PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913343

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913343

Cooling Tower Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

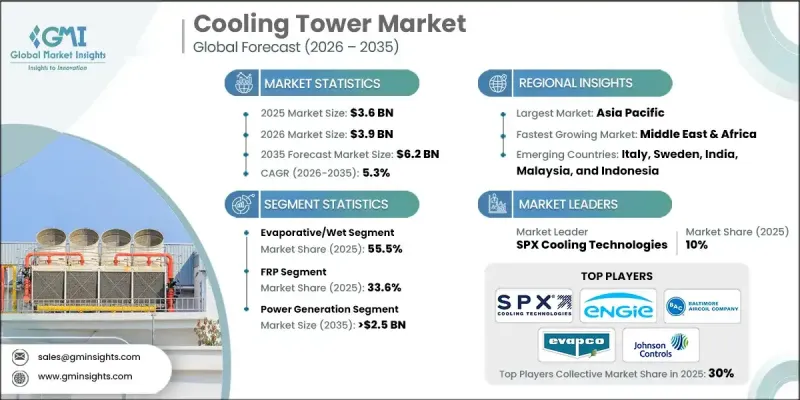

The Global Cooling Tower Market was valued at USD 3.6 billion in 2025 and is estimated to grow at a CAGR of 5.3% to reach USD 6.2 billion by 2035.

Market growth is driven by rising demand for energy-efficient thermal management systems alongside tightening environmental and emission regulations across multiple end-use sectors. Cooling towers play a critical role in heat rejection by lowering water temperature through air interaction before recirculation, thereby supporting continuous operations and system efficiency. Growing adoption of smart monitoring technologies and predictive maintenance tools is enhancing operational performance, reducing unexpected shutdowns, and optimizing lifecycle costs. Increasing focus on water conservation and environmental compliance is accelerating the shift toward advanced designs that improve thermal efficiency while limiting resource consumption. The market is also benefiting from the transition toward durable materials that offer improved resistance to corrosion and longer operational life. In addition, scalable and modular configurations are gaining traction as industries seek flexible solutions that align with expanding capacity requirements. The combination of sustainability goals, technological innovation, and infrastructure upgrades continues to reinforce demand for modern cooling tower systems across global industrial and commercial landscapes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.6 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 5.3% |

The dry cooling tower segment is anticipated to reach USD 1.5 billion by 2035. These systems are increasingly preferred in regions facing water availability constraints and strict environmental mandates, as they operate without water evaporation and significantly reduce overall consumption. By relying solely on air for heat dissipation, dry cooling towers align well with sustainability objectives and are gaining wider acceptance in water-sensitive markets.

The concrete-based cooling tower segment is expected to grow at a CAGR of 5% through 2035. These structures are extensively deployed in large industrial and power-related installations due to their high mechanical strength and long-term reliability. Concrete cooling towers are favored for permanent setups where consistent thermal performance, structural stability, and extended service life are essential.

North America Cooling Tower Market held 86.7% share in 2025, generating USD 472.3 million. Growth in the country is supported by a strong industrial base, expanding digital infrastructure, and ongoing upgrades of existing power generation assets, which collectively sustain steady investment in advanced cooling solutions.

Key companies active in the Global Cooling Tower Market include SPX Cooling Tech, EVAPCO, Baltimore Aircoil Company (BAC), Thermax, Paharpur Cooling Towers, Enexio, Johnson Controls, Aggreko, Delta Cooling Towers, Brentwood Industries, John Cockerill, Advance Cooling Towers, Berg Chilling Systems, Araco, AEW Technik, VOLGA COOLING TECHNOLOGIES, Tower Thermal, Classik Cooling Towers, Faisal Jassim Trading, Konuk ISI, HCTC Cooling Equipment Trading, Harrison Cooling Towers, Threcell Cooling Tower, Bellct, and CTP Engineering. Companies operating in the Cooling Tower Market are strengthening their competitive position through a combination of product innovation, strategic partnerships, and geographic expansion. Manufacturers are focusing on developing energy-efficient and environmentally compliant solutions that address water conservation and emission reduction requirements. Investment in digital technologies such as remote monitoring, automation, and predictive maintenance is being prioritized to enhance system reliability and customer value. Many players are expanding manufacturing capabilities and service networks to improve regional presence and shorten delivery timelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Technology trends

- 2.5 Design trends

- 2.6 Build trends

- 2.7 Construction material trends

- 2.8 Flow trends

- 2.9 Application trends

- 2.10 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Supply chain resilience & risk factors

- 3.1.3 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of cooling tower

- 3.8 Price trend analysis

- 3.8.1 By region

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization and IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Evaporative/wet

- 5.3 Dry

- 5.4 Hybrid

Chapter 6 Market Size and Forecast, By Technology, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Open circuit

- 6.3 Closed circuit

- 6.4 Hybrid

Chapter 7 Market Size and Forecast, By Design, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Mechanical

- 7.3 Natural

Chapter 8 Market Size and Forecast, By Build, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Field erection

- 8.3 Package

Chapter 9 Market Size and Forecast, By Construction Material, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 Concrete

- 9.3 Steel

- 9.4 FRP

- 9.5 Wood

- 9.6 Others

Chapter 10 Market Size and Forecast, By Flow, 2022 - 2035 (USD Million)

- 10.1 Key trends

- 10.2 Cross flow

- 10.3 Counter flow

Chapter 11 Market Size and Forecast, By Application, 2022 - 2035 (USD Million)

- 11.1 Key trends

- 11.2 Chemicals & fertilizers

- 11.3 Oil & gas

- 11.4 Power generation

- 11.5 HVACR

- 11.6 Others

Chapter 12 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 France

- 12.3.3 Germany

- 12.3.4 Italy

- 12.3.5 Sweden

- 12.3.6 Netherlands

- 12.3.7 Denmark

- 12.3.8 Spain

- 12.3.9 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 South Korea

- 12.4.4 India

- 12.4.5 Australia

- 12.4.6 Malaysia

- 12.4.7 Indonesia

- 12.5 Middle East & Africa

- 12.5.1 UAE

- 12.5.2 Saudi Arabia

- 12.5.3 Qatar

- 12.5.4 Oman

- 12.5.5 Kuwait

- 12.5.6 Egypt

- 12.5.7 South Africa

- 12.5.8 Turkey

- 12.6 Latin America

- 12.6.1 Brazil

- 12.6.2 Argentina

- 12.6.3 Chile Peru

Chapter 13 Company Profiles

- 13.1 Advance Cooling Towers

- 13.2 AEW Technik

- 13.3 Aggreko

- 13.4 Araco

- 13.5 Baltimore Aircoil Company (BAC)

- 13.6 Bellct

- 13.7 Berg Chilling Systems

- 13.8 Brentwood Industries

- 13.9 Classik Cooling Towers

- 13.10 CTP Engineering

- 13.11 Delta Cooling Towers

- 13.12 Enexio

- 13.13 EVAPCO

- 13.14 Faisal Jassim Trading

- 13.15 Harrison Cooling Towers

- 13.16 HCTC Cooling Equipment Trading

- 13.17 John Cockerill

- 13.18 Johnson Controls

- 13.19 Konuk ISI

- 13.20 Paharpur Cooling Towers

- 13.21 SPX Cooling Tech

- 13.22 Thermax

- 13.23 Threcell Cooling Tower

- 13.24 Tower Thermal

- 13.25 VOLGA COOLING TECHNOLOGIES