PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833629

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833629

Automotive Cockpit Domain Controller Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

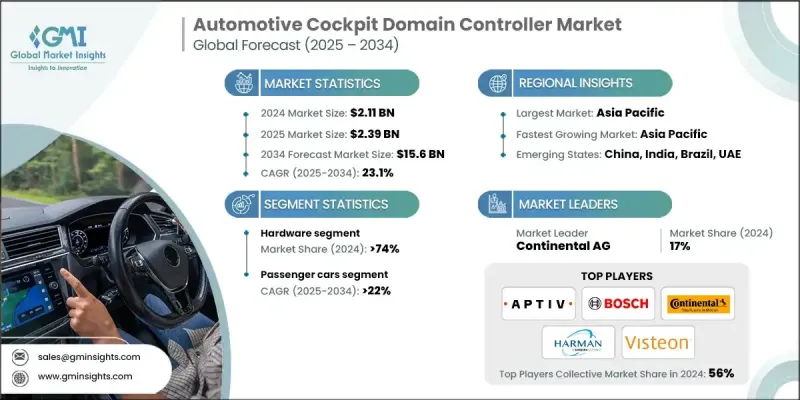

The global automotive cockpit domain controller market was estimated at USD 2.11 billion in 2024 and is expected to grow from USD 2.39 billion in 2025 to USD 15.6 billion by 2034, at a CAGR of 23.1%, according to the latest report published by Global Market Insights Inc.

Automakers are shifting from multiple standalone ECUs to centralized cockpit domain controllers, streamlining software architecture and reducing complexity. This consolidation not only cuts down on wiring and weight but also simplifies updates and diagnostics across infotainment, instrument clusters, and climate systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.11 Billion |

| Forecast Value | $15.6 Billion |

| CAGR | 23.1% |

Rising Adoption in Hardware

The hardware segment from the automotive cockpit domain controller market held a significant share in 2024, driven by innovation focusing on delivering powerful and energy-efficient processors capable of managing complex infotainment, connectivity, and safety features simultaneously. This segment drives growth by integrating advanced SoCs, GPUs, and high-speed communication interfaces into compact, thermally optimized modules designed to withstand automotive-grade conditions. With increasing demand for real-time processing and multitasking capabilities, hardware suppliers are prioritizing modular designs and scalable architectures to meet diverse vehicle requirements, ensuring reliability and performance in next-generation smart cockpits.

Passenger Cars to Gain Traction

The passenger cars segment generated notable revenues in 2024, fueled by rising consumer expectations for enhanced user experiences, connectivity, and safety. OEMs are investing heavily in integrating smart cockpits that offer seamless interaction through voice recognition, multi-display setups, and AI-powered assistants, all orchestrated by robust domain controllers. This reflects a clear trend toward smarter, more connected interiors that redefine the driving experience.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific stands as a key growth engine in the automotive cockpit domain controller market, driven by rapid urbanization, increasing vehicle production, and expanding consumer demand for advanced in-car technologies. Countries like China, Japan, South Korea, and India are investing heavily in smart vehicle technologies, supported by government initiatives promoting electric mobility and digital transformation. The market growth is propelled by local manufacturing capabilities and strong collaborations between global suppliers and regional automakers seeking to capture the rising demand for connected, intelligent cockpit solutions.

Major players in the automotive cockpit domain controller market are Visteon, NVIDIA, Robert Bosch, Qualcomm Technologies, Aptiv, HARMAN, Denso, Intel, Faurecia, and Continental.

To strengthen their market position, companies in the automotive cockpit domain controller space are focusing on several strategic initiatives. These include investing in R&D to develop scalable, high-performance platforms integrate emerging technologies such as AI, AR, and 5G connectivity. Many firms are forging partnerships and joint ventures with OEMs and software developers to co-create customized solutions tailored to specific vehicle models and regions. Additionally, expanding regional manufacturing footprints, particularly in the Asia Pacific, enables faster delivery and cost advantages. Companies also emphasize cybersecurity features and over-the-air update capabilities to meet evolving safety standards and consumer expectations, securing their foothold in this competitive and rapidly evolving market.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for connected and software-defined vehicles

- 3.2.1.2 Transition toward centralized e/e vehicle architecture

- 3.2.1.3 Increasing consumer demand for advanced infotainment & digital cockpit experiences

- 3.2.1.4 Growth of EVs and autonomous vehicles

- 3.2.1.5 OEM-tier 1 collaborations with semiconductor & software players

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration & software validation costs

- 3.2.2.2 Cybersecurity and data privacy risks

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of cloud-enabled and OTA update ecosystems

- 3.2.3.2 Growing penetration in emerging markets (APAC, LATAM, MEA)

- 3.2.3.3 Advanced HMI & multimodal interaction systems

- 3.2.3.4 Integration with mobility services and fleet applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory and standards landscape

- 3.4.1 Global regulatory framework analysis

- 3.4.2 Functional safety standards and implementation

- 3.4.3 Regional regulatory variations and compliance

- 3.4.4 Compliance cost analysis and implementation strategy

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology & innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Hardware technology maturity

- 3.7.1.2 Software platform readiness

- 3.7.1.3 Integration complexity assessment

- 3.7.2 Future technology roadmap

- 3.7.2.1 Hardware evolution timeline and milestones

- 3.7.2.2 Software platform development roadmap

- 3.7.2.3 Emerging technology integration schedule

- 3.7.3 Standards evolution and industry impact

- 3.7.3.1 Autosar adaptive platform evolution

- 3.7.3.2 Iso 26262 updates and safety implications

- 3.7.3.3 Cybersecurity standards roadmap

- 3.7.1 Current technological trends

- 3.8 Cost structure analysis and business case framework

- 3.8.1 Total cost of ownership (TCO) analysis

- 3.8.2 ROI models and payback analysis

- 3.8.3 Pricing strategy analysis and benchmarking

- 3.8.4 Investment requirements by market segment

- 3.9 Patent analysis

- 3.10 Sustainability and esg impact assessment

- 3.10.1 Environmental impact analysis and metrics

- 3.10.2 Social impact considerations and metrics

- 3.10.3 Governance and compliance framework

- 3.10.4 Esg investment implications and financial impact

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Supply chain intelligence and risk assessment

- 3.13.1 Global supply chain mapping and analysis

- 3.13.2 Semiconductor supply chain deep dive

- 3.13.3 Geopolitical risk assessment

- 3.13.4 Supply chain resilience and optimization strategies

- 3.14 Intellectual property and patent landscape

- 3.14.1 Patent filing trends and innovation analysis

- 3.14.2 Key patent holders and ip strategy analysis

- 3.14.3 Ip monetization opportunities and strategies

- 3.14.4 Freedom to operate and ip risk management

- 3.15 Go-to-market strategy framework

- 3.15.1 Market entry strategy analysis

- 3.15.2 Customer segmentation and targeting strategy

- 3.15.3 Channel strategy and partner ecosystem

- 3.15.4 Marketing and sales effectiveness

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 System on chip

- 5.2.1.1 Modules

- 5.2.1.1.1 Memory

- 5.2.1.1.2 Connectivity

- 5.2.1.1 Modules

- 5.2.2 Display interfaces

- 5.2.3 Camera & sensors

- 5.2.4 Others (power management IC, HUD)

- 5.2.1 System on chip

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Centralized architecture

- 7.3 Distributed architecture

- 7.4 Zonal architecture

- 7.5 Hybrid architecture

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Original equipment manufacturer (oem) channel

- 8.3 Aftermarket channel

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Infotainment systems

- 9.3 Digital instrument cluster

- 9.4 Human machine interface (hmi)

- 9.5 Head-up display (hud) integration

- 9.6 Driver monitoring systems

- 9.7 Climate control and comfort systems

- 9.8 Advanced applications and emerging use cases

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aptiv

- 11.1.2 Continental

- 11.1.3 Denso

- 11.1.4 HARMAN International Industries

- 11.1.5 Intel

- 11.1.6 NVIDIA

- 11.1.7 Qualcomm Technologies

- 11.1.8 Robert Bosch

- 11.1.9 STMicroelectronics

- 11.1.10 Texas Instruments

- 11.1.11 Visteon

- 11.1.12 Valeo

- 11.2 Regional Players

- 11.2.1 Alpine Electronics

- 11.2.2 Faurecia

- 11.2.3 Hyundai Mobis

- 11.2.4 Infineon Technologies

- 11.2.5 LG Electronics

- 11.2.6 Magna International

- 11.2.7 NXP Semiconductors

- 11.2.8 Panasonic

- 11.2.9 Sony

- 11.3 Emerging Players/Disruptors

- 11.3.1 Analog Devices

- 11.3.2 Black Sesame Technologies

- 11.3.3 BYD Company

- 11.3.4 ECARX Holdings

- 11.3.5 Horizon Robotics

- 11.3.6 Huawei Technologies

- 11.3.7 MediaTek

- 11.3.8 Renesas Electronics

- 11.3.9 Tesla