PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892808

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892808

Ophthalmic Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

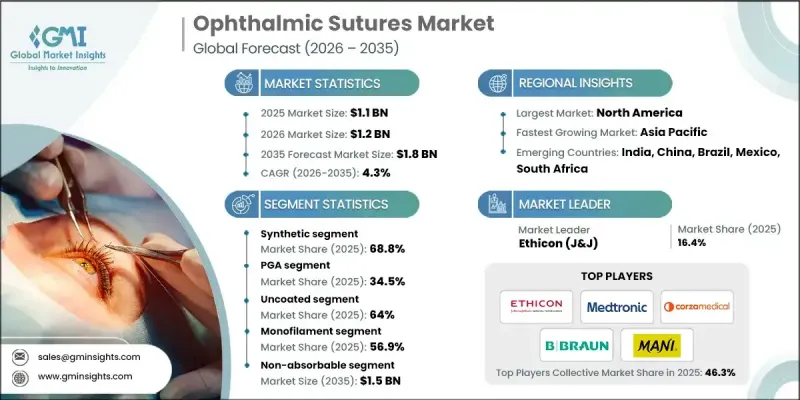

The Global Ophthalmic Sutures Market was valued at USD 1.1 billion in 2025 and is estimated to grow at a CAGR of 4.3% to reach USD 1.8 billion by 2035.

Market expansion is driven by the rising number of ophthalmic surgeries, an aging population, technological innovations, and increased prevalence of eye disorders, alongside broader access to quality healthcare. Ophthalmic sutures provide crucial surgical solutions to hospitals, specialty eye clinics, and ambulatory surgical centers, enhancing patient outcomes, precise wound management, and surgical efficiency in cataract, corneal, glaucoma, and retinal procedures. These sutures, including advanced absorbable and non-absorbable options, are engineered for superior handling, minimal tissue trauma, and reliable postoperative healing, enabling ophthalmologists to perform delicate surgeries with greater precision and safety. Advancements in microsurgical techniques and the growing trend toward outpatient and ambulatory ophthalmic procedures have increased demand for sutures that reduce inflammation, accelerate healing, and provide predictable recovery outcomes. Expanding healthcare infrastructure and rising expenditure in emerging economies are also improving patient access to corrective eye surgeries, supporting consistent market growth.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 4.3% |

The synthetic segment held a 68.8% share in 2025, driven by high tensile strength, predictable absorption, and widespread clinical adoption. Synthetic sutures, composed of materials like polyglactin, polyglycolic acid, and polydioxanone, offer reduced tissue reactivity and minimal risk of infection or inflammation, making them highly suitable for delicate eye surgeries.

The PGA segment held a 34.5% share in 2025, valued at USD 607 million, due to its biodegradable properties and excellent tensile strength. PGA sutures degrade gradually in the body, eliminating the need for removal, reducing patient discomfort, and minimizing follow-up visits, particularly benefiting pediatric and geriatric patients.

North America Ophthalmic Sutures Market held a 38.1% share in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and growing prevalence of eye disorders. The region's extensive network of hospitals, ambulatory surgical centers, and specialty eye clinics performing a high volume of cataract, glaucoma, and retinal procedures ensures sustained demand for ophthalmic sutures.

Key players in the Global Ophthalmic Sutures Market include Teleflex Incorporated, Assut Medical, Aurolab, Ethicon, Alcon, Corza Medical, Accutome, Mani, DemeTECH, FCI Ophthalmics, Geuder AG, Medtronic, B Braun, and Unilene. Companies in the Ophthalmic Sutures Market are strengthening their position through continuous product innovation, developing sutures with improved handling, biodegradability, and tensile strength. Strategic partnerships with hospitals, clinics, and distributors enable wider reach and faster adoption of new solutions. Expanding global footprints and entering emerging markets allow manufacturers to capture rising demand in underserved regions. Investment in R&D, clinical training programs, and after-sales support enhances brand loyalty, while regulatory compliance and quality certifications build trust among healthcare providers. Marketing initiatives, educational outreach, and digital engagement strategies further solidify their market presence and competitiveness.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Material trends

- 2.2.4 Coating trends

- 2.2.5 Material structure trends

- 2.2.6 Absorption trends

- 2.2.7 Application trends

- 2.2.8 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of eye diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Rising prevalence of diabetes leading to ophthalmic disorders

- 3.2.1.4 Favorable government initiatives

- 3.2.1.5 Surging demand and preference for minimally invasive surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Postoperative complications associated with ophthalmic procedures

- 3.2.2.2 Lack of skilled ophthalmologist

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of specialty and premium sutures

- 3.2.3.2 Expansion in emerging markets with improving eye care infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.1.1 Precision-engineered suture-needle combinations

- 3.5.1.2 Preloaded and ready-to-use suture kits

- 3.5.1.3 Minimally invasive microsurgical suturing techniques

- 3.5.2 Emerging technologies

- 3.5.2.1 Bio-absorbable and coated sutures

- 3.5.2.2 Advanced polymer and composite materials

- 3.5.2.3 Smart surgical tools and robotic-assisted suturing

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Integration of digital surgical planning and AI-assisted microsurgery

- 3.9.2 Development of bioengineered and drug-eluting sutures

- 3.9.3 Expansion in emerging markets with advancing ophthalmic infrastructure

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Natural

- 5.3 Synthetic

Chapter 6 Market Estimates and Forecast, By Material, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 PGA

- 6.3 Nylon

- 6.4 Silk

- 6.5 Polypropylene

- 6.6 Other materials

Chapter 7 Market Estimates and Forecast, By Coating, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Coated

- 7.3 Uncoated

Chapter 8 Market Estimates and Forecast, By Material Structure, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Monofilament

- 8.3 Multifilament/Braided

Chapter 9 Market Estimates and Forecast, By Absorption, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 Absorbable

- 9.3 Non-absorbable

Chapter 10 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 10.1 Key trends

- 10.2 Cataract surgery

- 10.3 Corneal transplantation surgery

- 10.4 Glaucoma surgery

- 10.5 Vitrectomy

- 10.6 Oculoplastic surgery

- 10.7 Other applications

Chapter 11 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 11.1 Key trends

- 11.2 Hospitals

- 11.3 Ambulatory surgical centers

- 11.4 Other End use

Chapter 12 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Alcon

- 13.2 Assut Medical

- 13.3 Aurolab

- 13.4 Accutome

- 13.5 B Braun

- 13.6 Corza Medical

- 13.7 DemeTECH

- 13.8 Ethicon

- 13.9 FCI Ophthalmics

- 13.10 Geuder AG

- 13.11 Mani

- 13.12 Medtronic

- 13.13 Teleflex Incorporated

- 13.14 Unilene