PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859009

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859009

Aroma Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

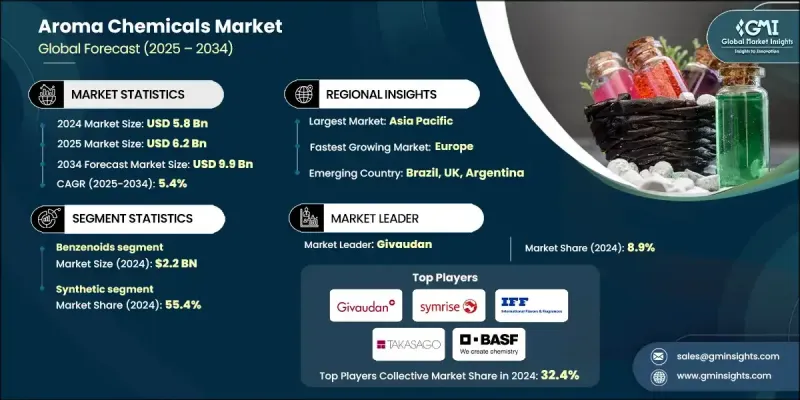

The Global Aroma Chemicals Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 9.9 billion by 2034.

Aroma chemicals are a core ingredient in flavor and fragrance formulations, widely used in personal care, household items, food, and beverages. Their role in shaping scent and taste experiences strongly influences consumer preferences and purchasing behavior. Market growth is being fueled by shifting lifestyle patterns, increased disposable incomes, and rising consumer demand for sensory-driven products. The growing preference for personalized and premium items across beauty, grooming, and edible goods is accelerating the demand for sophisticated aroma compounds, pushing manufacturers to develop more complex scent profiles using both synthetic and natural ingredients. As consumer expectations evolve toward cleaner, high-performance, and sustainable products, innovation within aroma chemistry is becoming increasingly essential to stay competitive and relevant in global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 5.4% |

In 2024, the benzenoids segment generated USD 2.2 billion. Their versatility in scent compositions, ranging from floral to spicy notes, makes them integral to food, beverage, and personal care products. Advances in synthesis methods and the ability to produce high-purity benzenoids at scale enhance their appeal, especially among brands aiming for cost efficiency without sacrificing quality. Regulatory compliance is also a key benefit, as these compounds are manufactured under strict quality standards, making them reliable for broad applications.

The synthetic aroma chemicals segment accounted for a 55.4% share in 2024, driven by affordability, reliable quality, and scalable production. These lab-made compounds offer fragrance manufacturers precise control over scent characteristics and are ideal for high-volume industries such as cosmetics, household care, and packaged food. They are also preferred due to lower production costs, faster lead times, and broader availability compared to natural sources.

North America Aroma Chemicals Market held a CAGR of 5.3% in 2024, backed by a developed food processing ecosystem and rising demand for packaged consumables. Aroma chemicals in the region are widely used to enhance flavor, texture, and shelf life in processed meat, seafood, dairy, and bakery products. Phosphate-based compounds are extensively utilized in various food applications to meet regulatory food safety standards while improving overall product performance. This strong demand across multiple verticals, paired with high consumer awareness, ensures steady regional growth.

Key players in the Global Aroma Chemicals Market include PFW Aroma Chemicals (Kelkar Group), MANE, Symrise AG, Takasago International Corporation, International Flavors & Fragrances Inc., Givaudan, S H Kelkar and Company, Robertet, BASF SE, LANXESS, Hindustan Mint and Agro, and Kao Corporation. To strengthen their position, key players are focusing on expanding their global supply chains, upgrading manufacturing technologies, and increasing investments in R&D. Many companies are developing customized aroma solutions tailored to regional preferences and regulatory requirements. Strategic mergers, partnerships, and acquisitions are helping players scale operations and diversify their product portfolios.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Source trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Benzenoids

- 5.3 Terpenoids

- 5.4 Musk Chemicals

- 5.5 Other

Chapter 6 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & Beverage

- 7.3 Fine Fragrances

- 7.4 Cosmetics & Toiletries

- 7.5 Soaps & Detergents

- 7.6 Household

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Givaudan

- 9.3 Hindustan Mint and Agro

- 9.4 International Flavors & Fragrances Inc.

- 9.5 Kao Corporation

- 9.6 LANXESS

- 9.7 MANE

- 9.8 PFW Aroma Chemicals (Kelkar Group)

- 9.9 Robertet

- 9.10 S H Kelkar and Company

- 9.11 Symrise AG

- 9.12 Takasago International Corporation