PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892821

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892821

Transportation Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 -2035

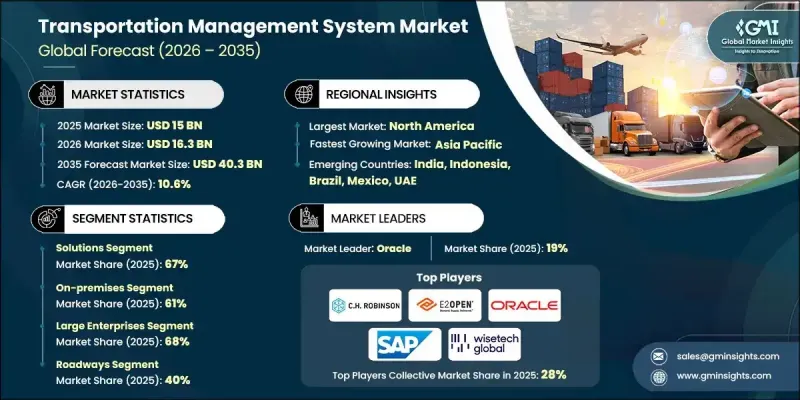

The Global Transportation Management System Market was valued at USD 15 billion in 2025 and is estimated to grow at a CAGR of 10.6% to reach USD 40.3 billion by 2035.

Rapid growth in e-commerce has significantly increased parcel and LTL activity while shortening delivery expectations, making manual routing and issue resolution more expensive and less effective. As cloud-native platforms reduce upfront investment and shorten deployment timelines, organizations of all sizes are turning to Transportation Management Systems to streamline operations. Vendors are redesigning their platforms with microservices, broader API access, and embedded AI to improve predictive ETAs, automate pricing, and optimize capacity utilization. As a result, TMS platforms are now viewed as essential tools for building reliable, scalable transportation operations rather than solely an avenue for cost reduction. With global supply chains growing more interconnected and multimodal, businesses need systems that coordinate carriers, digitize documentation, support compliance, and enhance cross-border visibility. TMS platforms now combine GPS data, telematics, and IoT signals to offer real-time tracking, strengthening transparency for both logistics teams and end customers.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $15 Billion |

| Forecast Value | $40.3 Billion |

| CAGR | 10.6% |

The solutions segment held a 67% share in 2025 and is expected to grow at a CAGR of 10% from 2025 to 2035. Core TMS platforms manage planning, execution, routing, freight sourcing, invoicing, visibility, and analytics. Their ability to automate workflows and deliver real-time insights drives their strong adoption curve. Future growth will be supported by emerging capabilities such as AI-enabled route optimization, predictive analytics, and IoT-enhanced visibility.

The on-premises segment held a 61% share in 2025 and is projected to grow at a CAGR of 9.2% through 2035. While on-premises solutions maintain a larger revenue share due to customization and data control requirements, cloud deployments continue to grow more quickly as organizations adopt modular platforms, faster implementation cycles, and usage-based pricing models. Hybrid architectures are gaining traction as companies balance regulatory needs with modern analytics and workflow automation.

US Transportation Management System Market generated USD 5.2 billion in 2025. The country remains a leader in adopting AI-driven and cloud-based TMS platforms, supported by a complex domestic freight landscape and rising pressure to enhance service quality. Predictive planning tools, automation, and real-time data integration are essential as transportation networks across road, freight, parcel, and last-mile delivery face labor shortages and fluctuating demand.

Major players in the Global Transportation Management System Market include SAP, Oracle, CH Robinson, Trimble, Manhattan Associates, Blue Yonder, MercuryGate International, E2open, Descartes, and Wise Tech Global. Companies operating in the Transportation Management System Market strengthen their competitive position by investing heavily in AI automation, modular platform designs, and advanced analytics that enhance forecasting accuracy and shipment visibility. Many organizations expand through strategic integrations with telematics providers, freight platforms, and warehouse management systems, creating unified logistics ecosystems for their customers. Vendors also focus on cloud-native architectures that deliver continuous updates and scalable deployments, enabling clients to adopt new features without operational disruption. Customized solutions for different transportation modes, along with flexible pricing based on shipment volume or usage, help broaden customer reach. Partnerships with carriers and 3PLs further enhance network data quality, ensuring TMS platforms deliver more reliable insights and measurable efficiency gains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Platform

- 2.2.3 Transportation mode

- 2.2.4 Deployment mode

- 2.2.5 Enterprise size

- 2.2.6 Industry vertical

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising e-commerce and online retail demand

- 3.2.1.2 Globalization of supply chains

- 3.2.1.3 Need for real-time shipment visibility

- 3.2.1.4 Increasing focus on cost optimization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation cost

- 3.2.2.2 Data security and compliance challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.3.2 Growth in small and medium-sized enterprises (SMEs)

- 3.2.3.3 Fleet electrification and green logistics

- 3.2.3.4 Partnerships with 3PL and logistics providers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FMCSA Electronic Logging Device (ELD) mandate

- 3.4.1.2 Hours-of-Service (HOS) regulations

- 3.4.1.3 DOT safety regulations (CFR Parts 300-399)

- 3.4.2 Europe

- 3.4.2.1 GDPR compliance for shipment data

- 3.4.2.2 C-ITS (Cooperative Intelligent Transport Systems)

- 3.4.2.3 Cross-border transportation regulations

- 3.4.3 Asia Pacific

- 3.4.3.1 China ITS investment & standards

- 3.4.3.2 India GST impact on logistics

- 3.4.3.3 ASEAN cross-border transport facilitation

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Cloud-native microservices architecture

- 3.7.1.2 Artificial Intelligence & Machine Learning integration

- 3.7.2 Emerging technologies

- 3.7.2.1 Digital twin technology for network modeling

- 3.7.2.2 Autonomous vehicle integration readiness

- 3.7.1 Current technological trends

- 3.8 Pricing analysis

- 3.8.1 SaaS subscription pricing models

- 3.8.2 Perpetual license pricing

- 3.8.3 Transaction-based pricing (per shipment)

- 3.8.4 User-based pricing models

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.10.1 USPTO patent classification for TMS technologies

- 3.10.2 Key patent holders & innovation leaders

- 3.10.3 Emerging patent trends (AI, Blockchain, IoT)

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.12.1 Retail & e-commerce use case economics

- 3.12.2 Healthcare & pharmaceuticals use case economics

- 3.12.3 Food & beverage use case economics

- 3.12.4. 3 PL & freight forwarders use case economics

- 3.13 Feature adoption rates & utilization analysis

- 3.13.1 Core feature adoption rates

- 3.13.2 Advanced feature adoption rates

- 3.13.3 Emerging feature adoption rates

- 3.13.4 Feature adoption by industry vertical

- 3.14 Migration patterns & switching trends

- 3.14.1 TMS migration drivers

- 3.14.2 Migration patterns by deployment type

- 3.14.3 Vendor switching trends

- 3.14.4 Migration timeline & complexity

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.6.4.1 Venture capital investment in TMS startups

- 4.6.4.2 Private equity activity in logistics technology

- 4.6.4.3 Government infrastructure investment (World Bank ITS report)

- 4.6.4.4 Corporate R&D spending by major vendors

- 4.7 Vendor selection criteria

- 4.8 Go-to-Market Strategies

Chapter 5 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Shipment planning

- 5.2.2 Order management

- 5.2.3 Audit & payments

- 5.2.4 Analytics & reporting

- 5.2.5 Routing & Tracking

- 5.2.6 Others

- 5.3 Services

- 5.3.1 Consulting

- 5.3.2 Implementation & integration

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Transportation Mode, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Roadways

- 6.3 Railways

- 6.4 Airways

- 6.5 Waterways

Chapter 7 Market Estimates & Forecast, By Deployment model, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud

Chapter 8 Market Estimates & Forecast, By Enterprise size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SMEs

Chapter 9 Market Estimates & Forecast, By Industry vertical, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Retail & e-commerce

- 9.3 Healthcare & pharmaceuticals

- 9.4 Distribution & logistics

- 9.5 Manufacturing

- 9.6 Government

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Blue Yonder

- 11.1.2 C.H. Robinson

- 11.1.3 Descartes

- 11.1.4. E2 open

- 11.1.5 Infor

- 11.1.6 Manhattan Associates

- 11.1.7 Oracle

- 11.1.8 SAP

- 11.1.9 Trimble

- 11.1.10 Wise Tech Global

- 11.2 Regional players

- 11.2.1. Gtms

- 11.2.2 Alpega

- 11.2.3 Blujay Solutions

- 11.2.4 CTSI-Global

- 11.2.5 Korber

- 11.2.6 Kuebix

- 11.2.7 Logility

- 11.2.8 MercuryGate

- 11.2.9 Shippeo

- 11.2.10 Transporeon

- 11.3 Emerging players

- 11.3.1 Arrive Logistics

- 11.3.2 FourKites

- 11.3.3 Loadsmart

- 11.3.4 Locus

- 11.3.5 Motive

- 11.3.6 Parade

- 11.3.7 project44

- 11.3.8 Samsara

- 11.3.9 Shipsy

- 11.3.10 Transfix