PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928944

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928944

Data Center Liquid Cooling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

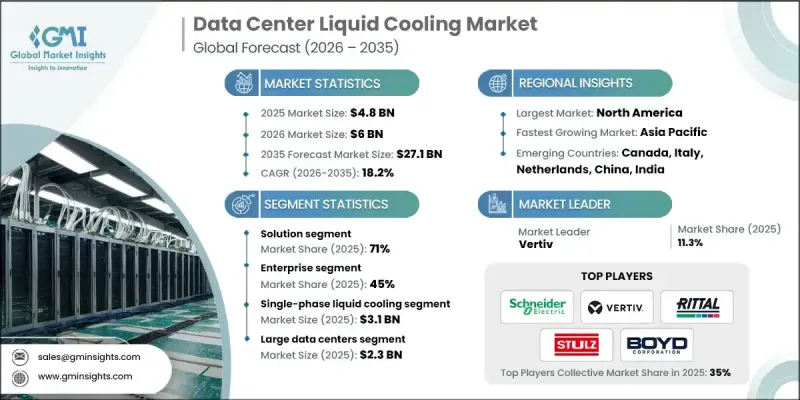

The Global Data Center Liquid Cooling Market was valued at USD 4.8 billion in 2025 and is estimated to grow at a CAGR of 18.2% to reach USD 27.1 billion by 2035.

Rising energy costs, coupled with stringent sustainability requirements, are accelerating the adoption of liquid cooling technologies across data centers. Liquid cooling systems offer significantly lower Power Usage Effectiveness (PUE) ratios ranging from 1.05 to 1.15 compared to 1.4-1.8 for traditional air-cooled facilities, which directly lowers electricity consumption and reduces carbon emissions. Regulatory mandates, including the EU Energy Efficiency Directive, Germany's Energy Efficiency Act targeting PUE 1.3 by 2027, and California's energy efficiency standards, are pushing operators toward advanced cooling solutions. Furthermore, the ability of liquid cooling systems to recover waste heat for district heating or industrial processes transforms data centers into contributors to circular energy economies, supporting corporate net-zero initiatives and enhancing operational sustainability. North America continues to lead the data center liquid cooling market, driven by a dense concentration of hyperscale cloud operators, semiconductor manufacturers, and systems integrators deploying high-density AI and HPC infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.8 Billion |

| Forecast Value | $27.1 Billion |

| CAGR | 18.2% |

The solution segment held a 71% share in 2025 and is forecast to grow at a CAGR of 15% from 2026 to 2035. Direct-to-chip cooling is the fastest-growing technology, employing cold plates and micro-channel coolers attached directly to processors, GPUs, and memory to remove 60-80% of heat before it enters the air. These systems circulate coolants such as water with inhibitors or glycol mixtures across chip surfaces, achieving thermal resistances as low as 0.01-0.05°C/W.

The single-phase liquid cooling systems segment reached USD 3.1 billion in 2025. These systems maintain coolant in liquid form throughout the cycle, transferring heat via conduction and convection without phase change. Coolants circulate through cold plates, immersion tanks, or heat exchangers at 18-50°C, depending on design, while facility chillers, dry coolers, or towers remove heat from the loop.

U.S. Data Center Liquid Cooling Market captured USD 1.29 billion in 2025. Federal initiatives, including AI and HPC programs, semiconductor funding under the CHIPS Act, and defense modernization projects incorporating AI, are key drivers of liquid cooling adoption in public sector data centers.

Leading companies in the Data Center Liquid Cooling Market include Alfa Laval, Asetek, Boyd, CoolIT Systems, Green Revolution Cooling, LiquidStack, Rittal, Schneider Electric (Motivair), Stulz, and Vertiv. Key strategies adopted by companies in the Data Center Liquid Cooling Market focus on technological innovation, such as developing high-efficiency immersion and direct-to-chip cooling solutions for next-generation processors and GPUs. Firms are forming strategic partnerships with hyperscale cloud providers, semiconductor manufacturers, and HPC integrators to expand deployment. Investments in R&D for energy-efficient, modular, and scalable systems strengthen product differentiation. Companies are also emphasizing geographic expansion into emerging markets, supporting sustainability initiatives, and integrating IoT-enabled monitoring tools to optimize performance, enhance reliability, and maintain long-term client relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022-2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Cooling mechanism

- 2.2.4 Coolant

- 2.2.5 Data center

- 2.2.6 Application

- 2.2.7 End use

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component suppliers

- 3.1.1.2 Manufacturers

- 3.1.1.3 System integrators

- 3.1.1.4 Distribution channel analysis

- 3.1.1.5 Cloud service providers

- 3.1.1.6 End user

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Exponential growth in AI and high-performance computing workloads

- 3.2.1.2 Increasing energy costs and sustainability mandates

- 3.2.1.3 Expansion of hyperscale and colocation data center infrastructure

- 3.2.1.4 Proliferation of edge computing and distributed architecture

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment and complexity

- 3.2.2.2 Technical risks and operational concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Retrofit and modernization of existing data center facilities

- 3.2.3.2 Development of hybrid cooling architecture

- 3.2.3.3 Emergence of cooling-as-a-service and managed service models markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Energy Policy Act (PUE Standards)

- 3.4.1.2 California Title 24 Energy Efficiency Regulations

- 3.4.1.3 NERC Critical Infrastructure Protection (Cooling Reliability)

- 3.4.2 Europe

- 3.4.2.1 EU Energy Efficiency Directive (EED)

- 3.4.2.2 German Energy Efficiency Act (PUE ≤1.3)

- 3.4.2.3 UK Energy-related Products Policy Framework

- 3.4.2.4 Climate Neutral Data Centre Pact

- 3.4.2.5 French Data Center Energy Reporting Decree

- 3.4.3 Asia Pacific

- 3.4.3.1 China GB 50174 PUE Standards (≤1.3 Mandate)

- 3.4.3.2 India Digital India Efficiency Guidelines

- 3.4.3.3 Singapore Green Data Centre Roadmap

- 3.4.3.4 Japan Seismic Cooling Standards

- 3.4.3.5 Australia Data Centre Energy Regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil ANATEL Energy Efficiency Norms

- 3.4.4.2 Mexico Data Center Sustainability Guidelines

- 3.4.4.3 Chile Green Data Center Incentives

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Green Agenda 2030

- 3.4.5.2 Saudi Arabia Vision Data Efficiency 2030

- 3.4.5.3 South Africa Critical Infrastructure Regulations

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Cost per kW cooled across rack density tiers

- 3.8.2 Greenfield vs retrofit cost delta

- 3.8.3 Total Cost of Ownership (TCO)

- 3.9 Patent analysis

- 3.10 Case studies

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Architecture analysis

- 3.12.1 Direct to chip liquid cooling

- 3.12.2 Immersive cooling

- 3.13 Analysis of shift from air cooling to liquid cooling

- 3.14 Power density trends in data centers

- 3.14.1 Increasing demands for high-performance computing

- 3.14.2 Acceleration of edge computing

- 3.14.3 Advanced cooling technologies

- 3.14.4 Optimization of space

- 3.14.5 Customized workload solutions

- 3.15 Relationship and partnership build-out

- 3.15.1 Strategic integration partnership models

- 3.15.1.1 Joint engineering services

- 3.15.1.2 Co-development of integration standards

- 3.15.1.3 Co-bidding for hyperscale dc projects

- 3.15.2 Pilot deployment collaboration opportunities

- 3.15.2.1 Demonstration projects with hyperscalers

- 3.15.2.2 Strategic adoption in enterprise retrofits

- 3.15.1 Strategic integration partnership models

- 3.16 Integration with existing infrastructure & efficiency optimization

- 3.16.1 Integration strategies

- 3.16.1.1 Retrofit pathways

- 3.16.1.2 Direct-to-chip implementation with existing chilled water

- 3.16.1.3 Rear-door heat exchanger drop-in retrofits

- 3.16.1.4 Immersion pod modular addition

- 3.16.2 Hybrid integration

- 3.16.2.1 Air cooling + liquid cooling zones

- 3.16.2.2 Partial rack liquid assist (GPU racks)

- 3.16.3 Greenfield adaptation

- 3.16.3.1 Design-to-integrate with existing systems if part of campus

- 3.16.3.2 Secondary loop for isolated liquid cooling

- 3.16.4 Efficiency optimization approaches

- 3.16.4.1 Thermal efficiency

- 3.16.4.2 Rack-level heat removal optimization

- 3.16.4.3 Hot/cold aisle containment integration

- 3.16.4.4 Minimizing recirculation and bypass airflow

- 3.16.1 Integration strategies

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Integration & retrofit benchmarking

- 4.7.1 Time-to-deploy liquid cooling in existing racks

- 4.7.2 Downtime impact during retrofits

- 4.7.3 Compatibility with existing CRAH/CRAC or in-row units

- 4.7.4 Operational complexity scaling

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Direct to chip

- 5.2.1.1 Cold plates

- 5.2.1.2 Micro-channel coolers

- 5.2.2 Immersive

- 5.2.2.1 IT chassis

- 5.2.2.2 Tub/Open bath

- 5.2.3 Rear-door heat exchangers

- 5.2.3.1 Active (pumped)

- 5.2.3.2 Passive

- 5.2.1 Direct to chip

- 5.3 Service

- 5.3.1 Managed service

- 5.3.1.1 Remote monitoring

- 5.3.1.2 Performance optimization

- 5.3.1.3 Maintenance & support services

- 5.3.2 Professional service

- 5.3.2.1 Consultation & design

- 5.3.2.2 Installation & deployment

- 5.3.1 Managed service

Chapter 6 Market Estimates & Forecast, By Cooling Mechanism, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Single-phase liquid cooling

- 6.3 Two-phase liquid cooling

Chapter 7 Market Estimates & Forecast, By Coolant, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Water-based coolants

- 7.3 Dielectric fluids

- 7.4 Synthetic fluids

- 7.5 Mineral oils

- 7.6 Bio-based/Natural coolants

Chapter 8 Market Estimates & Forecast, By Data Center, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Small data centers

- 8.3 Medium data centers

- 8.4 Large data centers

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Server cooling

- 9.2.1 CPU cooling

- 9.2.2 GPU/AI accelerator cooling

- 9.3 Storage cooling

- 9.4 Networking cooling

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Enterprise

- 10.2.1 BFSI

- 10.2.2 Retail & e-commerce

- 10.2.3 Government

- 10.2.4 Healthcare

- 10.2.5 Manufacturing

- 10.2.6 IT enabled services (ITeS)

- 10.2.7 Others

- 10.3 Telecom service provider

- 10.4 Cloud service provider

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Poland

- 11.3.7 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Colombia

- 11.5.3 Argentina

- 11.5.4 Chile

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global leaders

- 12.1.1 Alfa Laval

- 12.1.2 Asetek

- 12.1.3 Boyd

- 12.1.4 CoolIT Systems

- 12.1.5 Green Revolution Cooling (GRC)

- 12.1.6 LiquidStack

- 12.1.7 Rittal

- 12.1.8 Schneider Electric

- 12.1.9 Stulz

- 12.1.10 Vertiv

- 12.2 Regional players

- 12.2.1 Asperitas

- 12.2.2 DCX Liquid Cooling Systems

- 12.2.3 Delta Electronics

- 12.2.4 DUG Technology

- 12.2.5 Iceotope Technologies

- 12.2.6 Kaori Heat Treatment

- 12.2.7 Submer Technologies

- 12.3 Emerging players

- 12.3.1 Accelsius

- 12.3.2 Chilldyne

- 12.3.3 JETCOOL Technologies

- 12.3.4 LiquidCool Solutions

- 12.3.5 Midas Green Technologies

- 12.3.6 Seguente

- 12.3.7 ZutaCore