PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885925

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885925

Medical Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

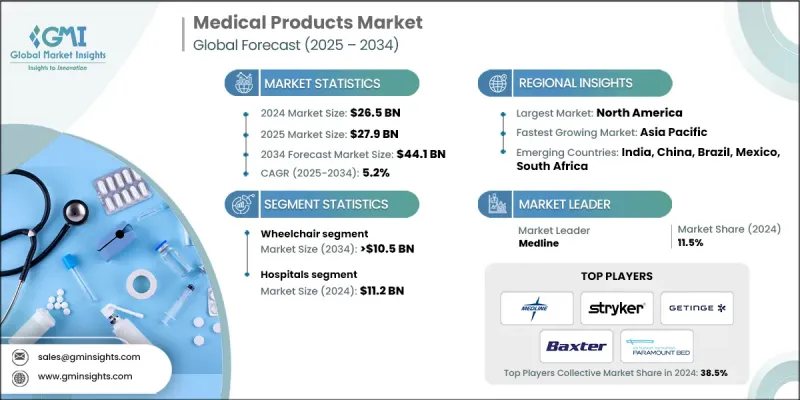

The Global Medical Products Market was valued at USD 26.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 44.1 billion by 2034.

Market expansion is driven by an aging population, increasing prevalence of disabilities, and rising demand for advanced mobility, orthopedic, and home healthcare solutions. Medical products provide innovative tools and equipment for hospitals, clinics, and home care services, aimed at improving patient safety, comfort, and operational efficiency. Key offerings include medical beds, mobility aids, patient handling equipment, and orthopedic supports, all designed to enhance rehabilitation, comfort, and overall quality of life. Technological innovation plays a pivotal role in this market, with smart hospital beds, ergonomic orthopedic supports, powered mobility devices, and digital monitoring systems improving patient outcomes and safety while streamlining clinical workflows. The integration of IoT and smart sensors allows remote patient monitoring and tele-rehabilitation, expanding opportunities in home care. Additionally, increasing investments in healthcare infrastructure across developed and emerging regions are supporting widespread adoption of medical products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.5 Billion |

| Forecast Value | $44.1 Billion |

| CAGR | 5.2% |

The medical beds segment is projected to grow at a CAGR of 4.5% through 2034, while the wheelchairs segment remains the market leader. Wheelchairs are divided into manual and powered types, with rising demand fueled by mobility impairments from aging, chronic conditions, and injuries. Awareness of accessibility standards and rehabilitation protocols is driving adoption of both manual and powered wheelchairs across hospitals, long-term care facilities, and home care environments.

The hospitals segment held a 27.9% share and generated USD 11.2 billion during 2025-2034. Hospitals drive demand for advanced patient care solutions, rehabilitation devices, and surgical support equipment. Continuous upgrades to meet stringent healthcare standards necessitate medical beds, patient handling tools, mobility aids, and orthopedic supports.

North America Medical Products Market held a 33.3% share in 2024. The region benefits from a combination of demographic, technological, and economic factors. An aging population with increasing chronic illnesses and mobility limitations creates strong demand for medical beds, mobility devices, orthopedic supports, and home care solutions. Advanced healthcare infrastructure, along with substantial investments in hospitals, clinics, and long-term care facilities, supports widespread adoption of technologically advanced medical products.

Key players in the Global Medical Products Market include Pride Mobility Products, Medline, Gendron, Baxter, Sunrise Medical, Cardinal Health, Stryker Corporation, INTCO MEDICAL TECHNOLOGY, Paramount Bed, Getinge AB, GF Health Products, Compass Health Brands, Antano Group, Invacare Corporation, and Malvestio Spa. Companies in the Medical Products Market are strengthening their presence through innovation, expanding product portfolios, and investing in R&D to improve patient outcomes. Strategic partnerships and acquisitions help broaden geographic reach and distribution networks. Businesses are focusing on developing technologically advanced and ergonomic solutions to differentiate themselves in the competitive landscape. Sustainability initiatives, enhanced customer service, and compliance with global healthcare standards reinforce brand credibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population base

- 3.2.1.2 Rising number of disabilities and road accidents

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increasing investments in healthcare infrastructural development and healthcare facilities

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulations

- 3.2.2.2 High cost of the device

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in home healthcare and tele-rehabilitation

- 3.2.3.2 Increasing demand in emerging economies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Smart hospital beds with adjustable positions and patient monitoring

- 3.5.1.2 Powered and ergonomic wheelchairs for enhanced mobility

- 3.5.1.3 IoT-enabled patient handling and rehabilitation devices

- 3.5.2 Emerging technologies

- 3.5.2.1 AI-driven patient monitoring and predictive analytics

- 3.5.2.2 IoT-connected orthopedic supports for remote rehabilitation.

- 3.5.2.3 Voice-controlled and automated hospital bed systems

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Pricing analysis, by product, 2024

- 3.8 Reimbursement scenario

- 3.9 Brand analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Future market trends

- 3.12.1 Expansion of home healthcare and tele-rehabilitation solutions

- 3.12.2 Smart, connected, and patient-centric medical products

- 3.12.3 Adoption of energy-efficient, low-maintenance devices

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launch

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wheelchairs

- 5.2.1 Manual wheelchair

- 5.2.2 Folding frame manual wheelchairs

- 5.2.3 Rigid frame manual wheelchairs

- 5.2.4 Powered wheelchair

- 5.3 Medical beds

- 5.3.1 Patient beds

- 5.3.2 Examination beds

- 5.3.3 Massage beds

- 5.3.4 Gurney beds

- 5.3.5 Other medical beds

- 5.4 Walkers

- 5.4.1 Double handed walkers

- 5.4.2 Single handed walkers

- 5.5 Bathroom assistive products

- 5.5.1 Commodes

- 5.5.2 Bathtub seats

- 5.5.3 Shower seats

- 5.5.4 Other bathroom assistive products

- 5.6 Orthopedics

- 5.6.1 Cervical collar support

- 5.6.2 Shoulder support

- 5.6.3 Arm sling

- 5.6.4 Wrist splint

- 5.6.5 Abdominal binder

- 5.6.6 Maternity belt

- 5.6.7 Elastic bandage

- 5.6.8 Air shield walker

- 5.6.9 Knee support

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Ambulatory surgical centers

- 6.4 Home healthcare

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Antano Group

- 8.2 Baxter

- 8.3 Cardinal Health

- 8.4 Compass Health Brands

- 8.5 Gendron

- 8.6 Getinge AB

- 8.7 GF Health Products

- 8.8 INTCO MEDICAL TECHNOLOGY

- 8.9 Invacare Corporation

- 8.10 Malvestio Spa

- 8.11 Medline

- 8.12 Paramount Bed

- 8.13 Pride Mobility Products

- 8.14 Stryker Corporation

- 8.15 Sunrise Medical