PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801916

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801916

EV Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

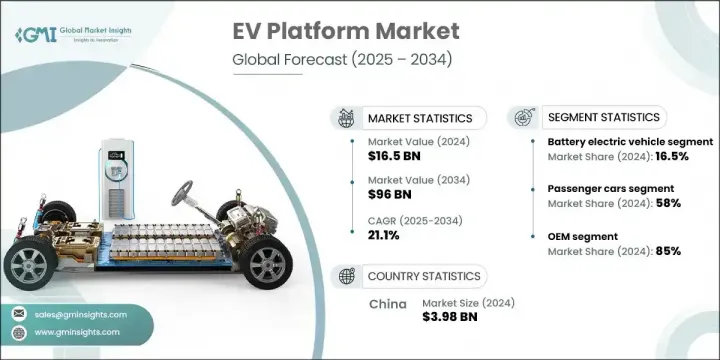

The Global EV Platform Market was valued at USD 16.5 billion in 2024 and is estimated to grow at a CAGR of 21.1% to reach USD 96 billion by 2034. The increasing shift toward sustainable and zero-emission mobility solutions has sparked rapid innovation in EV platforms. These platforms are now evolving into modular, software-defined systems that support advanced features like autonomous driving, battery integration, and scalable powertrains. Automakers are designing platforms that allow flexible architecture across vehicle classes while enabling cost-efficient production and improved energy efficiency.

AI-driven features and over-the-air updates play a crucial role in optimizing range and performance. The pandemic accelerated demand for digital-first vehicle experiences, pushing companies to integrate contactless functionalities and real-time connectivity tools into platform design. Advancements in remote diagnostics, voice-assisted controls, and intelligent route management have elevated EV platforms from basic structural components to intelligent, adaptable backbones for next-gen mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 Billion |

| Forecast Value | $96 Billion |

| CAGR | 21.1% |

The battery electric vehicles segment held 16.5% share and is forecasted to grow at a CAGR of 21% through 2034. BEVs are favored due to their clean architecture and compatibility with skateboard-style platforms that maximize interior space, battery placement, and design flexibility. Their pure electric nature eliminates combustion systems, allowing manufacturers to engineer streamlined structures, reduce production costs, and boost performance efficiency.

The passenger car segment held the highest share at 58% in 2024 and is projected to maintain strong growth with a CAGR of 20% from 2025 to 2034. Widespread adoption of electric passenger vehicles has been fueled by growing consumer demand, paired with substantial OEM investment in platform development. Companies are creating dedicated EV architectures optimized for sedans, hatchbacks, and compact SUVs, offering flexible designs, enhanced battery life, and support for connected features. This broad adaptability enables automakers to target a mass-market audience with improved range, safety, and digital integration.

China EV Platform Market held 69% share, generating USD 3.98 billion in 2024. The country plays a pivotal role in the market as both a major EV manufacturer and consumer. Strategic government support through subsidies, production mandates, and charging infrastructure investments has created strong momentum in platform innovation. Domestic firms continue to engineer scalable, affordable EV platforms that balance performance and range while catering to the needs of their expanding electric vehicle user base.

Leading companies shaping the Global EV Platform Market include Ford, Tesla, Toyota, Volkswagen, BMW, General Motors, and Volvo. To reinforce their market position, companies in the EV platform sector are prioritizing a mix of strategic investments and partnerships. OEMs are heavily investing in R&D to develop modular platforms that support a wide range of vehicle sizes and functions, while ensuring compatibility with emerging software-driven technologies. Automakers are also collaborating with battery producers and tech firms to create integrated ecosystems for connectivity, charging, and autonomy. Furthermore, many are adopting vertical integration models to control key components such as motors, controllers, and battery packs, which enhances performance and cost control. These strategies help ensure scalability, adaptability, and long-term competitiveness in the evolving EV landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Propulsion

- 2.2.3 Vehicle

- 2.2.4 Platform

- 2.2.5 Component

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Component suppliers

- 3.1.3 Platform developers

- 3.1.4 Manufacturers

- 3.1.5 Distribution channel

- 3.1.6 End users

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in global electric vehicle adoption

- 3.2.1.2 Advancements in battery technology

- 3.2.1.3 OEM shift to modular EV architectures

- 3.2.1.4 Expansion of EV charging infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment in EV platforms

- 3.2.2.2 Underdeveloped infrastructure in emerging regions

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in EV-as-a-service (EVaaS) models

- 3.2.3.2 Integration with autonomous & connected tech

- 3.2.3.3 Electrification of commercial fleets

- 3.2.3.4 Rising demand for urban micro-mobility solutions

- 3.2.1 Growth drivers

- 3.3 Regulatory landscape

- 3.3.1 North America

- 3.3.2 Europe

- 3.3.3 Asia Pacific

- 3.3.4 Latin America

- 3.3.5 Middle East & Africa

- 3.4 Porter’s analysis

- 3.5 PESTEL analysis

- 3.6 Technology and Innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Price Trend

- 3.8.1 By region

- 3.8.2 By Vehicle

- 3.9 Profit margin analysis

- 3.10 Cost breakdown analysis

- 3.10.1 Raw material cost components

- 3.10.2 Manufacturing and machinery costs

- 3.10.3 Logistics and distribution costs

- 3.10.4 Labor and assembly costs

- 3.10.5 R&D and testing costs

- 3.11 EV platform market evolution and maturity analysis

- 3.11.1 Historical development from ICE adaptations to dedicated platforms

- 3.11.2 Platform architecture evolution timeline

- 3.11.3 Technology adoption lifecycle analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery electric vehicles (BEV)

- 5.3 Hybrid electric vehicles (HEV)

- 5.4 Plug-in hybrid electric vehicles (PHEV)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 SUVs/crossovers

- 6.2.3 Hatchbacks

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 P0

- 7.3 P1

- 7.4 P2

- 7.5 P3

- 7.6 P4

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery

- 8.3 Suspension system

- 8.4 Motor system

- 8.5 Chassis

- 8.6 Electronic Control Units (ECUs)

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BMW

- 11.1.2 Ford

- 11.1.3 General Motors

- 11.1.4 Hyundai Motor

- 11.1.5 Nissan Motor

- 11.1.6 Renault

- 11.1.7 Stellantis

- 11.1.8 Tesla

- 11.1.9 Toyota Motor

- 11.1.10 Volkswagen

- 11.2 Regional Players

- 11.2.1 Avatar Technology

- 11.2.2 BYD Auto

- 11.2.3 Leapmotor

- 11.2.4 Mahindra Electric

- 11.2.5 Seres

- 11.2.6 Tata Motors

- 11.2.7 Zeekr

- 11.3 Emerging Players

- 11.3.1 Bollinger Motors

- 11.3.2 Canoo

- 11.3.3 Cenntro

- 11.3.4 Foxconn

- 11.3.5 Geely

- 11.3.6 Gaussin

- 11.3.7 Lucid Motors

- 11.3.8 NIO

- 11.3.9 OSVehicle

- 11.3.10 REE Automotive

- 11.3.11 Rivian Automotive

- 11.3.12 XPeng Motors

- 11.3.13 Zero Labs Automotive