PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913342

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913342

Isopropyl Alcohol Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

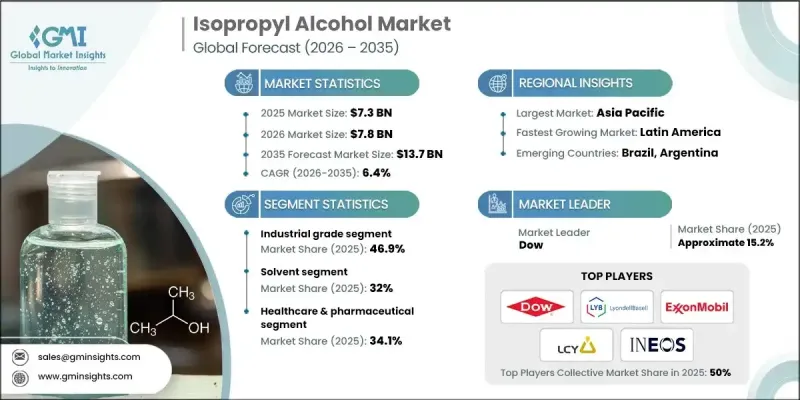

The Global Isopropyl Alcohol Market was valued at USD 7.3 billion in 2025 and is estimated to grow at a CAGR of 6.4% to reach USD 13.7 billion by 2035.

Market growth is supported by rising global emphasis on hygiene standards, expanding pharmaceutical production capacity, and increasing use of precision-grade cleaning solutions across technology-driven industries. Isopropyl alcohol remains widely valued for its disinfecting capability and its role as a reliable solvent in pharmaceutical manufacturing. Heightened long-term awareness around sanitation and infection prevention has sustained demand well beyond earlier surges, reinforcing its position as an essential chemical across multiple industries. In parallel, regulatory pressure and environmental priorities are accelerating the shift toward bio-based production pathways and greener solvent systems. Investments in sustainable chemical manufacturing and supply chain optimization are reshaping production models, enabling suppliers to target specialty and high-purity applications while improving environmental performance. These structural developments continue to enhance market resilience and long-term growth potential.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.3 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 6.4% |

The industrial-grade isopropyl alcohol segment held 46.9% share in 2025 and is expected to grow at a CAGR of 6.4% through 2035. Its dominance is driven by cost efficiency and broad functional applicability. Lower purification requirements reduce production energy intensity, allowing competitive pricing and supporting large-scale usage across industrial operations.

The healthcare and pharmaceutical segment held 34.1% share in 2025 and is forecast to expand at a CAGR of 6.5% from 2026 to 2035. Strong demand is supported by the critical role of isopropyl alcohol in sanitation, antiseptic use, and pharmaceutical-grade solvent applications.

North America Isopropyl Alcohol Market represented 24.3% share in 2025. Regional growth is driven by rising consumption across healthcare, chemical manufacturing, and professional cleaning sectors, supported by strong industrial infrastructure and consistent regulatory frameworks.

Key companies operating in the Global Isopropyl Alcohol Market include Dow, LyondellBasell, SABIC, Shell Chemicals, LG Chem, Mitsubishi Chemical Group, ExxonMobil, INEOS, Solvay, Sasol, PetroChina, Mitsui Chemicals, Deepak Fertilisers and Petrochemicals Corporation Ltd., Tokuyama Corporation, ISU Chemical, SK Geo Centric, LCY, Kukdo Chemical, Jiangsu Denoir Specialty Chemicals, and Shandong Dadi Supu Chemical Co., Ltd.

Companies in the isopropyl alcohol market are strengthening their competitive position through capacity expansion, sustainability-focused innovation, and portfolio optimization. Many producers are investing in bio-based and low-emission production technologies to meet regulatory and customer expectations. Strategic geographic expansion and localized manufacturing are helping reduce supply risks and improve responsiveness. Firms are also emphasizing high-purity and specialty-grade offerings to capture value-added segments. Long-term supply agreements with pharmaceutical and industrial customers are being used to stabilize demand, while operational efficiency initiatives and digitalized production systems support cost competitiveness and consistent product quality.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By grade

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Industrial Grade

- 5.3 Pharmaceutical Grade

- 5.4 Cosmetic Grade

- 5.5 Food Grade

- 5.6 Electronic Grade

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solvent

- 6.2.1 Industrial Solvent

- 6.2.2 Extraction Solvent

- 6.2.3 Process Solvent in Manufacturing

- 6.2.4 Coating & Ink Solvent

- 6.3 Cleaning Agent

- 6.3.1 Surface Cleaners

- 6.3.2 Electronic Component Cleaners

- 6.3.3 Glass & Hard Surface Cleaners

- 6.3.4 Metal Cleaning & Degreasing

- 6.4 Chemical Intermediate

- 6.4.1 Acetone Manufacturing

- 6.4.2 Production of Isopropyl Acetate

- 6.4.3 Resin & Polymer Intermediate

- 6.4.4 Other Organic Synthesis

- 6.5 Flavouring Agent

- 6.5.1 Food Flavor Extraction

- 6.5.2 Solvent in Natural Flavors

- 6.6 Disinfectant

- 6.6.1 Hand Sanitizers

- 6.6.2 Surface Disinfectants

- 6.6.3 Medical Disinfectants

- 6.6.4 Household Disinfectants

- 6.7 Others

- 6.7.1 Paint Thinner

- 6.7.2 Fuel Additive

- 6.7.3 Anti-freeze Component

- 6.7.4 Laboratory Reagent

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverages

- 7.3 Healthcare & Pharmaceutical

- 7.4 Cosmetic & Personal Care

- 7.5 Paints & Coatings

- 7.6 Chemicals

- 7.7 Electronics

- 7.8 Automotive

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL)

- 9.2 Dow

- 9.3 ExxonMobil

- 9.4 INEOS

- 9.5 ISU Chemical

- 9.6 Jiangsu Denoir Specialty Chemicals

- 9.7 Kukdo Chemical

- 9.8 LCY

- 9.9 LG Chem

- 9.10 LyondellBasell

- 9.11 Mitsubishi Chemical Group

- 9.12 Mitsui Chemicals

- 9.13 PetroChina

- 9.14 SABIC

- 9.15 Sasol

- 9.16 Shandong Dadi Supu Chemical Co., Ltd.

- 9.17 Shell Chemicals

- 9.18 SK Geo Centric

- 9.19 Solvay

- 9.20 Tokuyama Corporation

- 9.21 Others