PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892769

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892769

Glyphosate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

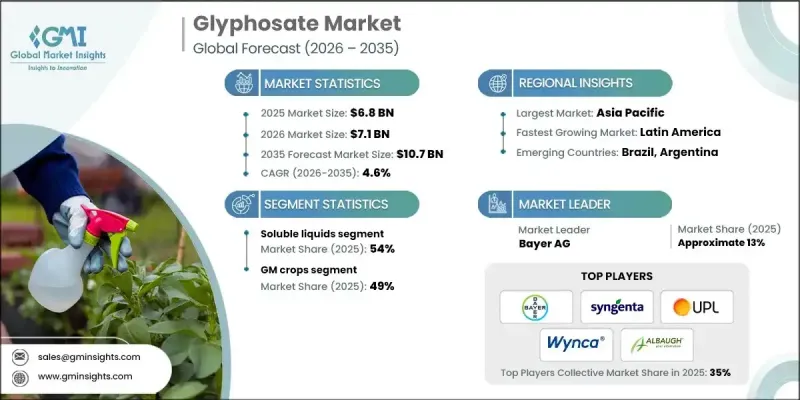

The Global Glyphosate Market was valued at USD 6.8 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 10.7 billion by 2035.

Glyphosate remains a cornerstone for pre-plant burndown, in-crop use on traited systems, and post-harvest stubble management, even as stewardship and regulatory expectations increase. The market is supported by the adoption of conservation and no-till practices, intensified multi-cropping, and cost-per-hectare advantages in price-sensitive regions. At the same time, resistance issues and tighter regulations in some parts of Europe are pushing users toward precision applications and diversified tank mixes. Chinese technical suppliers have rationalized capacities and improved environmental compliance, boosting purity standards and stabilizing prices for global formulators reliant on consistent long-term supply. Upgraded wastewater and emissions controls have minimized historical boom-bust cycles, allowing formulators in the Americas and Europe to plan reliably. Growers are embracing pulse-width modulation, section control, UAV spot-spraying, and digital platforms to optimize application rates while maintaining efficacy and regulatory compliance.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.8 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 4.6% |

The soluble liquids segment held a 54% share in 2025 and is expected to grow at a CAGR of 4.7% through 2035. These formulations are favored for their ease of handling, broad tank-mix compatibility, and improved uptake, rainfastness, and efficacy, including aquatic-approved options for canal and shoreline management.

The GM crops segment accounted for a 49% share in 2025 and is projected to grow at a CAGR of 5% through 2035. Glyphosate remains essential in soybean, corn, and cotton systems, addressing resistant biotypes and forming the backbone of pre-plant burndown and directed strip applications in permanent crops and orchards. Aquatic and industrial use relies on long-interval labels and aquatic-safe formulations.

North America Glyphosate Market held a 23.9% share in 2025, reflecting a mature and highly professionalized glyphosate market. The U.S. operates under EPA-approved labels, with endangered-species mitigation measures reinforcing timing, buffer zones, and comprehensive documentation requirements.

Key players in the Glyphosate Market include ADAMA Agricultural Solutions Ltd., Albaugh, LLC, Anhui Huaxing Chemical Industry Co., Ltd., Arysta LifeScience, Bayer AG, Excel Crop Care Limited, FMC Corporation, Gharda Chemicals Limited, Helm AG, Heranba Industries Limited, Hubei Xingfa Chemicals Group, Jiangsu Good Harvest-Weien Agrochemical Co., Ltd., Jiangsu Yangnong Chemical Co., Ltd., Nufarm Limited, Nutrien Ag Solutions, Rainbow Agro, Sinon Corporation (Taiwan), Syngenta Group (ChemChina), UPL Limited, and Zhejiang Xinan Chemical Industrial Group Co., Ltd. Companies in the Global Glyphosate Market are implementing several strategies to strengthen their foothold. They are investing in R&D to improve formulation performance, including enhanced surfactant systems and precision-compatible products. Strategic alliances with distributors, cooperatives, and agritech platforms expand market penetration and support the adoption of digital application tools. Regional expansion, particularly in emerging markets with rising farm incomes, helps capture new growth opportunities. Companies are also optimizing supply chains, improving environmental compliance, and offering training and technical support to growers to ensure correct usage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product formulation

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product formulations

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Formulation, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Technical Concentrate (TC - Powder)

- 5.3 Technical Concentrate (TK - Solution)

- 5.4 Soluble Liquid Concentrate (SL)

- 5.5 Water Soluble Granules (SG)

- 5.6 Ready-to-Use Liquids

- 5.7 Aquatic & Specialty Formulations

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 GM Crops

- 6.2.1 GM Corn

- 6.2.2 GM Cotton

- 6.2.3 GM Canola

- 6.2.4 GM Soybean

- 6.2.5 GM Sugar Beet

- 6.2.6 GM Alfalfa

- 6.3 Non-GM Arable Crops

- 6.3.1 Cereal Grains

- 6.3.2 Oilseed Crops

- 6.4 Fruits & Vegetables

- 6.4.1 Vegetables

- 6.4.2 Fruits

- 6.5 Industrial Crops

- 6.5.1 Sugarcane

- 6.5.2 Other Industrial Crops

- 6.6 Non-Agricultural Uses

- 6.6.1 Forestry Management

- 6.6.2 Turf & Ornamentals

- 6.6.3 Aquatic Areas

- 6.6.4 Rights-of-Way (ROW)

- 6.6.5 Commercial & Industrial Sites

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Large-Scale Commercial Farmers

- 7.3 Small & Medium Farmers

- 7.4 Government & Public Agencies

- 7.5 Commercial Landscapers

- 7.6 Industrial Vegetation Management Companies

- 7.7 Residential Consumers

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 ADAMA Agricultural Solutions Ltd.

- 9.2 Albaugh, LLC

- 9.3 Anhui Huaxing Chemical Industry Co., Ltd.

- 9.4 Arysta LifeScience

- 9.5 Bayer AG

- 9.6 Excel Crop Care Limited

- 9.7 FMC Corporation

- 9.8 Gharda Chemicals Limited

- 9.9 Helm AG

- 9.10 Heranba Industries Limited

- 9.11 Hubei Xingfa Chemicals Group

- 9.12 Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

- 9.13 Jiangsu Yangnong Chemical Co., Ltd.

- 9.14 Nufarm Limited

- 9.15 Nutrien Ag Solutions

- 9.16 Rainbow Agro

- 9.17 Sinon Corporation (Taiwan)

- 9.18 Syngenta Group (ChemChina)

- 9.19 UPL Limited

- 9.20 Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- 9.21 Others