PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822646

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822646

Contraceptives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

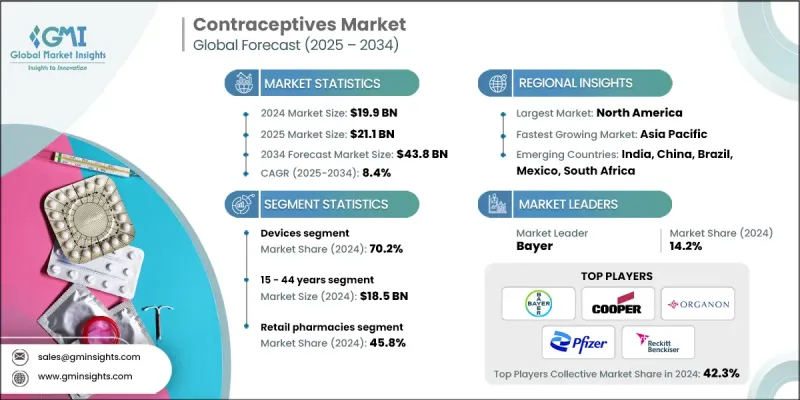

The global contraceptives market was estimated at USD 19.9 billion in 2024 and is expected to grow from USD 21.1 billion in 2025 to USD 43.8 billion by 2034, at a CAGR of 8.4%, according to the latest report published by Global Market Insights Inc.

Growing public health campaigns and education around reproductive rights and family planning are increasing awareness and acceptance of contraceptives. NGOs and government initiatives (e.g., UNFPA, WHO) are promoting access to modern contraceptives in both developed and developing regions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.9 Billion |

| Forecast Value | $43.8 Billion |

| CAGR | 8.4% |

Rising Adoption of Devices

The devices segment held a notable share in 2024, driven by the growing demand for long-acting and reversible contraceptive options. Products such as intrauterine devices (IUDs), condoms, and implants are increasingly favored for their efficacy and convenience. Among these, hormonal and copper-based IUDs remain the top choices due to their high success rates and long-term protection. Market players are focusing on product innovation, enhanced comfort, and extended duration of use to attract a wider customer base.

Increasing Prevalence Among 15-44 Years

The 15-44 years segment held a sizeable share in 2024 owing to their reproductive age and active participation in family planning. This segment is driven by the desire to delay pregnancies and the rising need for sexual health awareness among adolescents and young adults. Increased educational outreach, digital health platforms, and targeted marketing campaigns are helping to normalize contraceptive use among this demographic. Companies are tailoring their messaging to resonate with this audience by emphasizing lifestyle compatibility, ease of use, and access. Subscription models and discreet delivery services have also been introduced to appeal to privacy-conscious users in this segment.

Retail Pharmacies to Gain Traction

The retail pharmacies segment will grow at a decent CAGR during 2025-2034, backed by convenience, accessibility, and anonymity to consumers. With the growing over-the-counter availability of oral contraceptives and emergency pills, this segment is witnessing steady growth. The segment also benefits from extended pharmacy hours, growing penetration in semi-urban areas, and pharmacists' increasing role in reproductive health counseling. To strengthen their presence, pharmaceutical companies are forming partnerships with major retail chains, offering promotional discounts, and ensuring consistent product availability.

Regional Insights

North America to Emerge as a Lucrative Region

North America contraceptives market generated significant revenues in 2024, supported by high consumer awareness, favorable reimbursement policies, and robust healthcare infrastructure. The United States leads the region due to the widespread adoption of hormonal contraceptives, IUDs, and emergency contraceptive pills. As of recent estimates, the market in North America was valued at over USD 8 billion and is projected to grow steadily with the increasing availability of digital prescriptions and direct-to-consumer telehealth services. Companies operating in this region are focused on FDA approvals, product diversification, and expanding their online sales platforms to meet evolving consumer behavior.

Major players in the contraceptives market are HLL Lifecare (India), Pfizer, LifeStyles Healthcare, Church & Dwight, Exeltis, Reckitt, CooperSurgical, Medintim (Kessel), Organon, Pregna International, Evofem Biosciences, Mayne Pharma, Agile Therapeutics, Bayer, HRA Pharma / Perrigo (OTC).

To maintain and grow their position, companies in the contraceptives market are employing a mix of product innovation, regional expansion, and customer-centric initiatives. One of the most prominent strategies involves investing in R&D to develop safer, more effective, and user-friendly products, including non-hormonal and male contraceptive options. Additionally, brands are leveraging digital platforms for direct engagement, offering telehealth consultations and online fulfillment services to meet the demand for convenience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Age group trends

- 2.2.4 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favourable regulatory scenario in developed nations

- 3.2.1.2 Growing inclination towards planned delayed pregnancy

- 3.2.1.3 High unmet contraceptive needs in developing economies

- 3.2.1.4 Increasing prevalence of sexually transmitted diseases (STD)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of contraceptive drugs

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in demand for long-acting reversible contraceptives (LARCs)

- 3.2.3.2 Rising trend of non-hormonal and natural contraceptive alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 MEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Consumer behaviour analysis

- 3.8 Supply chain analysis

- 3.9 Brand analysis

- 3.10 Business model of top companies

- 3.10.1 CooperSurgical

- 3.10.2 Reckitt

- 3.11 Go-to-Market strategy analysis

- 3.12 Gap analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Future market trends

- 3.16 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 Latin America

- 4.3.6 MEA

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Devices

- 5.2.1 Condoms

- 5.2.1.1 Male

- 5.2.1.2 Female

- 5.2.2 Intra-uterine devices

- 5.2.2.1 Hormonal IUD

- 5.2.2.2 Copper IUD

- 5.2.3 Vaginal rings

- 5.2.4 Subdermal implants

- 5.2.5 Diaphragms

- 5.2.6 Contraceptive sponges

- 5.2.1 Condoms

- 5.3 Drugs

- 5.3.1 Oral contraceptive pills

- 5.3.2 Injectable contraceptives

- 5.3.3 Topical contraceptives

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 15 - 44 years

- 6.3 Above 44 years

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Hospital pharmacies

- 7.4 Online channels

- 7.5 Other distribution channels

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agile Therapeutics

- 9.2 Bayer

- 9.3 Church & Dwight

- 9.4 CooperSurgical

- 9.5 Evofem Biosciences

- 9.6 Exeltis

- 9.7 HLL Lifecare (India)

- 9.8 HRA Pharma / Perrigo (OTC)

- 9.9 LifeStyles Healthcare

- 9.10 Mayne Pharma

- 9.11 Medintim (Kessel)

- 9.12 Organon

- 9.13 Pfizer

- 9.14 Pregna International

- 9.15 Reckitt