PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892890

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892890

Rare Earth Metals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

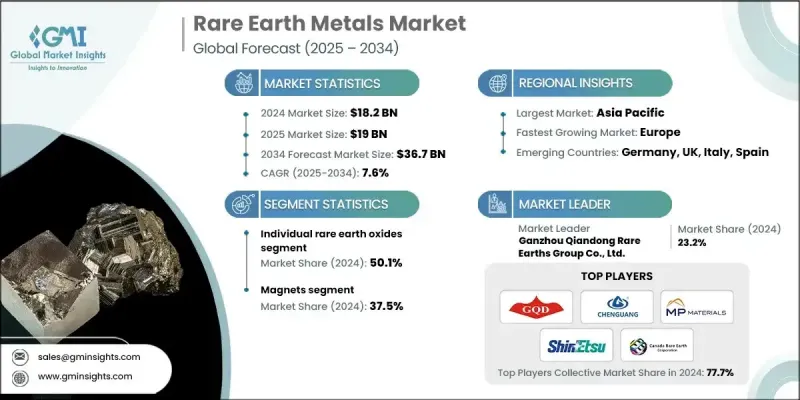

The Global Rare Earth Metals Market was valued at USD 18.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 36.7 billion by 2034.

Market expansion is driven by rising global dependence on high-performance materials required for electric vehicles, renewable energy technologies, advanced electronics, and modern defense systems. Rare earth metals, known for their exceptional magnetic, thermal, and optical properties, play an indispensable role in powering motors, batteries, sensors, catalysts, and communication systems. With industries aggressively transitioning toward clean energy and electrification, demand for these critical minerals continues to accelerate. Additionally, governments worldwide are increasingly prioritizing supply chain security, encouraging new mining investments, recycling initiatives, and strategic reserves to reduce dependence on limited geographical sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.2 Billion |

| Forecast Value | $36.7 Billion |

| CAGR | 7.6% |

The individual rare earth oxides segment accounted for 50.1% in 2024 and is projected to grow at a CAGR of 7.7% through 2034. Demand for these individual rare earth metals is rising rapidly as their applications in advanced technologies continue to expand. Elements such as neodymium, praseodymium, and dysprosium are experiencing particularly strong demand due to their critical role in high-performance permanent magnets used in electric vehicles, wind energy systems, and electronic devices.

By application, the magnets segment held a 37.5% share in 2024, driven by rapid adoption in clean energy technologies and industrial automation. Their superior magnetic strength, durability, and energy efficiency make them irreplaceable in modern motors, turbines, medical devices, and precision equipment.

Asia Pacific Rare Earth Metals Market will grow at a CAGR of 8.3% by 2034, reinforcing its position as the global hub for rare earth metals mining, processing, and manufacturing activities. China's extensive production capacity, combined with strong demand from electronics, automotive, and renewable energy industries, drives the region's leadership. Moreover, the rapid expansion of EV manufacturing, the development of offshore wind projects, and the steady growth of semiconductor production are fueling increased consumption of rare earth elements.

Key players operating in the Global Rare Earth Metals Market include China Northern Rare Earth Group, Lynas Rare Earths, MP Materials, Iluka Resources, Arafura Resources, Alkane Resources, Ucore Rare Metals, Rare Element Resources, Texas Mineral Resources, Avalon Advanced Materials, Greenland Minerals, Rainbow Rare Earths, Defence Metals Corp., Neo Performance Materials, and China Minmetals Rare Earth Co. Ltd. Companies in the rare earth metals market are strengthening their market position by expanding mining capacities, developing advanced separation technologies, and enhancing value-added processing to reduce reliance on external suppliers. Many firms are focusing on long-term supply agreements with EV manufacturers, wind turbine producers, and electronics companies to secure stable revenue streams. Innovation in recycling technologies is also gaining momentum, enabling companies to reclaim rare earths from magnets, batteries, and electronic waste, lowering environmental impact and improving supply resilience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Mixed Rare Earth Oxides (MREO)

- 5.2.1 Light REE Oxides Mix

- 5.2.2 Heavy REE Oxides Mix

- 5.2.3 Balanced LREO-HREO Mix

- 5.3 Individual Rare Earth Oxides

- 5.3.1 Light REE Oxides

- 5.3.2 Heavy REE Oxides

- 5.3.3 Yttrium Group Oxides

- 5.4 Individual Rare Earth Metals

- 5.4.1 Cerium

- 5.4.2 Dysprosium

- 5.4.3 Erbium

- 5.4.4 Gadolinium

- 5.4.5 Lanthanum

- 5.4.6 Neodymium

- 5.4.7 Praseodymium

- 5.4.8 Samarium

- 5.4.9 Scandium

- 5.4.10 Terbium

- 5.4.11 Ytterbium

- 5.4.12 Yttrium

- 5.4.13 Others (Europium, Holmium, Lutetium, Promethium, and Thulium)

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Magnets

- 6.3 Colorants

- 6.4 Alloys

- 6.5 Optical instruments

- 6.6 Catalysts

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 American Elements

- 8.2 Arafura Rare Earths

- 8.3 Australian Strategic Materials (ASM)

- 8.4 Canada Rare Earth Corporation

- 8.5 Energy Fuels Inc

- 8.6 Ganzhou Chenguang Rare Earths New Material Co., Ltd.

- 8.7 Ganzhou Qiandong Rare Earths Group Co., Ltd.

- 8.8 Iluka Resources Limited

- 8.9 Indian Rare Earths Limited

- 8.10 Lynas Rare Earths Ltd

- 8.11 MP Materials

- 8.12 Neo Performance Materials

- 8.13 Northern Minerals Limited

- 8.14 Rio Tinto

- 8.15 Shin-Etsu Chemical Co., Ltd.

- 8.16 Western Minmetals (SC) Corporation