PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698505

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698505

Flat Steel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

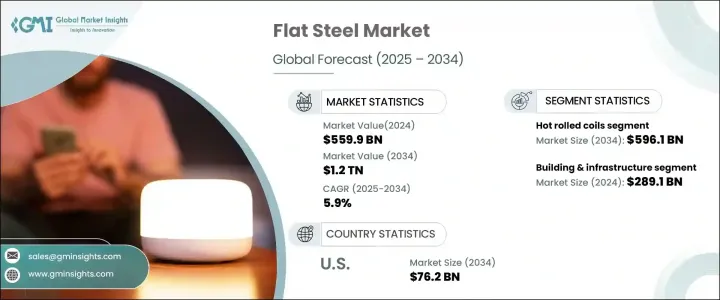

The Global Flat Steel Market reached USD 559.9 billion in 2024 and is set to expand at a CAGR of 5.9% between 2025 and 2034, driven by rising demand from the construction and automotive industries. Flat steel's cost-effectiveness, energy efficiency, and eco-friendly properties make it a preferred material across various applications. As governments and private enterprises worldwide increase infrastructure investments, the demand for flat steel in highways, bridges, and large-scale transportation projects continues to rise. With rapid urbanization and industrial growth, market players are focusing on innovation and sustainable production techniques to align with evolving industry needs.

The expansion of the flat steel market is closely linked to advancements in the automotive sector, where manufacturers prioritize lightweight, high-strength materials to improve fuel efficiency and meet stringent emission regulations. The shift toward electric vehicles further amplifies the demand for flat steel in battery casings and structural components. Additionally, the rising use of advanced metallic coatings enhances corrosion resistance, extending product lifespan across multiple industries. The appliance sector also benefits, as consumers and manufacturers seek durable and energy-efficient materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $559.9 Billion |

| Forecast Value | $1.2 Trillion |

| CAGR | 5.9% |

Hot rolled coils will remain a dominant product category, projected to generate USD 596.1 billion by 2034 at a CAGR of 7%. These coils are integral to industrial and structural applications due to their versatility and mechanical strength. Meanwhile, electrical sheets and strips are witnessing heightened demand as industries emphasize energy efficiency, particularly in transformers and electric motors. As global energy standards tighten, the need for specialized flat steel products in electrical applications is poised for significant growth.

The building and infrastructure segment accounted for USD 289.1 billion in 2024, capturing a 55.3% market share, and is projected to grow at a CAGR of 6% from 2025 to 2034. Expanding urban centers, large-scale residential and commercial developments, and government-led infrastructure projects drive consistent demand. Premium-grade steel remains essential in modern construction due to its durability, sustainability, and cost-effectiveness. Meanwhile, the transportation industry integrates flat steel to enhance vehicle performance, reduce weight, and optimize fuel consumption. With technological advancements in steel manufacturing, industry leaders are introducing high-strength, lightweight variants that meet stringent quality standards.

U.S. flat steel market is projected to reach USD 76.2 billion by 2034, growing at a CAGR of 4.8% from 2024. Economic and technological advancements are reshaping the industry, leading to increased adoption of high-performance steel solutions. The automotive and aerospace sectors, in particular, drive innovation as manufacturers seek materials that enhance structural integrity while minimizing weight. Additionally, rising investments in residential and commercial construction projects continue to reinforce demand. As industries prioritize modernized and sustainable solutions, the flat steel market is set for steady growth, with key players focusing on efficiency, recyclability, and reduced environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing infrastructure development

- 3.7.1.2 Rising demand from the automotive sector

- 3.7.1.3 Expansion of renewable energy projects

- 3.7.2 Market challenges

- 3.7.2.1 Environmental regulations and sustainability pressures

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Million Tons)

- 5.1 Key trends

- 5.2 Hot rolled flat sheets

- 5.3 Hot rolled coils

- 5.4 Electrical sheet & strip

- 5.5 Metallic coated sheet & strip

- 5.6 Non-metallic coated sheet & strip

- 5.7 Tin plates

Chapter 6 Market Size and Forecast, By End Use, 2021-2034 (USD Billion) (Million Tons)

- 6.1 Key trends

- 6.2 Building & infrastructure

- 6.3 Automotive & transportation

- 6.4 Mechanical equipment

- 6.5 Electrical appliances

- 6.6 Agriculture equipment

- 6.7 Gas containers

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Million Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Allegheny Technologies (ATI)

- 8.2 ArcelorMittal

- 8.3 China Steel Corporation

- 8.4 Essar Steel

- 8.5 Gerdau S.A.

- 8.6 Hyundai Steel Co., Ltd.

- 8.7 Nucor Corporation

- 8.8 Nippon Steel & Sumitomo Metal Corporation (NSSMC)

- 8.9 POSCO

- 8.10 Severstal JSC

- 8.11 Thyssenkrupp AG

- 8.12 Tata Steel Limited

- 8.13 Voestalpine Group

- 8.14 Wuhan Iron & Steel Corporation (WISCO)