PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716476

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716476

Dialysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

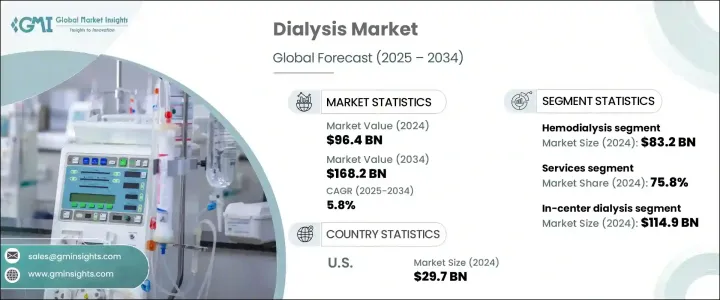

The Global Dialysis Market reached USD 96.4 billion in 2024 and is expected to witness a steady growth trajectory at a CAGR of 5.8% between 2025 and 2034. This growth is primarily driven by the rising incidence of chronic kidney disease (CKD), end-stage renal disease (ESRD), and a rapidly aging population worldwide. The increasing burden of diabetes and hypertension, the two major causes of kidney failure, is further propelling the demand for dialysis treatments. With healthcare systems under mounting pressure to provide effective renal care, the global dialysis market is poised to expand significantly. Additionally, advancements in dialysis technology, growing healthcare expenditures, and improved healthcare frameworks driven by public and private sectors are contributing to this market's growth.

The demand for home-based and in-center dialysis services is also surging, supported by rising awareness of renal diseases and enhanced patient access to innovative dialysis therapies. Furthermore, the integration of telemedicine, remote patient monitoring, and next-generation dialysis machines with user-friendly designs and improved biocompatibility are transforming the treatment landscape, allowing patients to undergo safer and more efficient dialysis sessions. The shift toward personalized care and the growing trend of home dialysis adoption are expected to further accelerate market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $96.4 Billion |

| Forecast Value | $168.2 Billion |

| CAGR | 5.8% |

The dialysis market is broadly segmented into two main types-hemodialysis and peritoneal dialysis. Hemodialysis accounted for a dominant share in 2024, generating USD 83.2 billion in revenue. As CKD and ESRD cases continue to climb globally, the pressure on healthcare systems to meet the growing demand for hemodialysis services is intensifying. Hemodialysis remains the most widely used treatment method, primarily because of its high efficacy in managing advanced kidney failure. The ongoing innovations in hemodialysis machines, including the development of Dialyzer HDF, biocompatible dialyzers, telemonitoring systems, and improved ergonomic equipment, are enhancing treatment outcomes and patient comfort. These advancements are expected to boost the adoption of hemodialysis worldwide, especially as more patients seek reliable and efficient long-term treatment options.

The dialysis market is further categorized into services, consumables, and equipment, with services dominating the landscape by generating USD 75.8 billion in 2024. Expected to grow at a 5.7% CAGR through 2034, the services segment includes both chronic and acute dialysis services, though chronic dialysis accounts for the majority share. Patients with CKD typically require ongoing dialysis treatments, such as three to four hemodialysis sessions weekly or daily peritoneal dialysis. This sustained need for dialysis services ensures a consistent revenue stream, driving long-term growth in this segment.

U.S. Dialysis Market alone was valued at USD 29.7 billion in 2024, with an anticipated growth rate of 6% CAGR from 2025 to 2034. As one of the most advanced healthcare markets, the U.S. is at the forefront of adopting cutting-edge dialysis technologies and home dialysis solutions. With well-established specialized dialysis centers and robust infrastructure, the country is witnessing an increasing shift toward remote patient monitoring and home-based treatments. Key market players such as Fresenius Medical Care and DaVita Inc. are expanding their service networks and integrating advanced dialysis equipment to meet rising demand. The push for innovative, patient-friendly solutions continues to enhance market growth across the U.S., positioning it as a leading contributor to the global dialysis market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of end-stage renal diseases (ESRD) patients

- 3.2.1.2 Increasing incidence of diabetes

- 3.2.1.3 Shortage of donor kidneys

- 3.2.1.4 Favorable reimbursement scenario for dialysis treatment

- 3.2.1.5 Growing research and development investments in developed and developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Product recalls

- 3.2.2.2 Complications associated with dialysis treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hemodialysis

- 5.3 Peritoneal dialysis

Chapter 6 Market Estimates and Forecast, By Product and Services, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Services

- 6.2.1 Chronic dialysis

- 6.2.2 Acute dialysis

- 6.3 Consumables

- 6.3.1 Dialyzers

- 6.3.2 Catheters

- 6.3.3 Access products

- 6.3.4 Concentrates

- 6.3.5 Other consumables

- 6.4 Equipment

- 6.4.1 Dialysis machines

- 6.4.2 Water treatment systems

- 6.4.3 Other equipment

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-center dialysis

- 7.3 Home dialysis

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 angiodynamics

- 9.2 Asahi KASEI

- 9.3 B. Braun

- 9.4 Baxter

- 9.5 Becton, Dickinson and Company

- 9.6 DaVita

- 9.7 Dialife

- 9.8 Fresenius

- 9.9 JMS

- 9.10 Medtronic

- 9.11 NIKKISO

- 9.12 NIPRO

- 9.13 Rogosin Institute

- 9.14 SATELLITE HEALTHCARE

- 9.15 SB-KAWASUMI

- 9.16 Teleflex

- 9.17 TORAY

- 9.18 U.S. RENAL CARE