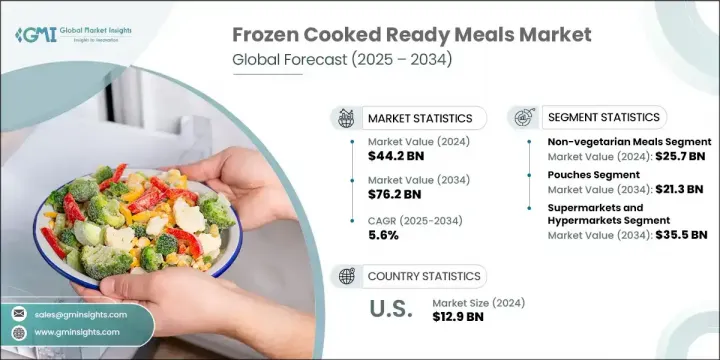

The Global Frozen Cooked Ready Meals Market was valued at USD 44.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 76.2 billion by 2034. Rising consumer preference for convenient and fast meal solutions continues to drive market momentum. Urbanization, increasing dual-income households, and the growing pace of everyday life are fueling the demand for quick-prep meals that also meet evolving health standards. Enhanced packaging formats and advanced preservation methods are enabling brands to deliver fresher-tasting, nutrient-retaining frozen meals. Simultaneously, e-commerce is reshaping how consumers shop, making these meals more accessible.

Across global regions, market volumes are expected to nearly double by 2034, supported by changing dietary preferences, expanded product offerings, and growing consumer willingness to spend more on healthier, time-saving food options. Plant-based eating habits are further propelling growth, with more consumers seeking sustainable, meat-free choices. Brands are evolving meat-based meals into plant protein alternatives, incorporating ingredients like lentils, soy, and peas to appeal to ethical and health-conscious shoppers. With demand rising for clean-label, ready-to-serve, and varied global cuisines, the frozen cooked ready meals category is becoming a central part of modern meal planning and food consumption patterns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.2 Billion |

| Forecast Value | $76.2 Billion |

| CAGR | 5.6% |

The non-vegetarian frozen meals segment accounted for USD 25.7 billion in 2024, capturing 58.1% share. This segment remains dominant due to the widespread demand for protein-rich and flavorful meal options. While vegetarian options are gaining traction, largely because of increased awareness around plant-based diets and health, non-vegetarian meals continue to benefit from an established consumer base and growing appetite for convenience without compromising variety. Consumers are drawn to meals that meet dietary needs while saving time, and this is especially true in urban environments where convenience is a priority. The rise in health consciousness is pushing brands to offer cleaner, better-balanced non-veg meals, further boosting growth.

Packaging innovation segment will reach USD 21.3 billion by 2034, pouches offer ease of use, portability, and better storage efficiency. These lightweight options cater to fast-paced lifestyles and align with the market's shift toward sustainability. New pouch formats with improved insulation, recyclability, and smart-packaging features are influencing how products are presented and preserved.

U.S. Frozen Cooked Ready Meals Market held 80.1% share and generated USD 12.9 billion in 2024. The region shows strong growth thanks to mature retail infrastructure and consistent consumer demand for innovation in product variety. Lifestyle changes such as the growth of dual-income homes and time-constrained consumers have created a culture of convenience that continues to expand the market. Traditional grocery stores and large-format retailers remain essential channels, though online grocery delivery platforms have significantly boosted visibility and accessibility of frozen meals. As consumer diets shift toward health and wellness, brands in the U.S. are steadily adding plant-based options to complement their core meat-based lines.

The key players shaping the Global Frozen Cooked Ready Meals Market include Dr. Oetker, General Mills, Frosta, Kerry Group, and Conagra Brands. To secure a competitive position in the frozen cooked ready meals market, leading brands are focusing on continuous product innovation, targeting diverse consumer needs. Companies are expanding their plant-based and clean-label portfolios to appeal to health-conscious and flexitarian consumers. Investing in R&D helps improve taste profiles and extend shelf life without artificial preservatives. Strategic partnerships with local suppliers allow faster product launches and better control over ingredients. Enhanced packaging solutions, including recyclable pouches and microwave-safe containers, are also a priority. Brands are further strengthening their market footprint through omnichannel retail strategies, emphasizing online grocery platforms and direct-to-consumer channels.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Packaging type

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing consumer demand for quick, convenient, and time-saving meal solutions

- 3.2.1.2 Rising urbanization and dual-income households with less cooking time

- 3.2.1.3 Advancements in freezing technology preserving taste, texture, and nutrition

- 3.2.1.4 Increasing penetration of organized retail and e-commerce grocery platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Consumer perception of frozen meals as less healthy than fresh alternatives

- 3.2.2.2 Intense competition from fresh meal kits and restaurant delivery services

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for plant-based and clean-label frozen meal options

- 3.2.3.2 Expansion into emerging markets with growing middle-class population

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product type

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Bn, Tons)

- 5.1 Key trends

- 5.2 Vegetarian meals

- 5.3 Non-vegetarian meals

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 - 2034 (USD Bn, Tons)

- 6.1 Key trends

- 6.2 Pouches

- 6.3 Trays

- 6.4 Bags

- 6.5 Boxes

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Bn, Tons)

- 7.1 Key trends

- 7.2 Supermarkets/hypermarkets

- 7.3 Convenience stores

- 7.4 Online retail

- 7.5 Specialty stores

- 7.6 Foodservice/restaurants

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest Of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Egypt

- 8.6.5 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Ajinomoto Co., Inc.

- 9.2 Bellisio Foods

- 9.3 Conagra Brands

- 9.4 Dr. Oetker

- 9.5 Frosta AG

- 9.6 General Mills

- 9.7 Iceland Foods

- 9.8 Kerry Group

- 9.9 Kraft Heinz

- 9.10 McCain Foods

- 9.11 MTR Foods

- 9.12 Nestle

- 9.13 Nomad Foods

- 9.14 Seara Foods (JBS)

- 9.15 Tyson Foods