PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913429

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913429

High-Pressure Processing (HPP) Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

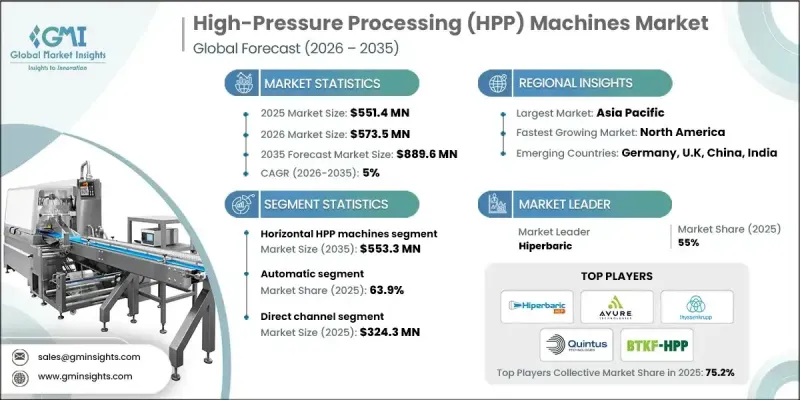

The Global High-Pressure Processing Machines Market was valued at USD 551.4 million in 2025 and is estimated to grow at a CAGR of 5% to reach USD 889.6 million by 2035.

Market momentum is supported by shifting consumer preferences toward healthier food options that emphasize natural composition and minimal processing. Manufacturers are increasingly adopting high-pressure processing technology as it allows food preservation without relying on synthetic additives while maintaining original sensory and nutritional characteristics. This non-thermal approach aligns with evolving expectations for clean-label products and longer shelf stability without compromising quality. The technology also plays a critical role in addressing global food safety concerns by effectively reducing microbial risks while preserving product integrity. Regulatory pressure surrounding food safety standards continues to accelerate equipment adoption across processing facilities. As producers focus on differentiation and compliance, high-pressure processing systems are becoming essential assets for modern food manufacturing operations. The market continues to benefit from advancements in equipment efficiency, scalability, and automation, enabling processors to manage safety, shelf life, and product consistency while responding to competitive and regulatory demands across international markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $551.4 Million |

| Forecast Value | $889.6 Million |

| CAGR | 5% |

The horizontal HPP machines segment generated USD 339.7 million in 2025 and is projected to reach USD 553.3 million by 2035. Horizontal high-pressure processing (HPP) machines continue to lead the market due to their operational efficiency and versatility. Adoption of HPP technology has been growing at a rate of over 15% annually, according to reports from the U.S. Department of Agriculture (USDA). HPP technology enhances food safety and extends shelf life while preserving the quality, texture, and nutritional integrity of products, making it a preferred solution for commercial food processing.

The automatic HPP machines segment held 63.9% share in 2025. Automatic HPP systems are critical for large-scale food and beverage manufacturers because they deliver precise, consistent performance that ensures high productivity. These machines streamline processing, reduce downtime, and maintain operational reliability, which is essential for producers handling juices, meats, and ready-to-eat meals. Automated HPP solutions allow companies to meet high-volume production demands while ensuring product safety and quality remain uncompromised.

U.S. High-Pressure Processing Machines Market held 73.7% share in 2025. Strong enforcement of food safety regulations by the FDA and USDA positions the country as a global leader in safe food preservation technologies. Strict government standards encourage food processors to adopt non-thermal processing solutions like HPP, which reduce pathogens, extend shelf life, and eliminate the need for chemical preservatives while maintaining product quality.

Key companies active in the Global High-Pressure Processing (HPP) Machines Market include Hiperbaric S.A., Quintus Technologies AB, Avure Technologies (JBT Corporation), Universal Pure, LLC, Multivac Sepp Haggenmuller SE & Co. KG, American Pasteurization Company (APC), Kobe Steel Ltd., Thyssenkrupp AG, Next HPP, Nordic High-Pressure Processing (NHPP), Bao Tou KeFa High Pressure Technology Co., Ltd., Stansted Fluid Power Ltd, Engineered Pressure Systems International (EPSI), Pulsemaster, and HPP Italia S.r.l. Companies operating in the Global High-Pressure Processing (HPP) Machines Market are strengthening their market position through continuous investment in technology innovation and system efficiency. Manufacturers are focusing on developing scalable equipment that supports higher throughput and flexible production requirements. Strategic partnerships with food processors and contract service providers are helping expand market reach and adoption. Firms are also emphasizing automation, digital monitoring, and energy optimization to improve operational reliability and reduce costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment Type

- 2.2.3 Capacity

- 2.2.4 Mode of Operation

- 2.2.5 Pressure Range

- 2.2.6 Technology

- 2.2.7 Application

- 2.2.8 End Use

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for clean-label and preservative-free foods

- 3.2.1.2 Stringent food safety regulations

- 3.2.1.3 Expansion of the cold-pressed products

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Limited awareness and adoption in emerging markets

- 3.2.3 Opportunities

- 3.2.3.1 Adoption of new technology for precision & energy efficiency

- 3.2.3.2 Integration of IoT & predictive maintenance solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By equipment type

- 3.6.2 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 8419.89)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2022-2035 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Horizontal HPP Machines

- 5.3 Vertical HPP Machines

Chapter 6 Market Estimates & Forecast, By Capacity, 2022-2035 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Below 100 Liters

- 6.3 100 Liters - 300 Liters

- 6.4 Above 300 Liters

Chapter 7 Market Estimates & Forecast, By Mode of Operation, 2022-2035 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

Chapter 8 Market Estimates & Forecast, By Pressure Range, 2022-2035 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Up to 400 MPa

- 8.3 400-600 MPa

- 8.4 Above 600 MPa

Chapter 9 Market Estimates & Forecast, By Technology, 2022-2035 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Cold Isostatic Pressing (CIP)

- 9.3 Hot Isostatic Pressing (HIP)

Chapter 10 Market Estimates & Forecast, By Application, 2022-2035 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Fruits & Vegetables

- 10.3 Meat & Seafood

- 10.4 Dairy Products

- 10.5 Beverages

- 10.6 Others (Packaged Condiments, Grains, etc.)

Chapter 11 Market Estimates & Forecast, By End Use, 2022-2035 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 Small & Medium Enterprises (SMEs)

- 11.3 Large Enterprises

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Million) (Thousand Units)

- 12.1 Key trends

- 12.2 Direct sales

- 12.3 Indirect sales

Chapter 13 Market Estimates & Forecast, By Region, 2022-2035 (USD Million) (Thousand Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 France

- 13.3.3 UK

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 MEA

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 Avure Technologies

- 14.2 Bao Tou Kefa High Pressure Technology

- 14.3 Engineered Pressure Systems International - EPSI

- 14.4 Hiperbaric

- 14.5 Kobe Steel

- 14.6 Multivac Sepp Haggenmuller

- 14.7 Next HPP

- 14.8 Quintus Technologies

- 14.9 Stansted Fluid Power

- 14.10 Thyssenkrupp - Uhde HPT

- 14.11 Hydrolock - Steribar HPP

- 14.12 HTSM HPP

- 14.13 Idus HPP Systems

- 14.14 Resato International

- 14.15 Shandong Pengneng Machinery Technology