PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913419

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913419

Automotive Heat Shield Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

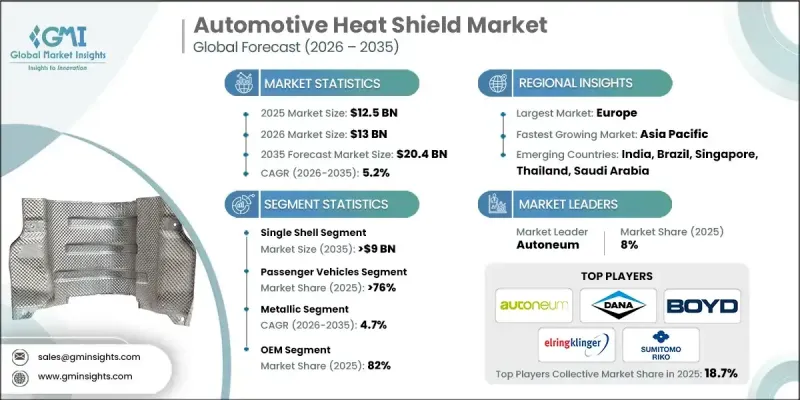

The Global Automotive Heat Shield Market was valued at USD 12.5 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 20.4 billion by 2035.

Market growth is supported by rising thermal management requirements across modern vehicle architectures. Increasing adoption of forced-induction engines in both gasoline and diesel vehicles is intensifying the need for durable heat protection solutions that safeguard surrounding components, preserve structural integrity, and support long-term engine performance. At the same time, the shift toward electrified mobility is introducing new thermal control demands linked to batteries, power electronics, and charging systems. Automotive heat shields are increasingly used to regulate heat dispersion, improve component lifespan, and support safe operation across electric and hybrid platforms. Growing consumer focus on driving comfort and vehicle safety is further strengthening demand, as effective thermal insulation limits heat transfer into the cabin and protects sensitive systems from elevated temperatures. Regulatory pressure also plays a key role, with automakers relying on heat shields to meet tightening emission, fire safety, and thermal compliance standards across global markets. As vehicles become more complex and power-dense, advanced heat shielding solutions remain essential to performance, safety, and regulatory alignment.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $12.5 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 5.2% |

In 2025, the single-shell category represented 47% share and is forecast to reach USD 9 billion by 2035. This segment continues to see strong adoption due to its cost efficiency, straightforward production, and effectiveness in applications with moderate thermal exposure, particularly across high-volume vehicle platforms.

The passenger vehicles accounted for 76% share in 2025, generating USD 9.5 billion. High production volumes, stricter emission requirements, widespread turbocharged engine use, and accelerating electrification are increasing thermal management complexity across both mainstream and premium vehicle segments.

U.S. Automotive Heat Shield Market was valued at USD 1.91 billion in 2025 and is expected to post solid growth through 2035. Continued uptake of turbocharged engines and hybrid drivetrains is sustaining demand for advanced exhaust and powertrain heat shielding solutions. Lightweighting priorities encourage greater use of composite and multilayer designs to support efficiency targets, extended electric driving range, and compliance with federal safety and emission standards.

Key companies operating in the Global Automotive Heat Shield Market include Dana, Autoneum, ElringKlinger, Morgan Advanced Materials, Boyd, Freudenberg Sealing Technologies, Sumitomo Riko, Zircotec, Carcoustics, and Thermo-Tec Automotive. Companies in the Global Automotive Heat Shield Market are strengthening their competitive position through material innovation, lightweight design development, and close collaboration with vehicle manufacturers. Investments in advanced composites and multilayer insulation technologies are helping suppliers address rising thermal loads while supporting fuel efficiency and electric vehicle range targets. Manufacturers are expanding localized production and engineering capabilities to align with OEM platform strategies and shorten development cycles. Long-term supply agreements, platform-specific customization, and early-stage design integration are being used to secure recurring business.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Material

- 2.2.5 Sales channel

- 2.2.6 Propulsion

- 2.2.7 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Stringent emission and thermal safety regulations

- 3.2.1.3 Rising vehicle production and vehicle parc growth

- 3.2.1.4 Increasing adoption of turbocharged and high-performance engines

- 3.2.1.5 Expanding thermal management needs in electric and hybrid vehicles

- 3.2.1.6 Growth in aftermarket replacement demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 Declining heat shield intensity in fully electric vehicles

- 3.2.3 Market opportunities

- 3.2.3.1 EV battery and power electronics heat shielding

- 3.2.3.2 Adoption of lightweight and advanced insulation materials

- 3.2.3.3 Expansion of underbody and modular heat shield solutions

- 3.2.3.4 Aftermarket and retrofit growth in emerging markets

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. - ISO 9001 Quality Management Systems

- 3.4.1.2 Canada - ISO 45001 Occupational Health and Safety

- 3.4.2 Europe

- 3.4.2.1 UK - ISO/IEC 27001 Information Security Management

- 3.4.2.2 Germany - ISO 50001 Energy Management Systems

- 3.4.2.3 France - ISO 45001 Occupational Health and Safety

- 3.4.2.4 Italy - ISO 14001 Environmental Management Systems

- 3.4.2.5 Spain - ISO 22000 Food Safety Management Systems

- 3.4.3 Asia Pacific

- 3.4.3.1 China - ISO/IEC 27001 Information Security Management

- 3.4.3.2 Japan - ISO 14001 Environmental Management Systems

- 3.4.3.3 India - ISO 45001 Occupational Health and Safety

- 3.4.4 Latin America

- 3.4.4.1 Brazil - ISO 14001 Environmental Management Systems

- 3.4.4.2 Mexico - ISO 45001 Occupational Health and Safety

- 3.4.4.3 Argentina - ISO 14001 Environmental Management Systems

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE - ISO 14001 Environmental Management Systems

- 3.4.5.2 South Africa - ISO 45001 Occupational Health and Safety

- 3.4.5.3 Saudi Arabia - ISO 14001 Environmental Management Systems

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Production statistics

- 3.8.1 Production hubs

- 3.8.2 Consumption hubs

- 3.8.3 Export and import

- 3.9 Cost breakdown analysis

- 3.9.1 Development cost structure

- 3.9.2 R&D cost analysis

- 3.9.3 Marketing & sales costs

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Future market outlook & opportunities

- 3.13 OEM design ownership & sourcing decision framework

- 3.13.1 OEM-specified vs supplier-designed heat shields

- 3.13.2 Cost, weight & thermal performance trade-offs

- 3.13.3 Platform-level sourcing strategies

- 3.14 Lightweighting & material substitution dynamics

- 3.14.1 Metal-to-composite transition trends

- 3.14.2 Weight reduction vs cost sensitivity

- 3.14.3 Impact on OEM CO2 compliance strategies

- 3.14.4 Adoption barriers for advanced materials

- 3.15 EV impact on heat shield content & design evolution

- 3.15.1 Heat shield demand shifts in ICE vs hybrid vs EVs

- 3.15.2 Battery, inverter & power electronics shielding needs

- 3.15.3 Net content change per vehicle

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast By Product, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single shell

- 5.3 Double shell

- 5.4 Sandwich

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Metallic

- 7.3 Ceramic

- 7.4 Composite

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Hybrid

- 8.4 Electric

- 8.4.1 BEV

- 8.4.2 FCEV

- 8.4.3 PHEV

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Underbody heatshield

- 10.3 Engine

- 10.4 Exhaust

- 10.5 Turbocharger

- 10.6 Transmission

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Portugal

- 11.3.9 Croatia

- 11.3.10 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Autoneum

- 12.1.2 Dana

- 12.1.3 ElringKlinger

- 12.1.4 Freudenberg Sealing Technologies

- 12.1.5 Morgan Advanced Materials

- 12.1.6 Sumitomo Riko

- 12.1.7 Carcoustics

- 12.1.8 UGN

- 12.1.9 Adler Pelzer

- 12.1.10 Toyoda Gosei

- 12.1.11 Nihon Tokushu Toryo

- 12.2 Regional Players

- 12.2.1 Boyd

- 12.2.2 Frenzelit

- 12.2.3 Happich

- 12.2.4 Talbros

- 12.2.5 Design Engineering

- 12.2.6 Thermo-Tec Automotive

- 12.2.7 Sekisui Chemical

- 12.2.8 Sika Automotive

- 12.2.9 Trelleborg Automotive

- 12.3 Emerging / Disruptor Players

- 12.3.1 Alpha Engineered Components

- 12.3.2 Anhui Parker New Material

- 12.3.3 Heatshield Products

- 12.3.4 Zircotec

- 12.3.5 Pyrotek Automotive Thermal Solutions

- 12.3.6 Unifrax