PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833684

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833684

ASEAN Medical and Wellness Tourism Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

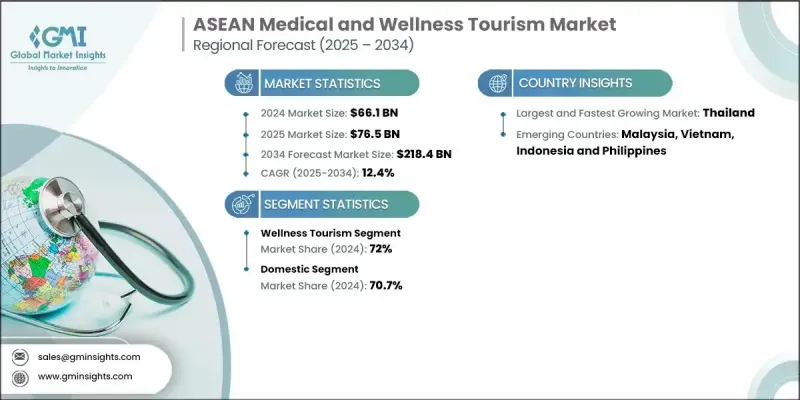

ASEAN medical and wellness tourism market was estimated at USD 66.1 billion in 2024 and is expected to grow from USD 76.5 billion in 2025 to USD 218.4 billion by 2034, at a CAGR of 12.4%, according to the latest report published by Global Market Insights Inc.

Many ASEAN countries offer world-class medical care at a fraction of the cost compared to Western nations. Countries like Thailand, Malaysia, and Singapore have internationally accredited hospitals, attracting patients seeking affordable surgeries, dental care, and fertility treatments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $66.1 Billion |

| Forecast Value | $218.4 Billion |

| CAGR | 12.4% |

Rising Adoption of Wellness Tourism

The wellness tourism segment held a significant share in 2024, fueled by increasing global demand for preventive healthcare, holistic therapies, and lifestyle retreats. Travelers are no longer seeking treatment only when ill; they're actively investing in physical, mental, and emotional well-being. This segment attracts both short-term and long-stay travelers, often from high-income countries, contributing significantly to the region's tourism revenue.

Domestics to Gain Traction

The domestic segment held a sizeable share in 2024, backed by COVID-19 pandemic, which disrupted international travel and pushed locals to seek high-quality care and wellness experiences within their home countries. Rising middle-class income, improved healthcare infrastructure, and growing awareness of preventive health have driven domestic patients to private hospitals, specialty clinics, and wellness resorts.

Thailand to Emerge as a Lucrative Region

Thailand medical and wellness tourism market is poised to grow at a significant CAGR during 2025-2034, owing to its globally recognized healthcare system, competitive pricing, and seamless integration of hospitality with clinical care. From cosmetic surgery and fertility treatment to orthopedic procedures and traditional Thai medicine, Thailand offers a diverse portfolio of services backed by international hospital accreditations. Its strategic investment in health-focused infrastructure, combined with visa facilitation and multilingual support, has positioned the country as a top-tier destination for both medical and wellness travelers.

Key players in the ASEAN medical and wellness tourism market are Radisson Hotel Group, Sunway Group, Raffles Medical Group, Mahkota Medical Centre, InterContinental Group, SingHealth Group, Four Seasons Hotels, Penang Adventist Hospital, Hilton Worldwide Holdings Inc., Makati Medical Center, Rosewood Hotel Group, KPJ Healthcare Berhad, Bumrungrad International Hospital, IHH Healthcare, National Heart Institute (Institut Jantung Negara), Marriott International, COMO Hotels and Resorts, and St. Luke's Medical Center.

To strengthen their foothold, companies in the ASEAN medical and wellness tourism market are focusing on service integration, digital transformation, and cross-border partnerships. Leading hospital groups and wellness resort chains are investing in bundled packages that include medical check-ups, recovery stays, and wellness therapies under one price.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Category trends

- 2.2.3 Travel type trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Low cost of medical treatment in developing countries

- 3.2.1.2 Growing compliance towards international standards for surgical procedures

- 3.2.1.3 Various government policies to ease medical travel

- 3.2.1.4 Growing interest of people toward health and wellness

- 3.2.1.5 Rising government initiatives to promote wellness tourism

- 3.2.1.6 Growing preference for eco-friendly and sustainable wellness practices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of wellness programs

- 3.2.2.2 Long wait time for certain medical procedures

- 3.2.2.3 Issue with patient follow-up and post-surgery complications

- 3.2.2.4 Limited awareness and education for wellness tourism

- 3.2.3 Opportunities

- 3.2.3.1 Development of health special economic zones

- 3.2.3.2 Digital healthcare and telemedicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.1.1 AI-powered translation tools

- 3.5.1.2 Digital wellness platforms

- 3.5.1.3 Electronic medical records (EMR) integration

- 3.5.2 Emerging technologies

- 3.5.2.1 Blockchain-based health data security

- 3.5.2.2 AR/VR for medical tourism

- 3.5.1 Current technological trends

- 3.6 Medical coverage scenario

- 3.7 Consumer insights

- 3.8 Number of wellness tourism trips and average spending in key ASEAN countries

- 3.9 Wellness tourism, by travel purpose, 2021 - 2034 (USD Mn)

- 3.9.1 Primary

- 3.9.2 Secondary

- 3.10 Developments and initiatives by country

- 3.10.1 Thailand

- 3.10.2 Vietnam

- 3.10.3 Malaysia

- 3.10.4 Indonesia

- 3.10.5 Philippines

- 3.10.6 Singapore

- 3.10.7 Cambodia

- 3.11 Demographics of patients/tourists

- 3.12 Investment landscape

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wellness tourism, by service

- 5.2.1 Lodging

- 5.2.2 Transport

- 5.2.3 Wellness activities

- 5.2.4 Other services

- 5.3 Medical tourism, by application

- 5.3.1 Cardiovascular surgery

- 5.3.2 Cosmetic surgery

- 5.3.2.1 Breast augmentation

- 5.3.2.2 Hair transplant

- 5.3.2.3 Other cosmetic surgeries

- 5.3.3 Orthopedic surgery

- 5.3.4 Oncology treatment

- 5.3.5 Fertility treatment

- 5.3.6 Bariatric surgery

- 5.3.7 Other applications

Chapter 6 Market Estimates and Forecast, By Travel type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wellness tourism

- 6.2.1 Domestic

- 6.2.2 International

- 6.3 Medical tourism

- 6.3.1 Domestic

- 6.3.2 International

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Thailand

- 7.3 Malaysia

- 7.4 Vietnam

- 7.5 Indonesia

- 7.6 Philippines

- 7.7 Singapore

- 7.8 Cambodia

- 7.9 Laos

- 7.10 Brunei

Chapter 8 Healthcare and Wellness Providers

- 8.1 Key players

- 8.1.1 Bumrungrad International Hospital

- 8.1.2 COMO Hotels and Resorts

- 8.1.3 Four Seasons Hotels

- 8.1.4 Hilton Worldwide Holdings Inc.

- 8.1.5 IHH Healthcare

- 8.1.6 InterContinental Group

- 8.1.7 KPJ Healthcare Berhad

- 8.1.8 Mahkota Medical Centre

- 8.1.9 Makati Medical Center

- 8.1.10 Marriott International

- 8.1.11 National Heart Institute (Institut Jantung Negara)

- 8.1.12 Penang Adventist Hospital

- 8.1.13 Radisson Hotel Group

- 8.1.14 Raffles Medical Group

- 8.1.15 Rosewood Hotel Group

- 8.1.16 SingHealth Group

- 8.1.17 St. Luke's Medical Center

- 8.1.18 Sunway Group

- 8.2 Emerging players

- 8.2.1 AEK Udon International Hospital

- 8.2.2 Gojek

- 8.2.3 Grab Holdings Ltd.

- 8.2.4 Kamalaya

- 8.2.5 Keemala

- 8.2.6 RAKxa

- 8.2.7 Yanhee International Hospital