PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885920

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885920

Asia Pacific Contact Lenses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

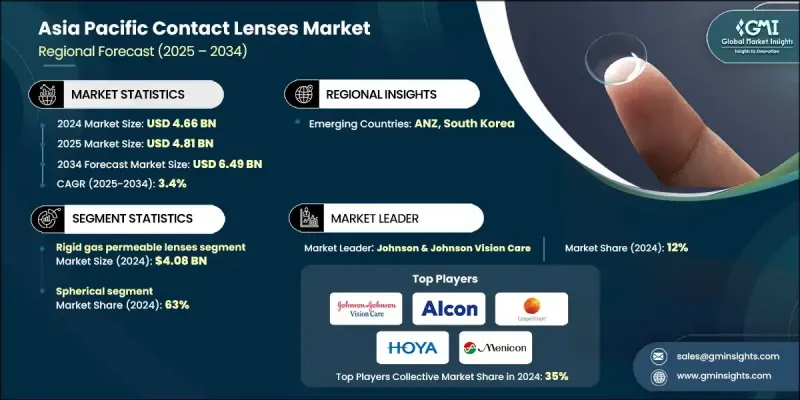

Asia Pacific Contact Lenses Market was valued at USD 4.66 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 6.49 billion by 2034.

The market is fueled by the rising prevalence of myopia, particularly among children and young adults, driven by increasing screen time, extensive near-work activities, and reduced outdoor exposure. Countries such as China, Japan, and South Korea report some of the highest myopia rates globally, which has led to growing demand for effective myopia management solutions. Contact lenses, especially specialty lenses designed for myopia control, are gaining popularity as they offer convenience, superior visual performance, and aesthetic benefits compared to traditional spectacles. Urbanization, rising disposable incomes, and changing lifestyles are further promoting the adoption of high-value vision correction solutions. The increasing endorsement of early intervention by governments and healthcare organizations also supports market expansion. The growing burden of refractive errors offers manufacturers an opportunity to innovate and expand product portfolios. Companies are developing advanced options, including orthokeratology lenses and specialized soft lenses for myopia control, to meet rising demand. Partnerships with eye-care professionals and targeted marketing to parents and children are boosting adoption rates. As disposable incomes increase, consumers are favoring lenses that offer comfort, aesthetics, and advanced functionalities over basic spectacles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.66 Billion |

| Forecast Value | $6.49 Billion |

| CAGR | 3.4% |

In 2024, the rigid gas permeable (RGP) lenses segment generated USD 4.08 billion. RGP lenses are preferred for patients with complex visual requirements, including high astigmatism, keratoconus, and irregular corneal conditions. In regions with high myopia prevalence, RGP lenses are increasingly recommended due to their superior optical performance and oxygen permeability, influencing long-term clinical preference among eye-care practitioners.

The spherical lenses segment held a 63% share in 2024. These lenses are easier to manufacture and require minimal customization compared to toric or multifocal lenses, making them highly suitable for online sales. E-commerce platforms across China, India, and Southeast Asia are enhancing accessibility, including tier-2 and tier-3 cities. Subscription models and bundled offers for spherical lenses are also gaining traction, allowing brands to expand distribution and reach price-sensitive consumers.

China Contact Lenses Market held a 30.8% share and generated USD 1.44 billion in 2024. With one of the highest childhood and adolescent myopia rates globally, China presents a strong demand for corrective lenses, including orthokeratology and myopia-control soft lenses. Government initiatives and incentive programs to manage childhood myopia are driving the adoption of these products, positioning China as a hub for advanced vision correction solutions.

Major players in the Asia Pacific Contact Lenses Market include Johnson & Johnson Vision Care, Neo Vision, SEED, Pegavision, Alcon Vision, Menicon, Hoya, ClearLab, Visco Vision, Coopervision, G&G Contact Lens, Shanghai Weicon Optics, E.O.S. Co., St. Shine Optical, and Vizionfocus. Market leaders are focusing on product innovation by developing advanced lenses, such as orthokeratology, toric, and multifocal options, to address rising myopia and complex refractive errors. Partnerships with optometrists and ophthalmologists help expand professional recommendation channels. Companies are investing in e-commerce and digital platforms to increase accessibility in urban and rural regions, while subscription and bundled models drive recurring sales and customer loyalty. Marketing initiatives targeting parents and younger demographics are increasing awareness of myopia control benefits. Expansion into high-growth countries and tier-2/3 cities ensures broader market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Countries

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Design

- 2.2.5 Color variation

- 2.2.6 Usage

- 2.2.7 Pricing

- 2.2.8 Application

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of myopia and refractive errors

- 3.2.1.2 Urbanization and rising disposable incomes

- 3.2.1.3 Growing cosmetic application

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Raw material supply fluctuations

- 3.2.2.2 Stringent regulatory barriers

- 3.2.3 Opportunities

- 3.2.3.1 Smart contact lens innovation

- 3.2.3.2 Sustainability & eco-friendly products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By countries

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Soft contact lenses

- 5.3 Rigid gas permeable lenses

- 5.4 Hybrid contact lenses

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Hydrogel

- 6.2.1 Silicone hydrogel

- 6.2.2 HEMA hydrogels

- 6.3 Rigid gas permeable

- 6.4 Others (PMMA, hybrid)

Chapter 7 Market Estimates and Forecast, By Design, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Spherical

- 7.3 Toric

- 7.4 Multifocal

- 7.5 Others (monovision, etc.)

Chapter 8 Market Estimates and Forecast, By Color Variation, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Opaque contact lenses

- 8.3 Enhancers/tinted contact lenses

- 8.4 Visibility tinted contact lenses

Chapter 9 Market Estimates and Forecast, By Usage, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Daily disposable

- 9.3 Weekly disposable

- 9.4 Monthly disposable

- 9.5 Annual

Chapter 10 Market Estimates and Forecast, By Pricing, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Vision correction

- 11.3 Therapeutic lenses

- 11.4 Cosmetic lenses

- 11.4.1 Colored

- 11.4.2 Circle

- 11.5 Prosthetic lenses

- 11.6 Others (Myopia control, smart contact)

Chapter 12 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 Offline

- 12.2.1 Specialty stores

- 12.2.2 Supermarkets & hypermarkets

- 12.2.3 Pharmacy stores

- 12.2.4 Others

- 12.3 Online

- 12.3.1 E-commerce

- 12.3.2 Brand websites

Chapter 13 Market Estimates and Forecast, By Countries, 2021 - 2034 (USD Billion) (Thousand Units)

- 13.1 Key trends

- 13.2 China

- 13.3 India

- 13.4 Japan

- 13.5 South Korea

- 13.6 ANZ

- 13.7 SEA

- 13.8 Rest of APAC

Chapter 14 Company Profiles

- 14.1 Alcon vision

- 14.2 ClearLab

- 14.3 CooperVision

- 14.4 E.O.S Co.

- 14.5 G&G Contact Lens

- 14.6 Hoya

- 14.7 Johnson & Johnson Vision Care

- 14.8 Menicon

- 14.9 Neo Vision

- 14.10 Pegavision

- 14.11 SEED

- 14.12 Shanghai Weicon Optics

- 14.13 St. Shine Optical

- 14.14 Visco Vision

- 14.15 Vizionfocus