PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699375

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1699375

U.S. Residential HVAC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

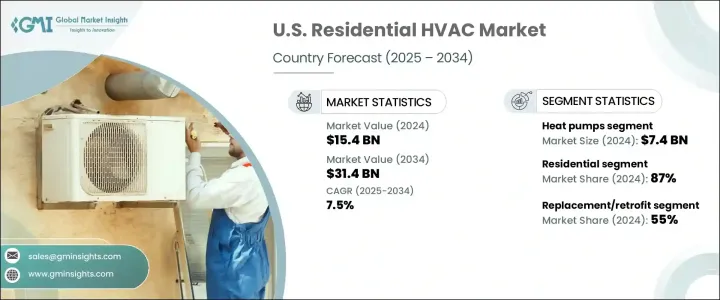

U.S. Residential Hvac Market was valued at USD 15.4 billion in 2024 and is projected to grow at a CAGR of 7.5% between 2025 and 2034. The market is gaining traction as homeowners increasingly prioritize energy-efficient and sustainable heating and cooling solutions. With environmental concerns on the rise, consumers are actively seeking HVAC systems that minimize energy consumption, lower carbon footprints, and reduce long-term operational costs. The growing emphasis on sustainability has significantly influenced purchasing decisions, pushing manufacturers to develop advanced HVAC technologies that align with evolving consumer preferences.

Federal and state incentives, including tax credits and rebates, are further accelerating the adoption of eco-friendly HVAC systems. As demand for smarter, more efficient climate control solutions grows, industry players are focusing on innovation to enhance system performance, increase connectivity, and improve indoor air quality. The introduction of smart thermostats, variable-speed compressors, and AI-driven climate control features is reshaping the landscape of the U.S. residential HVAC industry, setting the stage for continued expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.4 Billion |

| Forecast Value | $31.4 Billion |

| CAGR | 7.5% |

Among HVAC systems, heat pumps accounted for USD 7.4 billion in revenue in 2024. The increasing adoption of heat pumps is largely attributed to their ability to transfer heat using electricity rather than generating it, making them a crucial component in residential decarbonization efforts. As homeowners look for energy-efficient alternatives to traditional HVAC systems, the demand for heat pumps continues to surge. Manufacturers are integrating digital technologies, such as IoT-enabled performance monitoring and predictive maintenance features, to enhance the efficiency and reliability of these systems. The expansion of solar-thermal energy applications is also expected to complement the growth of heat pumps, further driving market development.

The split air conditioner segment is positioned for significant growth, with a strong CAGR anticipated over the next decade. The rising preference for ductless systems, which offer flexible installation and improved energy efficiency, is fueling demand across new and existing residential properties. With technological advancements improving system capabilities and reducing operational costs, split air conditioners are expected to play a vital role in the overall expansion of the U.S. residential HVAC market.

The residential sector remains the dominant force in the U.S. HVAC industry, projected to capture an 87% market share in 2024. Homeowners are increasingly investing in HVAC solutions that offer energy savings, improved air quality, and smart home integration. The growing popularity of programmable thermostats, home automation compatibility, and zoning systems reflects the shift toward intelligent climate management. Federal initiatives promoting energy efficiency have incentivized consumers to upgrade outdated systems, reinforcing the trend toward sustainable residential HVAC solutions.

By installation type, the replacement and retrofit segment continues to lead the market, accounting for a 55% share in 2024. Aging HVAC infrastructure, stringent environmental policies, and consumer demand for high-efficiency upgrades are key drivers of this trend. Homeowners are replacing outdated systems with high-SEER-rated air conditioners, advanced heat pumps, and smart thermostats that optimize energy consumption while meeting new emissions standards. As regulatory frameworks become more stringent, the push for eco-friendly HVAC solutions is expected to strengthen, ensuring sustained market growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturer

- 3.1.6 Distributor

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rising demand for energy-efficient and sustainable cooling solutions

- 3.5.1.2 Advancements in HVAC technology

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Energy shortages and crisis

- 3.5.2.2 Complex regulatory landscape

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Heat pumps

- 5.2.1 Ducted

- 5.2.1.1 Vertical discharge

- 5.2.1.2 Side discharge

- 5.2.2 Ductless

- 5.2.1 Ducted

- 5.3 Spilt air conditioner

- 5.3.1 Ducted

- 5.3.1.1 Vertical discharge

- 5.3.1.2 Side discharge

- 5.3.2 Ductless

- 5.3.1 Ducted

- 5.4 Furnace

- 5.4.1 Gas furnaces

- 5.4.2 Oil furnaces

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Residential

- 6.2.1 Single family

- 6.2.2 Multi family

- 6.3 Light commercial

Chapter 7 Market Estimates & Forecast, By Installation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Replacement/retrofit

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Company Profiles

- 9.1 American Standard

- 9.2 Bosch

- 9.3 Bryant Heating & Cooling Systems

- 9.4 Carrier

- 9.5 Daikin

- 9.6 Goodman Manufacturing

- 9.7 Honeywell

- 9.8 Ingersoll Rand

- 9.9 Johnson Controls

- 9.10 Lennox

- 9.11 LG Electronics USA

- 9.12 Midea

- 9.13 Panasonic

- 9.14 Rheem

- 9.15 Trane Technologies