PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833678

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833678

U.S. Surgical Staplers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

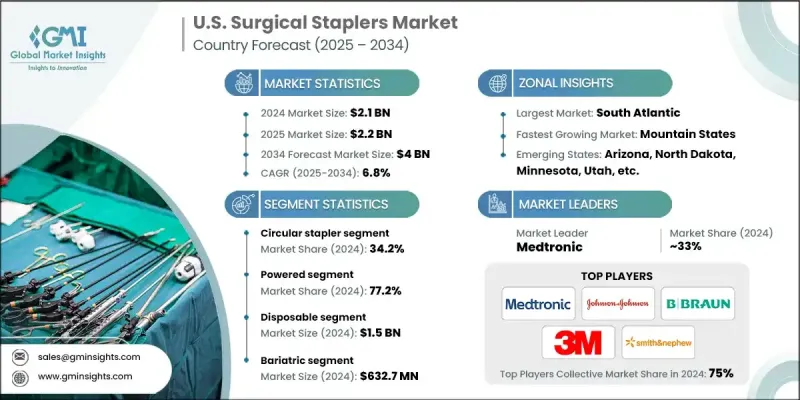

U.S. Surgical Staplers Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 4 billion by 2034.

With rising rates of chronic conditions like obesity, heart disease, and digestive disorders, more patients are undergoing surgical interventions that require precise and efficient wound closure. Surgical staplers offer several advantages over traditional sutures, such as reduced operating time, consistent closure strength, and minimized tissue trauma.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4 Billion |

| CAGR | 6.8% |

Rising Demand for Circular Stapler

The circular stapler segment held a notable share in 2024, driven by gastrointestinal tract surgeries, such as colorectal and gastric surgeries, where a precise end-to-end tissue connection is essential. These staplers enable uniform, airtight closures that support faster healing and reduce the risk of leaks or infection. In the U.S. market, hospitals increasingly favor circular staplers for their reliability in complex anastomoses.

Powered Sector to Gain Traction

The powered segment is poised to grow at a notable CAGR from 2025 to 2034, owing to its ability to deliver greater consistency, speed, and control compared to manual alternatives. These staplers help reduce hand fatigue for surgeons, improve staple formation, and are particularly valuable in minimally invasive and robotic surgeries. The demand is driven by a shift toward surgical precision and better ergonomic support in high-volume operating rooms.

Disposable Segment

Disposable surgical staplers continue to dominate in terms of volume, particularly due to their infection control benefits and convenience in fast-paced surgical environments. These single-use devices eliminate the need for sterilization, reduce the risk of cross-contamination, and simplify logistics in outpatient and emergency procedures. As hospitals place growing emphasis on infection prevention and cost containment, the demand for high-performance disposable staplers is rising.

South Atlantic to Emerge as a Lucrative Region

South Atlantic surgical staplers market held a significant share in 2024, driven by a high concentration of healthcare facilities and a growing elderly population. This region sees a steady flow of elective and chronic disease-related surgeries, creating consistent demand for advanced stapling devices. Hospitals and ambulatory surgical centers are seeking staplers that enhance speed and surgical outcomes, particularly for cardiovascular, gastrointestinal, and bariatric procedures.

Major players in the U.S. surgical staplers market are CooperSurgical, Smith+Nephew, REACH SURGICAL, INTUITIVE, 3M, HOLOGIC, Medtronic, LEXINGTON MEDICAL, B BRAUN, Johnson & Johnson, INTEGRA, Dextera, and CONMED.

To reinforce their market presence, leading surgical stapler manufacturers in the U.S. are focusing on a mix of product innovation, clinical partnerships, and service-oriented sales models. Companies are developing next-generation staplers with powered mechanisms, integrated safety features, and enhanced precision for both open and minimally invasive procedures.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.3.2 Zone/State

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Usability trends

- 2.2.5 Surgery trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in the number of surgical procedures

- 3.2.1.2 Shift toward minimally invasive surgery

- 3.2.1.3 Rising adoption of staplers over sutures

- 3.2.1.4 Technological advancements in surgical staplers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse events and product malfunctions associated with surgical staplers

- 3.2.2.2 High cost of advanced staplers

- 3.2.3 Market opportunities

- 3.2.3.1 Introduction of robot-compatible staplers

- 3.2.3.2 Adoption of customized and specialty staplers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Consumer behaviour and trends

- 3.9 Pricing analysis, 2024

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Investment landscape

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Linear stapler

- 5.3 Circular stapler

- 5.4 Skin stapler

- 5.5 Endoscopic stapler

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Powered

Chapter 7 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Reusable

- 7.3 Disposable

Chapter 8 Market Estimates and Forecast, By Surgery, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Gynaecology

- 8.3 Cardiac

- 8.4 Bariatric

- 8.5 Colorectal

- 8.6 Other surgeries

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 East North Central

- 10.2.1 Illinois

- 10.2.2 Indiana

- 10.2.3 Michigan

- 10.2.4 Ohio

- 10.2.5 Wisconsin

- 10.3 West South Central

- 10.3.1 Arkansas

- 10.3.2 Louisiana

- 10.3.3 Oklahoma

- 10.3.4 Texas

- 10.4 South Atlantic

- 10.4.1 Delaware

- 10.4.2 Florida

- 10.4.3 Georgia

- 10.4.4 Maryland

- 10.4.5 North Carolina

- 10.4.6 South Carolina

- 10.4.7 Virginia

- 10.4.8 West Virginia

- 10.4.9 Washington, D.C.

- 10.5 Northeast

- 10.5.1 Connecticut

- 10.5.2 Maine

- 10.5.3 Massachusetts

- 10.5.4 New Hampshire

- 10.5.5 Rhode Island

- 10.5.6 Vermont

- 10.5.7 New Jersey

- 10.5.8 New York

- 10.5.9 Pennsylvania

- 10.6 East South Central

- 10.6.1 Alabama

- 10.6.2 Kentucky

- 10.6.3 Mississippi

- 10.6.4 Tennessee

- 10.7 West North Central

- 10.7.1 Iowa

- 10.7.2 Kansas

- 10.7.3 Minnesota

- 10.7.4 Missouri

- 10.7.5 Nebraska

- 10.7.6 North Dakota

- 10.7.7 South Dakota

- 10.8 Pacific Central

- 10.8.1 Alaska

- 10.8.2 California

- 10.8.3 Hawaii

- 10.8.4 Oregon

- 10.8.5 Washington

- 10.9 Mountain States

- 10.9.1 Arizona

- 10.9.2 Colorado

- 10.9.3 Utah

- 10.9.4 Nevada

- 10.9.5 New Mexico

- 10.9.6 Idaho

- 10.9.7 Montana

- 10.9.8 Wyoming

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 B BRAUN

- 11.3 CONMED

- 11.4 CooperSurgical

- 11.5 Dextera

- 11.6 HOLOGIC

- 11.7 INTEGRA

- 11.8 INTUITIVE

- 11.9 Johnson & Johnson

- 11.10 LEXINTON MEDICAL

- 11.11 Medtronic

- 11.12 REACH SURGICAL

- 11.13 Smith+Nephew