PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801945

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801945

AI Server Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

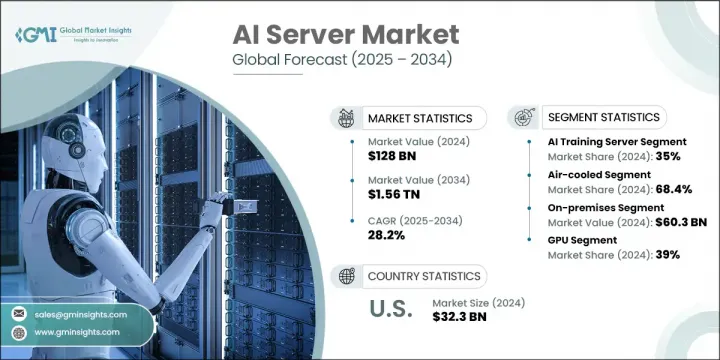

The Global AI Server Market was valued at USD 128 billion in 2024 and is estimated to grow at a CAGR of 28.2% to reach USD 1.56 trillion by 2034. This surge is being fueled by the rapid adoption of AI technologies across various industries and the growing requirement for robust servers to support increasingly complex AI-driven workloads. As AI continues to transform sectors such as manufacturing, finance, and healthcare, demand for high-performance computing infrastructure is surging. The rise of hybrid environments, edge deployments, and real-time data processing further supports the upward trajectory of AI server demand. Enhanced focus on generative AI, predictive analytics, and automation in enterprise operations is pushing organizations to invest heavily in AI-optimized infrastructure, driving both revenue and technological innovation in this space.

North America remains the front runner in AI server deployment, supported by an established ecosystem of cloud providers and AI semiconductor firms. The region benefits from strong institutional investments and government-backed AI initiatives, enabling sustained innovation. Edge AI computing has emerged as a transformative trend in the market, especially in data-intensive verticals such as healthcare, smart industry, and automated systems. These use cases require compact, power-efficient servers with specialized AI accelerators for on-site data processing, eliminating the need to rely heavily on centralized cloud networks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128 Billion |

| Forecast Value | $1.56 Trillion |

| CAGR | 28.2% |

The AI training servers segment held 35% share in 2024 and is projected to grow at a CAGR of 26% between 2025 and 2034. The segment is gaining momentum as more organizations adopt advanced machine learning, computer vision, and generative AI systems. These high-performance servers, equipped with AI-specific processors and GPUs, are crucial for handling large datasets and complex training models. Increased spending from enterprises and research institutions is reinforcing the growth of this segment, as AI training becomes integral to innovation and competitive strategy.

The air-cooled AI servers segment held 68.4% share in 2024 and is expected to grow at a 27% CAGR through 2034. These systems continue to dominate due to their straightforward installation, lower costs, and simpler maintenance requirements. Technological advancements in airflow management, thermal control, and chassis design have allowed these servers to support more dense AI workloads, making them ideal for deployment in edge environments or enterprise facilities with limited infrastructure resources.

United States AI Server Market generated USD 32.3 billion in 2024 and held 80% share. Growth is strongly influenced by the integration of AI-driven robotics and automation in manufacturing environments. As production of next-generation servers becomes increasingly complex, manufacturers are leveraging automation to streamline operations, improve accuracy, and cut down on labor costs. The push for scalable, high-efficiency AI infrastructure is reshaping factory floors, emphasizing the role of intelligent machines in building the very systems that drive AI forward.

The major companies shaping the Global AI Server Market include Microsoft, Dell, Fujitsu, Nvidia, IBM, Super Micro Computer, and Hewlett Packard Enterprise. To secure stronger market positions, companies in the AI server space are focusing on multi-pronged strategies. This includes expanding their AI server portfolios to cater to both training and inference applications and developing energy-efficient cooling solutions. Leading firms are collaborating with AI software vendors and semiconductor producers to deliver fully optimized systems. Several players are increasing investments in localized manufacturing and automation to meet rising regional demand while reducing supply chain risk. Cloud integration, scalable design, and rapid deployment capabilities remain central to product innovation strategies, along with strategic alliances to penetrate high-growth verticals such as healthcare, finance, and autonomous systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Data mining sources

- 1.2.1 Global

- 1.2.2 Regional/Country

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Hardware providers

- 3.1.1.4 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.2.1 Current technologies

- 3.2.1.1 GPU and AI accelerator evolution

- 3.2.1.2 Liquid cooling system and advanced thermal management

- 3.2.1.3 High-bandwidth memory (HBM) and advanced memory technology

- 3.2.1.4 Power edge AI and distributed computing

- 3.2.2 Emerging technologies

- 3.2.2.1 Quantum computing integration

- 3.2.2.2 Neuromorphic computing and brain-inspired processor

- 3.2.2.3 Photonic computing and optical interconnects

- 3.2.2.4 AI-Specific Silicon and Custom ASICs

- 3.2.3 Innovation ecosystem and partnerships

- 3.2.3.1 Technology partnership strategy

- 3.2.3.2 Innovation acceleration mechanisms

- 3.2.1 Current technologies

- 3.3 Patent analysis

- 3.4 Pricing analysis

- 3.5 Cost structure analysis

- 3.6 Key news and initiatives

- 3.7 Regulatory landscape

- 3.8 AI server trends, 2020-2024

- 3.9 Cost structure breakdown by cooling

- 3.10 Average lifespan of AI servers

- 3.11 Server procurement volume by CSPs and OEMs, 2020-2024

- 3.12 Regional AI server deployment by CSPs and OEMs, 2020-2024

- 3.13 AI server product integration: In-house vs outsourced, 2020-2024

- 3.14 Power consumption by server

- 3.15 Maintenance cost: OEM vs. third party

- 3.16 Failure rate by component

- 3.17 AI server market case studies

- 3.17.1 Microsoft's Azure AI infrastructure transformation

- 3.17.2 Google's TPU-based custom silicon strategy

- 3.17.3 Tesla's AI training infrastructure for full self-driving

- 3.18 Future outlook and recommendations

- 3.18.1 Market transformation and growth trajectory

- 3.18.2 Strategic infrastructure recommendations

- 3.18.3 Regulatory compliance and sustainability framework

- 3.18.4 Long-term success strategies and ecosystem development

- 3.19 Impact forces

- 3.19.1 Growth drivers

- 3.19.1.1 Explosive enterprise AI adoption and proven return on investment

- 3.19.1.2 Massive cloud infrastructure expansion and investment

- 3.19.1.3 Edge computing growth and real-time processing demands

- 3.19.1.4 High-performance computing requirements for AI workloads

- 3.19.2 Industry pitfalls & challenges

- 3.19.2.1 Astronomical infrastructure costs and power consumption

- 3.19.2.2 Critical skills shortage and technical complexity

- 3.19.3 Regulatory compliance and data sovereignty requirements

- 3.19.1 Growth drivers

- 3.20 Growth potential analysis

- 3.21 Porter's analysis

- 3.22 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Server, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 AI data

- 5.3 AI training

- 5.4 AI inference

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Hardware, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ASIC

- 6.3 FPGA

- 6.4 GPU

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Cooling Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Air-cooled

- 7.2.1 Passive air cooling

- 7.2.2 Active air cooling

- 7.2.3 Precision air conditioning

- 7.2.4 Containment solutions

- 7.3 Liquid-cooled

- 7.3.1 Direct-to-chip

- 7.3.2 Immersion cooling

- 7.3.3 Single-phase

- 7.3.4 Two-phase

- 7.4 Hybrid cooling systems

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 IT & telecommunications

- 9.3 Transportation and automotive

- 9.4 BFSI

- 9.5 Retail and e-commerce

- 9.6 Healthcare and Pharmaceutical

- 9.7 Industrial Automation

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Cloud Service Provider (CSP)

- 10.4 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 North America

- 11.1.1 US

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Belgium

- 11.2.7 Netherlands

- 11.2.8 Sweden

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 Singapore

- 11.3.6 South Korea

- 11.3.7 Vietnam

- 11.3.8 Indonesia

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Global players

- 12.1.1 Advanced Micro Devices

- 12.1.2 Intel

- 12.1.3 NVIDIA

- 12.1.4 Cisco Systems

- 12.2 Server system manufacturers

- 12.2.1 Dell

- 12.2.2 Hewlett Packard Enterprise

- 12.2.3 Huawei

- 12.2.4 Inspur

- 12.2.5 International Business Machines

- 12.2.6 Lenovo

- 12.2.7 Super Micro Computer

- 12.3 Hyperscale and cloud providers

- 12.3.1 Amazon Web Services

- 12.3.2 Google

- 12.3.3 Microsoft

- 12.3.4 Oracle

- 12.4 Emerging and regional players

- 12.4.1 Foxconn (Hon Hai)

- 12.4.2 Fujitsu

- 12.4.3 Inventec

- 12.4.4 Quanta Computer

- 12.4.5 Wistron