PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833668

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833668

Electric Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

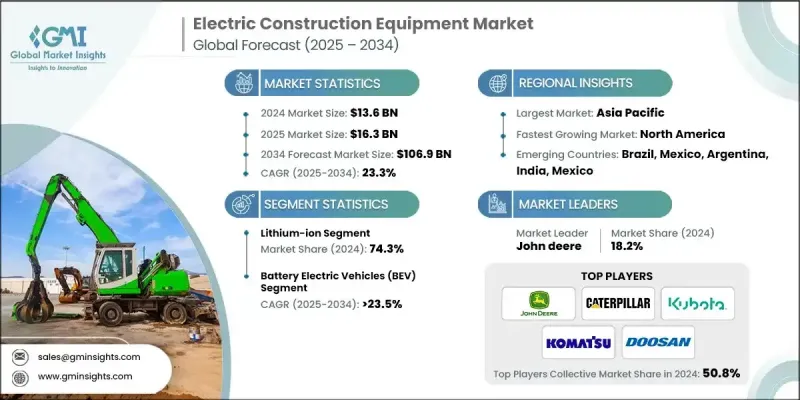

The global electric construction equipment market was estimated at USD 13.6 billion in 2024 and is expected to grow from USD 16.3 billion in 2025 to USD 106.9 billion by 2034 at a CAGR of 23.3%, according to the latest report published by Global Market Insights Inc.

Governments across Europe, North America, and parts of Asia are increasingly tightening emission standards for non-road mobile machinery, including construction equipment. These regulations aim to curb harmful pollutants such as nitrogen oxides (NOx), particulate matter (PM), and carbon dioxide (CO2), which are major contributors to air pollution and climate change.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.6 Billion |

| Forecast Value | $106.9 billion |

| CAGR | 23.3% |

Rising Adoption of Lithium-Ion

The lithium-ion battery segment held a significant share in 2024, owing to its high energy density, longer lifecycle, and rapid charging capabilities. Companies emphasize lithium-ion technology because it provides the reliable power needed for demanding construction tasks while reducing overall equipment weight. As battery costs continue to decline, driven by technological innovation and economies of scale, lithium-ion batteries are becoming the preferred choice for both manufacturers and end-users.

Increasing Demand for Battery Electric Vehicles

The battery electric vehicles (BEVs) are witnessing significant growth from 2025 to 2034, fueled by a global push toward zero-emission solutions. These vehicles offer the dual benefits of minimizing noise pollution and eliminating tailpipe emissions, making them ideal for urban and indoor construction sites. Companies developing BEVs are prioritizing advancements in battery technology to extend operational hours and reduce charging downtime.

Asia Pacific to Emerge as a Lucrative Region

Asia Pacific electric construction equipment market held a sizeable share in 2024, driven by rapid urbanization, infrastructure development, and supportive government policies promoting clean energy adoption. Countries such as China, Japan, and South Korea are leading the charge with substantial investments in research and development and the deployment of electric fleets. The region's expanding construction industry, coupled with rising environmental awareness, is accelerating demand for electric machinery that meets both performance and sustainability criteria.

Major players operating in the electric construction equipment industry are Liebherr, Kubota, Doosan Infracore, Mecalac, John Deere, LiuGong Machinery, Caterpillar, Komatsu, Manitou, and Hitachi Construction.

To secure and strengthen their foothold in the evolving electric construction equipment market, companies are adopting multifaceted strategies. Product innovation remains a core focus, with investments funneled into developing longer-lasting batteries, improved energy management systems, and versatile electric models that cover various equipment categories. Strategic collaborations and joint ventures with battery manufacturers and technology firms help companies accelerate innovation and reduce time-to-market. Furthermore, expanding after-sales service networks and investing in customer education initiatives are critical to building trust and easing the transition from diesel to electric machinery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 Battery Capacity

- 2.2.4 Battery Technology

- 2.2.5 Power Source

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component manufacturers

- 3.1.3 Equipment manufacturers

- 3.1.4 Distributors and dealers

- 3.1.5 Aftermarket suppliers

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent emission regulations

- 3.2.1.2 Urbanization & smart city projects

- 3.2.1.3 Cost savings & efficiency

- 3.2.1.4 OEM and rental adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High upfront costs

- 3.2.2.2 Charging infrastructure gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Government incentives & subsidies

- 3.2.3.2 Advancements in battery tech

- 3.2.3.3 Smart jobsite integration

- 3.2.3.4 Green infrastructure projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology Integration and Standardization Challenges

- 3.8.1 Charging Infrastructure Compatibility and Standards

- 3.8.1.1 Connector Standards and Interoperability Issues

- 3.8.1.2 Communication Protocols and Data Exchange

- 3.8.1.3 Cross-Manufacturer Compatibility Challenges

- 3.8.1.4 Legacy System Integration and Migration Costs

- 3.8.2 Fleet Management System Integration

- 3.8.2.1 Multi-Brand Fleet Management Complexity

- 3.8.2.2 Data Integration and Analytics Platforms

- 3.8.2.3 Telematics and Remote Monitoring Systems

- 3.8.2.4 Maintenance Scheduling and Optimization

- 3.8.3 Digital Transformation and IoT Integration

- 3.8.3.1 Connectivity Standards and Protocols

- 3.8.3.2 3Data Security and Privacy Requirements

- 3.8.3.3 Edge Computing and Real-Time Analytics

- 3.8.3.4 Digital Twin Technology and Simulation

- 3.8.4 Multi-Vendor Integration Complexity

- 3.8.4.1 Charging Connector Compatibility Issues Across Brands

- 3.8.4.2 Fleet Management System Integration Challenges (15+ Platforms)

- 3.8.4.3 Data Format Standardization and Interoperability Gaps

- 3.8.4.4 Service Diagnostic Tool Requirements and Training

- 3.8.1 Charging Infrastructure Compatibility and Standards

- 3.9 3 Energy Management and Grid Integration

- 3.9.1 Smart Charging and Load Management Systems

- 3.9.1.1 Dynamic Load Balancing and Peak Shaving

- 3.9.1.2 Time-of-Use Optimization and Cost Reduction

- 3.9.1.3 Grid Stability and Demand Response Integration

- 3.9.1.4 AI and Machine Learning Applications

- 3.9.2 Renewable Energy Integration

- 3.9.2.1 Solar and Wind Power Integration Benefits

- 3.9.2.2 Energy Storage and Battery Systems

- 3.9.2.3 Microgrid Development and Islanding Capabilities

- 3.9.2.4 Carbon Footprint Reduction and Sustainability

- 3.9.3 Vehicle-to-Grid (V2G) and Bidirectional Charging

- 3.9.3.1 Grid Services and Revenue Opportunities

- 3.9.3.2 Technology Requirements and Standards

- 3.9.3.3 Business Model Development and Implementation

- 3.9.3.4 Regulatory Framework and Market Barriers

- 3.9.1 Smart Charging and Load Management Systems

- 3.10 Service Network Readiness Assessment

- 3.10.1 Geographic Service Coverage Analysis

- 3.10.1.1 Service Coverage Gap Identification (40% Markets Underserved)

- 3.10.1.2 Regional Service Density and Response Time Analysis

- 3.10.1.3 Rural vs Urban Service Availability Disparities

- 3.10.1.4 Emergency Service Response Capabilities

- 3.10.2 Technician Certification and Training Infrastructure

- 3.10.2.1 High-Voltage Certification Program Availability

- 3.10.2.2 Training Capacity and Bottleneck Analysis

- 3.10.2.3 Skill Development Timeline and Requirements

- 3.10.2.4 Certification Cost and Investment Analysis

- 3.10.3 Diagnostic Equipment and Tool Requirements

- 3.10.3.1 Specialized Diagnostic Tool Investment

- 3.10.3.2 Software Platform Integration and Updates

- 3.10.3.3 Multi-Brand Compatibility and Standardization

- 3.10.3.4 Technology Upgrade and Obsolescence Management

- 3.10.1 Geographic Service Coverage Analysis

- 3.11 Parts Availability and Supply Chain Support

- 3.11.1 Electric Component Supply Chain Maturity

- 3.11.2 Battery Replacement and Service Infrastructure

- 3.11.3 Emergency Parts Availability and Lead Times

- 3.11.4 Regional Supply Chain Development and Localization

- 3.12 Service Model Innovation and Digital Integration

- 3.12.1 Remote Diagnostics and Predictive Maintenance

- 3.12.2 Augmented Reality and Digital Service Tools

- 3.12.3 Service-as-a-Service Models and Subscriptions

- 3.12.4 Customer Self-Service and Digital Platforms

- 3.13 Patent analysis

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Use cases

- 3.16 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Excavators

- 5.3 Loaders

- 5.4 Bulldozers

- 5.5 Cranes

- 5.6 Dump Trucks

- 5.7 Roller

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Less than 50 kWh

- 6.3 50 kWh to 200 kWh

- 6.4 More than 200 kWh

Chapter 7 Market Estimates & Forecast, By Battery Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Lead-acid

- 7.3 Lithium-ion

- 7.4 Nickel-metal hydride

Chapter 8 Market Estimates & Forecast, By Power Source, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEV)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEV)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Construction

- 9.3 Mining

- 9.4 Material Handling

- 9.5 Agriculture

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Caterpillar

- 11.1.2 CNH Industrial

- 11.1.3 Hitachi Construction Machinery

- 11.1.4 JCB

- 11.1.5 John Deere

- 11.1.6 Komatsu

- 11.1.7 Komatsu

- 11.1.8 Liebherr

- 11.2 Regional Players

- 11.2.1 Develon

- 11.2.2 Doosan Infracore

- 11.2.3 Hyundai Construction Equipment

- 11.2.4 LiuGong Machinery

- 11.2.5 Manitou

- 11.2.6 Mecalac

- 11.2.7 SDLG

- 11.3 Emerging Players

- 11.3.1 Avant Tecno

- 11.3.2 Elematic

- 11.3.3 Kramer-Werke

- 11.3.4 Sunward Intelligent Equipment

- 11.3.5 Zoomlion Heavy Industry Science & Technology