PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698578

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698578

Synthetic Diamond Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

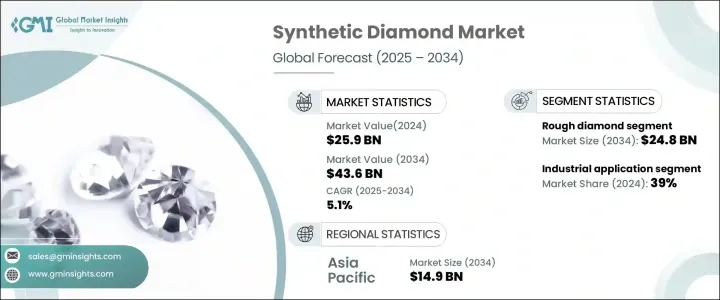

The Global Synthetic Diamond Market was valued at USD 25.9 billion in 2024 and is projected to grow at a 5.1% CAGR from 2025 to 2034. The increasing demand for lab-grown diamonds is reshaping the industry, attracting consumers and businesses alike. Unlike natural diamonds, synthetic variants cater to diverse applications, including electronics, industrial tools, and medical equipment. The shift toward sustainable and cost-effective alternatives is driving adoption, with manufacturers leveraging advanced production technologies to improve quality and performance.

Synthetic diamonds are classified into polished and rough types. The polished diamond segment accounted for a significant share of market revenue in 2024, generating USD 25.9 billion, up from USD 20 billion in 2020. The rough diamond segment was valued at USD 15 billion in 2024 and is expected to rise to USD 24.8 billion by 2034. Rough diamonds comprised 58% of the total market, reflecting strong international demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.9 Billion |

| Forecast Value | $43.6 Billion |

| CAGR | 5.1% |

Polished diamonds are primarily used in fine jewelry, luxury accessories, and high-end watches. Their market expansion is supported by increasing disposable income, evolving consumer preferences, and a rising inclination toward personalized jewelry. Despite being 30-40% more expensive than rough diamonds, their demand is expected to grow due to exclusivity. Meanwhile, rough diamonds serve as the foundation of the diamond trade, supplying raw materials to polishers and jewelers.

The manufacturing process for synthetic diamonds includes High-Pressure, High-Temperature (HPHT) and Chemical Vapor Deposition (CVD). The latter is rapidly advancing, outpacing offline sales growth by 5.2%. HPHT and CVD methods continue to expand due to their critical role in industrial applications, particularly in electronics and high-powered tools. Innovations in pressure control technology are enhancing crystal quality, making HPHT diamonds more competitive in the jewelry and industrial markets.

CVD techniques are evolving to meet the demands of next-generation applications such as quantum computing and thermal management solutions. The production of defect-free diamonds is accelerating their adoption in the semiconductor and optical industries. As these sectors integrate synthetic diamonds into high-performance systems, market expansion is expected.

By application, the synthetic diamond market is divided into jewelry, industrial, electronics, medical, and other uses. The industrial segment led with a 39% share in 2024 and is projected to maintain growth through 2034. Jewelry remains the fastest-growing segment, registering a 5.6% CAGR and comprising 29% of the total market in 2024. Increasing consumer preference for cost-effective and sustainable alternatives is driving demand across North America and Asia Pacific.

The market for industrial-grade synthetic diamonds is growing steadily, particularly in cutting tools and abrasives. The electronics and medical industries are also witnessing increased adoption, utilizing synthetic diamonds as heat conductors and precision instruments. Emerging applications in optics and aerospace are further expanding market potential.

Asia Pacific generated USD 9 billion in revenue in 2024, with projections to reach USD 14.9 billion by 2034. The region's strong manufacturing base and industrial demand position it as a global leader. China remains a key player due to substantial investments in research and development, advanced manufacturing capacity, and a dominant presence in industrial-grade diamond production. Sales in China are expected to reach USD 6.3 billion in 2024, continuing the upward trajectory observed in previous years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing Demand in the Semiconductor Industry

- 3.6.1.2 Rising Adoption in Advanced Technologies

- 3.6.1.3 Superior Thermal and Electrical Properties

- 3.6.1.4 Expansion in the Electronics Industry

- 3.6.1.5 Cost Competitiveness Over Natural Diamonds

- 3.6.1.6 Increased Research & Development Investments

- 3.6.1.7 Sustainability and Ethical Sourcing

- 3.6.1.8 Growing Use in Industrial Applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High Initial Production Costs

- 3.6.2.2 Technical Limitations in Mass Adoption

- 3.6.2.3 Competition from Alternative Materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Carats)

- 5.1 Key trends

- 5.2 Polished

- 5.3 Rough

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021 – 2034 (USD Billion) (Carats)

- 6.1 Key trends

- 6.2 High-pressure, high-temperature (HPHT)

- 6.3 Chemical vapor deposition (CVD)

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Carats)

- 7.1 Key trends

- 7.2 Jewelry

- 7.3 Industrial

- 7.4 Electronics

- 7.5 Medical

- 7.6 Other (including optics, aerospace etc)

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Carats)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adamas One

- 9.2 Applied Diamond

- 9.3 Blue Nile

- 9.4 Clean Origin

- 9.5 Diamond Foundry

- 9.6 Element Six UK

- 9.7 Henan Huanghe Whirlwind

- 9.8 Iljin Diamond

- 9.9 James Allen

- 9.10 New Diamond Technology

- 9.11 Pure Grown Diamonds (PGD)

- 9.12 Rahi Impex

- 9.13 Ritani

- 9.14 Sumitomo Electric Industries

- 9.15 Swarovski

- 9.16 Vibranium Lab