PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833625

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833625

Surface Mining Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

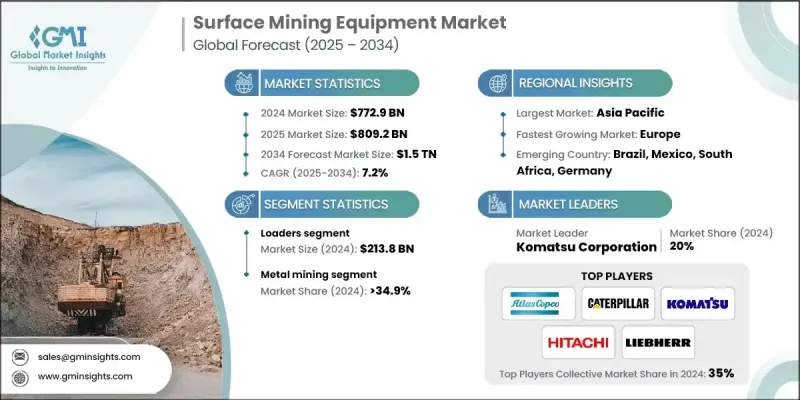

The Global Surface Mining Equipment Market was valued at USD 772.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 1.5 trillion by 2034.

The growth is fueled by rising demand for minerals and metals across major end-use industries, including construction, electronics, and automotive. As these sectors rely heavily on raw materials, mining operations are increasingly investing in technologically advanced equipment to boost output, improve operational reliability, and streamline processes. Companies are rapidly integrating automation and digital platforms into their mining operations to enhance efficiency, reduce human risk, and minimize downtime. Intelligent machinery equipped with real-time monitoring systems and AI-based analytics is transforming how operators manage productivity and resource allocation. The ability to make informed decisions through centralized control systems is making mining operations faster, safer, and more cost-effective.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $772.9 Billion |

| Forecast Value | $1.5 Trillion |

| CAGR | 7.2% |

The market is also seeing a shift toward sustainable and eco-conscious practices. With strict regulations in place, manufacturers are introducing hybrid and electric-powered mining machinery to reduce emissions. Cleaner engine technologies, biofuel compatibility, and energy-saving designs are becoming standard. Additionally, water conservation systems and dust control solutions are being implemented to help operations meet environmental benchmarks. Advanced safety systems, including LiDAR- and radar-based collision prevention, are enhancing site safety while remote-controlled machines allow operators to work safely from off-site locations, lowering on-site risk.

In 2024, the loaders segment generated USD 213.8 billion, maintaining a vital role in surface mining activities. Their versatility in handling tasks such as transporting, loading, and stockpiling makes them indispensable for mining operations of all scales. Enhanced fuel efficiency and rugged performance across varied terrains continue to drive their popularity, especially as companies seek reliable equipment that performs under harsh conditions.

The metal mining segment captured a 34.9% share in 2024, supported by heightened demand for metals like iron, aluminum, copper, and gold. Increased consumption from sectors like electronics, building, and transportation is driving expansion in mining projects. Surface mining remains a preferred method due to its higher extraction capacity and cost advantages, which are helping companies scale operations while managing expenses.

United States Surface Mining Equipment Market held a 76% share in 2024, contributing significantly to regional growth. With the rapid adoption of advanced technologies and increasing reliance on digital tools and automation, mining operations in the U.S. are becoming more efficient and safer. Supportive legislation, tax benefits, and higher commodity prices are encouraging upgrades and new equipment purchases. Sustainability-focused government policies and innovation incentives are also helping fuel demand for modern, environmentally friendly equipment.

Key companies shaping the Global Surface Mining Equipment Market include BHP Billiton, Metso, Barrick Gold, Komatsu, Liebherr, Rio Tinto, Anglo American, Hitachi Construction Machinery, Freeport-McMoRan, Sandvik, Atlas Copco, J.C. Bamford Excavators, Vale, Boart Longyear, Caterpillar, and Volvo. To reinforce their competitive position in the surface mining equipment market, leading players are prioritizing innovation, strategic partnerships, and sustainability. Many are expanding their product lines with electric and hybrid machinery to align with global emission targets. Investment in automation, AI integration, and digital monitoring tools is enabling companies to offer intelligent equipment with enhanced efficiency and predictive maintenance capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type trends

- 2.2.3 Method trends

- 2.2.4 Application trends

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for metals in industries

- 3.2.1.2 Increasing urbanization in developing countries

- 3.2.1.3 Favorable government regulations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Stricter environmental regulations

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of automation and smart manufacturing

- 3.2.3.2 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Loaders

- 5.3 Excavators

- 5.4 Crushing, pulverizing and screen equipment

- 5.5 Drills & breakers

- 5.6 Dumper

- 5.7 Shovels

- 5.8 Motor graders

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Method, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Strip mining

- 6.3 Terrace mining

- 6.4 Open-pit mining

Chapter 7 Market Estimates and Forecast, By Application 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Coal mining

- 7.3 Metal mining

- 7.4 Mineral mining

- 7.5 Other (bauxite mining)

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Anglo American

- 10.2 Atlas Copco

- 10.3 Barrick Gold

- 10.4 BHP Billiton

- 10.5 Boart Longyear

- 10.6 Caterpillar

- 10.7 Freeport-McMoRan

- 10.8 Hitachi Construction Machinery

- 10.9 J.C. Bamford Excavators

- 10.10 Komatsu

- 10.11 Liebherr

- 10.12 Metso

- 10.13 Rio Tinto

- 10.14 Sandvik

- 10.15 Vale

- 10.16 Volvo