PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844361

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844361

Electronic Parking Brake (EPB) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

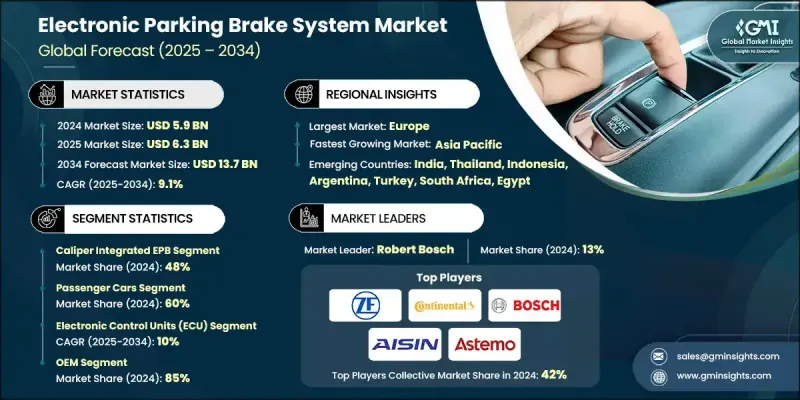

The Global Electronic Parking Brake (EPB) System Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 9.1% to reach USD 13.7 billion by 2034.

Market growth is propelled by the automotive industry's push toward automation, electrification, and advanced safety features. EPB systems are increasingly replacing traditional handbrakes due to their enhanced performance, space optimization, and seamless integration with modern driver assistance technologies. Automakers are embedding EPBs to support features like auto-hold, hill-start assist, and smart emergency braking, particularly in EVs, hybrids, and plug-in hybrids. Their compatibility with regenerative braking and vehicle energy systems further drives their inclusion in next-gen electric platforms. Emerging models also feature compact actuators and wireless control, allowing for greater modularity and design flexibility. With rising global regulatory emphasis on road safety and intelligent braking, EPBs are becoming essential components across various vehicle categories. In addition, software-controlled braking capabilities are transforming EPBs into smart safety systems, offering real-time responsiveness and diagnostics. Sustainability trends are also influencing EPB design, with manufacturers focusing on recyclable materials, low-energy components, and reduced environmental impact, aligning with the broader green mobility movement worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 9.1% |

The caliper-integrated EPB segment held a 48% share in 2024 and is expected to grow at a CAGR of 10% through 2034. This type of EPB is widely favored for its ability to minimize overall system weight, simplify installation, and deliver superior performance over traditional hydraulic or cable-pull mechanisms. Its rising adoption reflects industry preference for efficient and compact brake system architectures.

The passenger cars segment held a 60% share in 2024 and is projected to grow at a CAGR of 9.4% through 2034. Increasing implementation of EPBs in compact and mid-size vehicles, sedans, and SUVs is driving growth, particularly as automakers seek advanced braking technologies that align with ADAS platforms. Regulatory standards across North America, Asia-Pacific, and Europe continue to accelerate EPB penetration across this segment due to enhanced safety mandates and consumer demand for comfort and automation in everyday driving.

Europe Electronic Parking Brake (EPB) System Market held a 35% share in 2024, supported by the rapid adoption of premium and luxury vehicles equipped with intelligent braking systems. Strong policy frameworks, stringent automotive safety benchmarks, and ongoing R&D across the vehicle electronics sector have cemented Europe's position at the forefront of EPB technology. The continued shift toward connected vehicles, electrified platforms, and autonomous driving solutions further strengthens the region's dominance.

Key players shaping the competitive landscape in the Global Electronic Parking Brake (EPB) System Market include ZF Friedrichshafen, Continental, Hyundai Mobis, Mando, Robert Bosch, Akebono Brake Industry, Hitachi Astemo, Brembo, Knorr-Bremse, and Aisin Seiki. Companies operating in the electronic parking brake system market are focusing on innovation, modular design, and integration with digital vehicle platforms to strengthen their market presence. Key players are investing in software-driven EPB solutions that support ADAS compatibility, autonomous functionality, and electronic emergency control. Strategic collaborations with OEMs for platform-based development allow for seamless integration across various vehicle models.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System

- 2.2.3 Vehicles

- 2.2.4 Component

- 2.2.5 Sales Channel

- 2.2.6 Propulsion

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Shift toward vehicle automation and ADAS

- 3.2.1.3 Electrification of vehicle platforms (EVs, HEVs)

- 3.2.1.4 OEM push for lightweight and modular brake systems

- 3.2.1.5 Consumer demand for convenience and safety

- 3.2.1.6 Regulatory mandates for brake-by-wire systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Electronic reliability under extreme conditions

- 3.2.2.2 Integration complexity with ADAS and ECUs

- 3.2.3 Market opportunities

- 3.2.3.1 Market & powertrain integration opportunities

- 3.2.3.1.1 Integration with electric and hybrid powertrains

- 3.2.3.1.2 Advancements in actuator and ECU technologies

- 3.2.3.1.3 Expansion of ADAS and brake-by-wire platforms

- 3.2.3.1.4 Rising demand in emerging markets and mid-range vehicles

- 3.2.3.2 Future innovation opportunities

- 3.2.3.2.1 Advanced integration concepts

- 3.2.3.2.2 Smart EPB system development

- 3.2.3.2.3 Autonomous vehicle preparation

- 3.2.3.2.4 Connected vehicle integration

- 3.2.3.1 Market & powertrain integration opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 ESC & ABS integration

- 3.7.2 Hill start assist & auto hold functions

- 3.7.3 Emergency brake assist integration

- 3.7.4 ADAS & autonomous system integration

- 3.8 EPB system cost structure & value chain analysis

- 3.8.1 Component cost breakdown & analysis

- 3.8.2 Manufacturing cost structure by system type

- 3.8.3 Integration cost impact on vehicle pricing

- 3.8.4 Total cost of ownership vs traditional systems

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Patent analysis

- 3.11.1 Active patents by technology category & system type

- 3.11.2 Patent filing trends in EPB technology

- 3.11.3 IP licensing & technology transfer models

- 3.11.4 Patent litigation risk assessment

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Investment & funding analysis

- 3.13.1 R&D investment by EPB technology category

- 3.13.2 OEM investment in EPB system integration

- 3.13.3 Supplier investment & capacity expansion

- 3.13.4 Government funding & safety research programs

- 3.14 Supply chain dynamics & component integration

- 3.14.1 Actuator motor & drive component sourcing

- 3.14.2 Electronic control unit development ecosystem

- 3.14.3 Sensor & feedback system integration

- 3.14.4 Software development & validation processes

- 3.15 Standardization landscape & interoperability

- 3.15.1 ISO standards development & implementation

- 3.15.2 SAE international EPB standards

- 3.15.3 Regional standards harmonization efforts

- 3.15.4 OEM-specific requirements & variations

- 3.16 Case studies & implementation examples

- 3.16.1 Tesla EPB integration analysis

- 3.16.2 Traditional OEM EV EPB strategies

- 3.16.3 Chinese EV manufacturer approaches

- 3.16.4 Lessons learned & best practices

- 3.17 Connected vehicle & cybersecurity integration

- 3.17.1 Connected EPB system architecture

- 3.17.2 Cybersecurity requirements & threats

- 3.17.3 Data analytics & service enhancement

- 3.18 EPB system reliability & failure mode analysis

- 3.18.1 Common failure modes & root causes

- 3.18.2 Reliability testing & validation

- 3.18.3 Predictive maintenance & diagnostics

- 3.18.4 Quality assurance & control

- 3.19 Future outlook & technology disruption timeline

- 3.19.1 Near-term disruptions (2025-2027)

- 3.19.1.1 Mass market EPB adoption acceleration

- 3.19.1.2 Electric vehicle integration Maturity

- 3.19.1.3 Basic autonomous function integration

- 3.19.1.4 Connected vehicle service development

- 3.19.2 Medium-term disruptions (2028-2030)

- 3.19.2.1 Advanced autonomous vehicle integration

- 3.19.2.2 Brake-by-wire technology commercialization

- 3.19.2.3 AI-powered predictive maintenance

- 3.19.2.4 Full vehicle system integration

- 3.19.3 Long-term disruptions (2031-2034)

- 3.19.3.1 Fully autonomous vehicle EPB systems

- 3.19.3.2 Advanced materials & manufacturing

- 3.19.3.3 Quantum computing integration

- 3.19.3.4 Next-generation mobility solutions

- 3.19.1 Near-term disruptions (2025-2027)

- 3.20 Market evolution scenarios

- 3.20.1 Optimistic growth scenario

- 3.20.2 Conservative growth scenario

- 3.20.3 Disruption scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By System, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Cable-pull systems

- 5.3 Electric-hydraulic caliper systems

- 5.4 Caliper integrated EPB

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicles, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchbacks

- 6.2.2 Sedans

- 6.2.3 SUVS

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Electronic control unit (ECU)

- 7.3 Actuators

- 7.4 Sensors

- 7.5 Switches & wiring harnesses

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Internal combustion engine (ICE)

- 9.3 Hybrid electric vehicle (HEV / PHEV)

- 9.4 Battery electric vehicle (BEV)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aisin Seiki

- 11.1.2 Akebono Brake Industry

- 11.1.3 Brembo

- 11.1.4 Continental

- 11.1.5 Hitachi Astemo

- 11.1.6 Mando

- 11.1.7 Robert Bosch

- 11.1.8 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Advics

- 11.2.2 BWI

- 11.2.3 Chassis Brakes International

- 11.2.4 Haldex

- 11.2.5 Hyundai Mobis

- 11.2.6 Knorr-Bremse

- 11.2.7 Nissin Kogyo

- 11.2.8 WABCO

- 11.3 Emerging Players

- 11.3.1 Aptiv

- 11.3.2 Autoliv

- 11.3.3 Denso

- 11.3.4 Magna International

- 11.3.5 Nexteer Automotive

- 11.3.6 Schaeffler

- 11.3.7 Tenneco

- 11.3.8 Valeo