PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876802

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876802

Automotive Semiconductor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

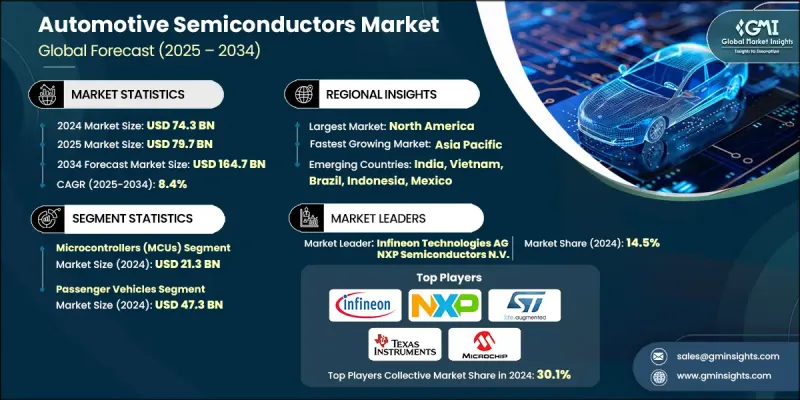

The Global Automotive Semiconductor Market was valued at USD 74.3 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 164.7 billion by 2034.

The growing adoption of electric mobility, coupled with the continuous evolution of powertrain technologies, is driving the demand for automotive semiconductors. Increasing vehicle electrification, along with the rapid advancement of ADAS and autonomous driving systems, is transforming automotive safety and operational efficiency. Rising integration of infotainment systems, vehicle connectivity solutions, and V2X communication is further accelerating semiconductor adoption. Additionally, tightening emission norms and regulatory standards are pushing OEMs to deploy semiconductor-based control systems for enhanced fuel efficiency and lower emissions. The global shift toward electric and intelligent mobility continues to reshape the semiconductor landscape, as these chips play a crucial role in energy conversion, battery management, and vehicle intelligence, supporting smarter and more sustainable automotive ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $74.3 Billion |

| Forecast Value | $164.7 Billion |

| CAGR | 8.4% |

The microcontroller segment was valued at USD 21.3 billion in 2024. Increasing electronic content in vehicles, especially within electric and ADAS-equipped models, continues to boost demand for high-performance automotive microcontrollers. These components remain integral to systems such as powertrain control, battery management, airbags, infotainment, and domain controllers. With the rise of software-defined vehicles (SDVs), the reliance on MCUs is expanding as they enable faster real-time computing and advanced vehicle coordination across multiple subsystems.

The light commercial vehicles (LCVs) segment is projected to register a CAGR of 7.9% throughout 2034. Electrification of urban delivery fleets and integration of connected telematics are key contributors to this growth. The increasing production of Class 2 commercial vehicles and the rising focus on fleet sustainability are creating steady demand for semiconductors designed for LCV electrification and digital monitoring.

U.S. Automotive Semiconductor Market generated USD 17.4 billion in 2024. The accelerating adoption of electric vehicles, coupled with favorable government incentives and stringent regulatory frameworks, is driving semiconductor demand across the nation. Manufacturers are realigning R&D strategies to match OEM requirements for zonal E/E architectures and developing advanced AI- and ML-based processors that meet AEC-Q100 Grade 1 standards for safety and reliability.

Prominent companies operating in the Global Automotive Semiconductor Market include ZF Friedrichshafen AG, Renesas Electronics Corporation, STMicroelectronics N.V., Infineon Technologies AG, Analog Devices, Inc., NXP Semiconductors N.V., Rohm Co., Ltd., Advanced Micro Devices, Continental, Toshiba, Texas Instruments, Inc., Tower Semiconductor Ltd., TE Connectivity, Microchip Technology Inc., Onsemi, Melexis N.V., Robert Bosch GmbH, Micron Technology, and Allegro Microsystems. Leading companies in the automotive semiconductor industry are focusing on innovation, strategic alliances, and capacity expansion to strengthen their market position. They are heavily investing in R&D to develop chips that support electric and autonomous vehicle architectures while enhancing energy efficiency and processing speed. Partnerships with OEMs and Tier-1 suppliers help in aligning product development with emerging vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component type trends

- 2.2.2 Vehicle type trends

- 2.2.3 Application trends

- 2.2.4 Sales channel trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical Success Factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Electrification and powertrain evolution is driving demand for automotive semiconductors

- 3.2.1.2 Increasing focus on advanced driver-assistance systems (ADAS) and autonomous driving

- 3.2.1.3 Rising integration of infotainment systems and in-vehicle networking

- 3.2.1.4 Growing need for connectivity and vehicle-to-everything (V2X) communication

- 3.2.1.5 Regulatory pressure and stricter emission standards are accelerating semiconductor adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Supply Chain Disruptions

- 3.2.2.2 High R&D and Compliance Costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Measures

- 3.11 Patent and IP analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Microcontrollers (MCUs)

- 5.3 Sensors

- 5.4 Power semiconductors

- 5.5 Memory

- 5.6 Analog & mixed-signal ICs

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Vehicle Type, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.3 Light commercial vehicles (LCVs)

- 6.4 Heavy commercial vehicles (HCVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Powertrain & electrification

- 7.2.1 Engine control units (ECU)

- 7.2.2 Battery management systems (BMS)

- 7.2.3 Onboard chargers

- 7.2.4 Others

- 7.3 Safety systems

- 7.3.1 Advanced driver assistance systems (ADAS)

- 7.3.2 Anti-lock braking systems (ABS)

- 7.3.3 Electronic stability control (ESC)

- 7.3.4 Others

- 7.4 Body electronics

- 7.4.1 Door, seat & window control

- 7.4.2 Lighting (LED, Adaptive headlamps)

- 7.4.3 HVAC systems

- 7.4.4 Others

- 7.5 Chassis & suspension

- 7.5.1 Electric power steering (EPS)

- 7.5.2 Suspension control units

- 7.5.3 Others

- 7.6 Infotainment & telematics

- 7.6.1 Audio processing & amplifiers

- 7.6.2 GPS & navigation systems

- 7.6.3 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Infineon Technologies AG

- 10.1.2 NXP Semiconductors N.V.

- 10.1.3 STMicroelectronics N.V.

- 10.1.4 Texas Instruments, Inc.

- 10.1.5 Renesas Electronics Corporation

- 10.1.6 Microchip Technology Inc.

- 10.2 Regional Key Players

- 10.2.1 North America:

- 10.2.1.1 Advanced Micro Devices (AMD)

- 10.2.1.2 Analog Devices, Inc.

- 10.2.1.3 Micron Technology

- 10.2.1.4 Onsemi

- 10.2.2 Europe:

- 10.2.2.1 Continental

- 10.2.2.2 Melexis N.V.

- 10.2.2.3 Robert Bosch GmbH

- 10.2.2.4 ZF Friedrichshafen AG

- 10.2.3 Asia Pacific:

- 10.2.3.1 Toshiba

- 10.2.3.2 Rohm Co., Ltd.

- 10.2.3.3 Tower Semiconductor Ltd.

- 10.2.1 North America:

- 10.3 Niche / Disruptors

- 10.3.1 Allegro Microsystems

- 10.3.2 TE Connectivity