PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833617

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833617

U.S. Dialysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

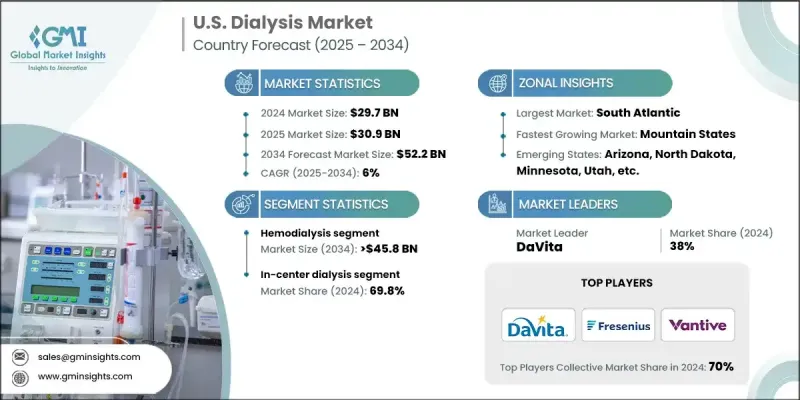

U.S. dialysis market was estimated at USD 29.7 billion in 2024 and is expected to grow from USD 30.9 billion in 2025 to USD 52.2 billion in 2034, at a CAGR of 6%, according to the latest report published by Global Market Insights Inc.

As more patients progress to later stages of CKD and eventually to end-stage renal disease (ESRD), the need for regular dialysis treatments becomes critical for survival. With CKD often going undiagnosed until it reaches advanced stages, the number of patients requiring dialysis is expected to rise steadily in the coming years, placing consistent demand on both in-center and home-based dialysis providers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $52.2 Billion |

| CAGR | 6% |

Increasing Prevalence of the Hemodialysis Segment

The hemodialysis segment generated a significant share in 2024, accounting for many treatment volumes and revenue. Hemodialysis continues to be the most widely prescribed modality for patients with end-stage renal disease, particularly those requiring structured, supervised care. With treatment typically performed three times a week in specialized clinics, the demand for advanced dialysis machines, bloodline systems, and real-time patient monitoring is steadily rising.

Rising Demand for In-Center Dialysis

The In-center dialysis segment held a notable share in 2024, owing to its reliability, accessibility, and strong clinical oversight. Many patients, especially those with comorbidities or limited home support, prefer in-center treatments that offer routine care, immediate medical assistance, and structured scheduling. The market growth is supported by strong Medicare reimbursement and consistent patient flow. Providers are modernizing facilities with state-of-the-art equipment, reducing treatment times, and improving infection control protocols to enhance efficiency and safety while maintaining high standards of care.

South Atlantic to Emerge as a Propelling Region

South Atlantic dialysis market held a robust share in 2024, driven by high population density, a significant elderly demographic, and rising rates of diabetes and hypertension. Localized outreach programs and community partnerships are playing a critical role in improving early CKD detection and access to care, particularly in underserved urban and rural areas.

Major players in the U.S. dialysis market are Mozarc Medical, DaVita, TERUMO, Vantive (Baxter), Teleflex, U.S. RENAL CARE, Asahi KASEI, Fresenius, B. Braun, Becton, Dickinson and Company, and AngioDynamics.

To strengthen their position, leading dialysis providers are pursuing a multi-pronged strategy that focuses on patient-centric care, digital transformation, and geographic expansion. Many are investing in telehealth platforms, remote monitoring, and predictive analytics to improve care coordination and reduce hospitalizations. At the same time, companies are increasing their footprint in high-growth regions by opening new centers, acquiring smaller operators, and partnering with health systems. There's also a strong push to grow the adoption of home dialysis through education, training programs, and simplified equipment.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.3.2 Zonal/State

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of end stage renal diseases (ESRD) patients

- 3.2.1.2 Increasing incidence of diabetes

- 3.2.1.3 Shortage of donor kidneys

- 3.2.1.4 Favourable reimbursement scenario available for dialysis treatment

- 3.2.1.5 Growing R&D investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Product recalls

- 3.2.2.2 Complications in the treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in home dialysis adoption

- 3.2.3.2 Development of biocompatible and high-efficiency membranes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.6.1 Impact of reimbursement policies on market growth

- 3.7 Pricing analysis, 2024

- 3.7.1 Hemodialysis

- 3.7.2 Peritoneal dialysis

- 3.8 Historical timeline and industry evolution

- 3.9 Consumer behaviour analysis

- 3.10 Investment landscape

- 3.11 Epidemiological scenario

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hemodialysis

- 5.2.1 Equipment

- 5.2.1.1 Dialysis machines

- 5.2.1.2 Water treatment systems

- 5.2.2 Consumables

- 5.2.2.1 Dialyzers

- 5.2.2.2 Catheters

- 5.2.2.3 Access products

- 5.2.2.4 Concentrates

- 5.2.2.5 Other consumables

- 5.2.3 Services

- 5.2.3.1 Chronic dialysis

- 5.2.3.2 Acute dialysis

- 5.2.1 Equipment

- 5.3 Peritoneal dialysis

- 5.3.1 Equipment/Cyclers

- 5.3.2 Consumables

- 5.3.2.1 Peritoneal dialysis solution/Dialysate

- 5.3.2.1.1 Dextrose

- 5.3.2.1.2 Icodextrin

- 5.3.2.1.3 Amino Acid

- 5.3.2.2 Catheters

- 5.3.2.3 Access products

- 5.3.2.4 Other consumables

- 5.3.2.1 Peritoneal dialysis solution/Dialysate

- 5.3.3 Services

- 5.3.3.1 Chronic dialysis

- 5.3.3.2 Acute dialysis

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 In-center dialysis

- 6.3 Home dialysis

Chapter 7 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 East North Central

- 7.2.1 Illinois

- 7.2.2 Indiana

- 7.2.3 Michigan

- 7.2.4 Ohio

- 7.2.5 Wisconsin

- 7.3 West South Central

- 7.3.1 Arkansas

- 7.3.2 Louisiana

- 7.3.3 Oklahoma

- 7.3.4 Texas

- 7.4 South Atlantic

- 7.4.1 Delaware

- 7.4.2 Florida

- 7.4.3 Georgia

- 7.4.4 Maryland

- 7.4.5 North Carolina

- 7.4.6 South Carolina

- 7.4.7 Virginia

- 7.4.8 West Virginia

- 7.4.9 Washington, D.C.

- 7.5 Northeast

- 7.5.1 Connecticut

- 7.5.2 Maine

- 7.5.3 Massachusetts

- 7.5.4 New Hampshire

- 7.5.5 Rhode Island

- 7.5.6 Vermont

- 7.5.7 New Jersey

- 7.5.8 New York

- 7.5.9 Pennsylvania

- 7.6 East South Central

- 7.6.1 Alabama

- 7.6.2 Kentucky

- 7.6.3 Mississippi

- 7.6.4 Tennessee

- 7.7 West North Central

- 7.7.1 Iowa

- 7.7.2 Kansas

- 7.7.3 Minnesota

- 7.7.4 Missouri

- 7.7.5 Nebraska

- 7.7.6 North Dakota

- 7.7.7 South Dakota

- 7.8 Pacific Central

- 7.8.1 Alaska

- 7.8.2 California

- 7.8.3 Hawaii

- 7.8.4 Oregon

- 7.8.5 Washington

- 7.9 Mountain States

- 7.9.1 Arizona

- 7.9.2 Colorado

- 7.9.3 Utah

- 7.9.4 Nevada

- 7.9.5 New Mexico

- 7.9.6 Idaho

- 7.9.7 Montana

- 7.9.8 Wyoming

Chapter 8 Company Profiles

- 8.1 Key players

- 8.1.1 angiodynamics

- 8.1.2 Asahi KASEI

- 8.1.3 B. Braun

- 8.1.4 Becton, Dickinson and Company

- 8.1.5 DaVita

- 8.1.6 Fresenius

- 8.1.7 Mozarc Medical

- 8.1.8 Teleflex

- 8.1.9 TERUMO

- 8.1.10 U.S. RENAL CARE

- 8.1.11 Vantive (Baxter)

- 8.2 Emerging players

- 8.2.1 JMS

- 8.2.2 NIKKISO

- 8.2.3 NIPRO

- 8.2.4 Northwest Kidney Centers

- 8.2.5 POLYMED

- 8.2.6 Rogosin Institute

- 8.2.7 SATELLITE HEALTHCARE

- 8.2.8 TORAY

- 8.2.9 UTAH MEDICAL PRODUCTS INC.