PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871296

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871296

Multi Cancer Early Detection (MCED) Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

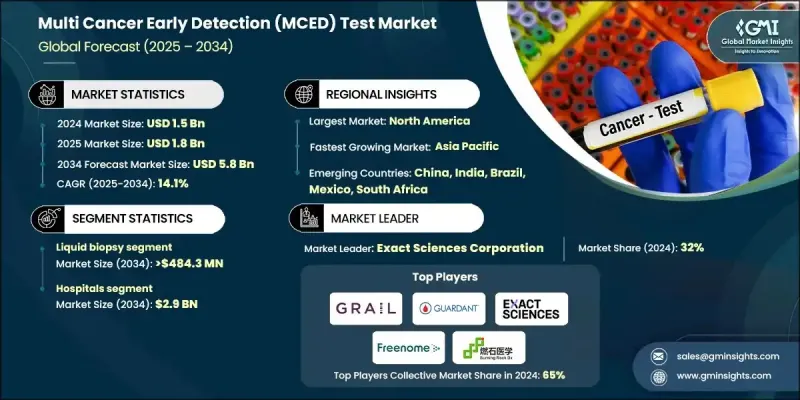

The Global Multi Cancer Early Detection (MCED) Test Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 14.1% to reach USD 5.8 billion by 2034.

The market is witnessing strong momentum, fueled by the rising prevalence of cancer worldwide, increasing demand for early diagnostic solutions, and rapid progress in molecular diagnostic technologies. MCED tests, leveraging methods such as liquid biopsy and next-generation sequencing (NGS), enable the detection of multiple cancer types from a single blood sample, redefining traditional screening approaches. These tests are transforming oncology by allowing clinicians to identify cancers earlier and more comprehensively. These companies enhance test precision and clinical applicability through continuous advancements in liquid biopsy techniques, integration of multi-omics data, and AI-driven analytics, creating highly sensitive and specific diagnostic solutions for a wide spectrum of cancer types.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 14.1% |

The gene panel, laboratory-developed test (LDT), and other related segments are projected to grow at a CAGR of 14% through 2034. This segment dominates the market due to early commercialization, flexibility in targeting specific mutations, and adoption by healthcare providers and research institutions. These tests analyze genetic mutations, methylation patterns, and other molecular signatures, supporting personalized screening approaches across multiple cancers.

The hospitals segment is projected to reach USD 2.9 billion by 2034. Hospitals are preferred for managing complex diagnostic workflows and multidisciplinary care, with oncologists, pathologists, and geneticists collaborating to interpret test results. This teamwork ensures accurate early detection and actionable insights for treatment planning. Preventive healthcare initiatives further reinforce the segment's prominence.

North America Multi Cancer Early Detection (MCED) Test Market is supported by high awareness of preventive healthcare, robust investment in precision oncology, and early adoption of liquid biopsy and gene panel-based screening. The region's advanced healthcare infrastructure and focus on early diagnosis sustain demand across hospitals, laboratories, and wellness programs.

Key companies in the Multi Cancer Early Detection (MCED) Test Market include AnPac Bio-Medical Science, Burning Rock Biotech, EarlyDiagnostics, Elypta, Freenome Holdings, EXACT SCIENCES CORPORATION, Genecast Biotechnology, Guangzhou AnchorDx Medical, GUARDANT HEALTH, Harbinger Health, GRAIL, Micronoma, SeekIn, and Singlera Genomics. Market leaders strengthen their presence by investing in advanced diagnostic technologies, including AI-driven analysis and multi-omics integration, to improve test accuracy. They actively expand clinical collaborations, enhance partnerships with research institutions, and focus on regulatory approvals to increase accessibility. Continuous innovation in liquid biopsy and gene panel testing, alongside early commercialization strategies, allows companies to capture new markets. Additionally, they prioritize educating healthcare providers and patients about the benefits of MCED testing, invest in preventive healthcare campaigns, and optimize distribution channels to ensure wide availability across hospitals, laboratories, and wellness programs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cancer

- 3.2.1.2 High cancer detection rate coupled with growing demand for effective cancer tools

- 3.2.1.3 Advancements in data analytics and artificial intelligence (AI) utilized in cancer screening

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of multi-cancer screening tests

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into preventive care and population health programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gene panel, LDT and others

- 5.3 Liquid biopsy

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic laboratories

- 6.4 Other End use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 AnPac Bio-Medical Science

- 8.2 Burning Rock Biotech

- 8.3 EarlyDiagnostics

- 8.4 Elypta

- 8.5 EXACT SCIENCES CORPORATION

- 8.6 Freenome Holdings

- 8.7 Genecast Biotechnology

- 8.8 Guangzhou AnchorDx Medical

- 8.9 GUARDANT HEALTH

- 8.10 Harbinger Health

- 8.11 GRAIL

- 8.12 Micronoma

- 8.13 SeekIn

- 8.14 Singlera Genomics