PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885919

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885919

ENT Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

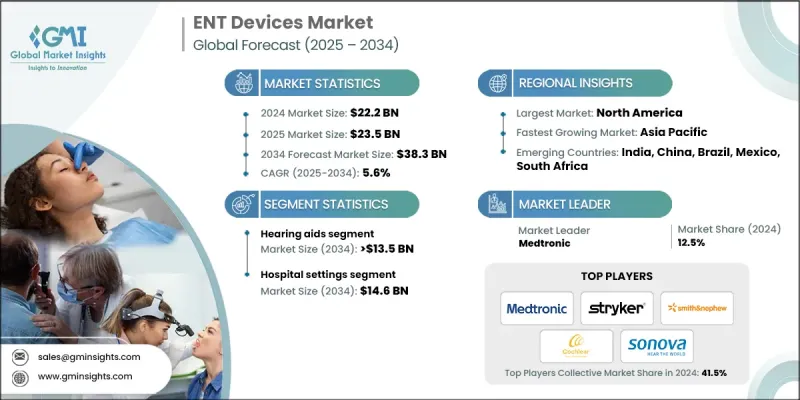

The Global ENT Devices Market was valued at USD 22.2 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 38.3 billion by 2034.

Growth is driven by the rising prevalence of ENT disorders, an expanding geriatric population, and increasing demand for minimally invasive procedures. The market offers innovative solutions to healthcare providers, life science companies, payers, and technology firms to improve patient care, regulatory adherence, and operational efficiency. Key offerings include endoscopy systems, hearing implants, minimally invasive surgical tools, diagnostic devices, and digital ENT platforms designed to enhance procedural precision, disease management, and overall quality of life. The global aging population is contributing to higher incidences of hearing loss, chronic sinusitis, and balance disorders, increasing the need for ENT interventions. Urbanization and lifestyle changes are also leading to higher rates of respiratory and allergic conditions, expanding the patient base. Clinicians and patients increasingly prefer minimally invasive techniques due to shorter recovery times, lower complication risks, and improved outcomes, driving the demand for specialized ENT devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.2 Billion |

| Forecast Value | $38.3 Billion |

| CAGR | 5.6% |

The hearing aids segment held a 37.5% share in 2024. Growth is fueled by the rising prevalence of hearing loss among the elderly and technological advancements, including digital and AI-enabled hearing aids. This segment includes behind-the-ear (BTE), receiver-in-ear/receiver-in-canal (RITE/RIC), completely-in-canal/invisible-in-canal (CIC/IIC), in-the-ear (ITE), and in-the-canal (ITC) devices. Increasing awareness of hearing health and the demand for advanced and conventional hearing devices are driving adoption across hospitals, clinics, and home care settings.

The diagnostic ENT devices segment generated USD 5.8 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2034. It includes rigid and flexible endoscopes, hearing screening devices, and robot-assisted endoscopes. Rising demand for early detection and accurate diagnosis of ENT disorders is fueling growth in this segment.

North America ENT Devices Market held 38.6% share in 2024. Market dominance is supported by a well-established healthcare infrastructure, adoption of advanced medical technologies, and high healthcare expenditure. Increasing cases of ENT disorders such as chronic sinusitis, hearing loss, and sleep apnea are boosting demand for sophisticated diagnostic and treatment devices. Technological innovations, including high-definition endoscopes, robotic surgical systems, and AI-powered diagnostic tools, improve procedural accuracy and efficiency, driving adoption in hospitals, ambulatory surgical centers, and clinics.

Key players in the ENT Devices Market include Medtronic, DeSoutter Medical, Zimmer Biomet, Boston Scientific, Stryker, Johnson & Johnson (Ethicon), Welch Allyn (Hillrom), Sonova, Lumenis, Atos Medical, Narang Medical, Olympus, Smith & Nephew, Nouvag, Vega Medical, and WestCMR. Companies in the ENT devices market are employing multiple strategies to strengthen their position and expand their footprint. They are investing heavily in research and development to introduce innovative and technologically advanced products. Strategic partnerships, collaborations, and acquisitions help broaden geographic presence and distribution networks. Companies are also focusing on expanding product portfolios with digital, AI-enabled, and minimally invasive solutions to meet diverse patient needs. Emphasis on regulatory compliance, quality certifications, and sustainability initiatives enhances credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of ENT disorders globally

- 3.2.1.2 Increasing geriatric population

- 3.2.1.3 Technological advancements in the ENT devices

- 3.2.1.4 Rising demand for minimally invasive ENT procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procedure and instruments cost

- 3.2.2.2 Social stigma across the globe

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI diagnostics

- 3.2.3.2 Rising tele-ENT consultations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Growth of minimally invasive ENT surgical instruments and endoscopic systems

- 3.5.1.2 Digital ENT platforms enabling tele-ENT consultations and remote diagnostics

- 3.5.1.3 Patient-friendly hearing implants and portable audiology devices

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-powered ENT diagnostics and predictive disease management

- 3.5.2.2 Wearable and connected hearing and balance devices

- 3.5.2.3 Smart ENT devices with adaptive treatment and personalized therapy modes

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of AI-integrated ENT devices for early disease detection and personalized treatment planning

- 3.9.2 Increased adoption of tele-ENT platforms and remote monitoring solutions for patient-centric care

- 3.9.3 Growth of minimally invasive, smart, and wearable ENT devices enhancing procedural efficiency and patient compliance

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launch

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hearing aids

- 5.2.1 Behind-the-ear (BTE)

- 5.2.2 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.2.3 Completely-in-the-canal/Invisible-in-canal (CIC/IIC)

- 5.2.4 In-the-ear (ITE)

- 5.2.5 In-the-canal (ITC)

- 5.3 Diagnostic ear, nose, and throat (ENT) devices

- 5.3.1 Rigid endoscopes

- 5.3.1.1 Laryngoscopes

- 5.3.1.2 Rhinoscopes

- 5.3.1.3 Otological endoscopes

- 5.3.2 Flexible endoscopes

- 5.3.3 Hearing screening devices

- 5.3.4 Robot assisted endoscopes

- 5.3.1 Rigid endoscopes

- 5.4 Surgical ear, nose, and throat (ENT) devices

- 5.4.1 Sinus dilation devices

- 5.4.2 Powered surgical instrument

- 5.4.3 Otological drill burrs

- 5.4.4 Radiofrequency handpieces

- 5.4.5 ENT hand instruments

- 5.4.6 Tympanostomy tubes

- 5.4.7 Nasal packing devices

- 5.5 Hearing implants

- 5.5.1 Cochlear implants

- 5.5.2 Bone anchored hearing system

- 5.5.3 Auditory brainstem implants

- 5.5.4 Middle ear implants

- 5.6 Voice prosthesis devices

- 5.7 Nasal splints

- 5.7.1 External nasal splints

- 5.7.2 Internal nasal splints

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 ENT clinics

- 6.5 Homecare

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Atos Medical

- 8.2 Boston Scientific

- 8.3 Cochlear

- 8.4 DeSoutter Medical

- 8.5 Johnson & Johnson (Ethicon)

- 8.6 Lumenis

- 8.7 Medtronic

- 8.8 Meril Life Sciences

- 8.9 Narang Medical

- 8.10 Nouvag

- 8.11 Olympus

- 8.12 Smith & Nephew

- 8.13 Sonova

- 8.14 Stryker

- 8.15 Vega Medical

- 8.16 Welch Allyn (Hillrom)

- 8.17 WestCMR

- 8.18 Zimmer Biomet