PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892823

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892823

Stolen Vehicle Recovery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

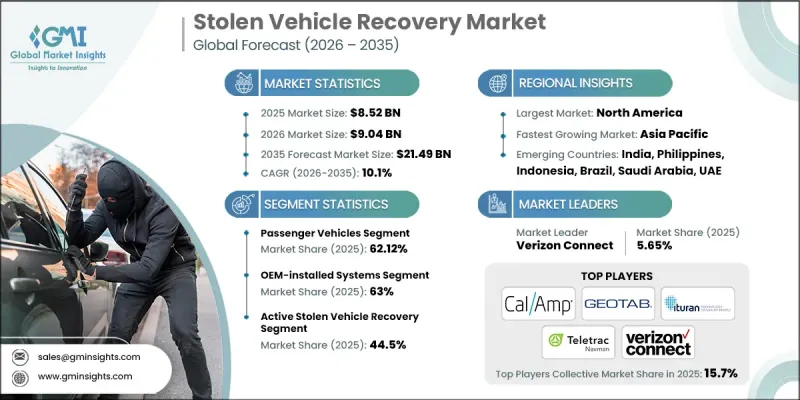

The Global Stolen Vehicle Recovery Market was valued at USD 8.52 billion in 2025 and is estimated to grow at a CAGR of 10.1% to reach USD 21.49 billion by 2035.

The market expansion is driven by the rapid adoption of connected vehicle architectures, intelligent telematics, and embedded security modules, transforming the SVR ecosystem. Modern SVR systems combine GNSS positioning, cellular and IoT connectivity, and AI-based analytics, enabling live vehicle tracking, geofencing, remote immobilization, and behavioral anomaly detection. Automakers, insurers, and fleet operators increasingly rely on integrated SVR solutions to reduce theft losses, speed up recovery, and enhance driver safety. These technologies minimize manual intervention, support continuous vehicle monitoring, and strengthen cybersecurity across both passenger and commercial fleets. Strategic investments, platform consolidations, and cross-industry partnerships are reshaping the competitive landscape. Leading telematics providers are deploying high-sensitivity GNSS modules, next-generation IoT modems, and cloud-based command centers, while automotive suppliers are focusing on encrypted communications, anti-jamming sensors, and interoperable APIs to accelerate adoption globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.52 Billion |

| Forecast Value | $21.49 Billion |

| CAGR | 10.1% |

The passenger vehicle segment held a 62.12% share in 2025 and is expected to grow at a CAGR of 9.8% through 2035. Rising vehicle theft concerns, the growth of connected cars, and the increase in mid-income and premium vehicle ownership are driving the adoption of GPS tracking, geofencing, and remote immobilization for personal vehicles.

The OEM-installed systems segment held a 63% share in 2025 and is projected to grow at a CAGR of 10.4% from 2026 to 2035. Factory-fitted telematics and connected-car platforms offer greater reliability, accuracy, and integration with vehicle electronics. OEM solutions enable features like remote immobilization, geofencing, tamper alerts, and automated theft notifications directly through the manufacturer's connected-car ecosystem, reducing the need for aftermarket installations.

United States Stolen Vehicle Recovery Market held an 85% share in 2025, generating USD 2.89 billion. Growth is fueled by rising telematics adoption, IoT connectivity, and AI-powered analytics, addressing higher vehicle theft rates in urban areas and complex criminal theft networks. Fleet operators, insurance companies, and OEMs are increasingly deploying advanced SVR platforms to mitigate financial losses, accelerate recovery, and improve driver safety.

Major players in the Global Stolen Vehicle Recovery Market include Geotab, CalAmp, Ituran Global, Netstar (Altron), Samsara, Spireon, Teletrac Navman, TomTom International, and Verizon Connect. Key strategies adopted by companies in the Stolen Vehicle Recovery Market include continuous R&D to enhance AI-driven analytics, GNSS accuracy, and IoT connectivity. Firms are focusing on integrating SVR solutions with OEM telematics platforms, fleet management systems, and insurance networks to offer value-added services. Expansion through strategic partnerships and acquisitions allows companies to extend their geographic presence and technological capabilities. Investment in cloud-based command centers, cybersecurity protocols, and anti-jamming technologies strengthens reliability and user trust. Additionally, companies are enhancing interoperability with cross-border tracking systems, offering scalable solutions for commercial fleets and high-value cargo, thereby consolidating their market position and improving customer retention.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Installation

- 2.2.4 Technology

- 2.2.5 End Use

- 2.2.6 Application

- 2.2.7 Service Model

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in vehicle theft rates and sophisticated auto-theft networks

- 3.2.1.2 Growing technological innovations (GPS, IoT, AI/ML)

- 3.2.1.3 Increase in insurance incentives for SVR installation

- 3.2.1.4 Growing fleet operations, ride-hailing, and logistics sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of SVR installation and subscription

- 3.2.2.2 Data privacy and cybersecurity concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets with growing vehicle ownership

- 3.2.3.2 Integration with smart-city initiatives and public-safety networks

- 3.2.3.3 Development of AI-powered predictive analytics and value-added services

- 3.2.3.4 Strategic partnerships among OEMs, insurers, and fleet managers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 GPS-based tracking technology

- 3.7.1.2 Radio frequency (RF) technology

- 3.7.1.3 Hybrid technology systems

- 3.7.2 Emerging technologies

- 3.7.2.1 Geofencing & virtual boundary technology

- 3.7.2.2 5g network integration

- 3.7.2.3 Internet of things (Iot) & LPWAN technologies

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Pricing Analysis

- 3.9.1 By region

- 3.9.2 By subscription & service pricing

- 3.10 Cost breakdown analysis

- 3.10.1 Manufacturing & assembly costs

- 3.10.2 Software & platform development costs

- 3.10.3 Network & connectivity costs

- 3.10.4 Customer acquisition costs (CAC)

- 3.10.5 Installation & activation costs

- 3.10.6 Research & development costs

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Business Case & ROI Analysis

- 3.12.1 Total cost of ownership framework

- 3.12.2 ROI calculation methodologies

- 3.12.3 Implementation timeline & milestones

- 3.12.4 Risk assessment & mitigation strategies

- 3.13 Consumer behavior & adoption trends

- 3.13.1 Adoption lifecycle analysis

- 3.13.2 Technology adoption curves by segment

- 3.13.3 Regional adoption patterns

- 3.13.4 Generational adoption differences

- 3.13.5 Seasonal & temporal adoption patterns

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Installation, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 OEM-installed systems

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 GPS-Based Tracking Systems

- 7.3 Radio Frequency (RF) Systems

- 7.4 Cellular & Telematics Platforms

- 7.5 Hybrid Systems (GPS + RF)

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Individual vehicle owners

- 8.3 Fleet owners

- 8.4 Insurance companies

- 8.5 Government & law enforcement

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Active Stolen Vehicle Recovery

- 9.3 Fleet Management & Security

- 9.4 Insurance Telematics & UBI

- 9.5 Automotive Dealer Solutions

- 9.6 Asset & Equipment Tracking

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Service Model, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Hardware + Subscription

- 10.3 Integrated Service Plans

- 10.4 One-Time Purchase

- 10.5 Enterprise/Fleet Licensing

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 CalAmp

- 12.1.2 General Motors

- 12.1.3 Geotab

- 12.1.4 Robert Bosch

- 12.1.5 Spireon

- 12.1.6 Verizon Communications

- 12.1.7 Vodafone Automotive

- 12.2 Regional Players

- 12.2.1 Ituran Location & Control

- 12.2.2 MiX Telematics

- 12.2.3 Netstar (Altron)

- 12.2.4 Samsara

- 12.2.5 Teletrac Navman

- 12.2.6 TomTom International

- 12.3 Emerging Players

- 12.3.1. 3 Si Security Systems

- 12.3.2 Ford Pro

- 12.3.3 Lytx

- 12.3.4 Matrack

- 12.3.5 Powerfleet

- 12.3.6 Quartix Technologies

- 12.3.7 RecovR

- 12.3.8 StarChase

- 12.3.9 Telematica

- 12.3.10 TRACKMATIC

- 12.3.11 Trimble

- 12.3.12 Zubie