PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892814

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892814

Ultra-High-Definition Panel 4K Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

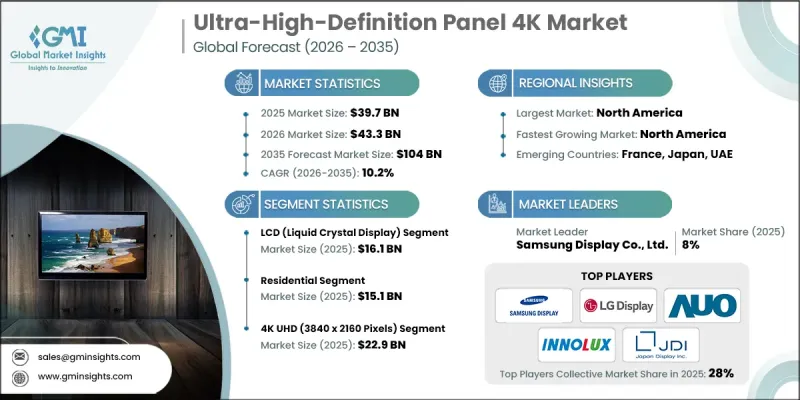

The Global Ultra-High-Definition Panel 4K Market was estimated at USD 39.7 billion in 2025 and is estimated to grow at a CAGR of 10.2% to reach USD 104 billion by 2035.

Market momentum is driven by the global shift toward richer visual quality and more immersive digital experiences across consumer and commercial environments. Continuous innovation in display engineering, combined with rising expectations for sharper resolution and color accuracy, is reshaping demand patterns. Manufacturers are increasingly investing in both large-scale fabrication plants and flexible localized assembly operations to deliver faster production cycles and customized panel solutions. This transformation is raising demand for advanced manufacturing systems capable of handling high-volume, precision-driven fabrication. As display performance benchmarks continue to rise, the market is also benefiting from the integration of next-generation panel architectures and high-efficiency components that enhance brightness, contrast, and power optimization. Streamlined logistics and faster movement of modular display units across the supply chain are becoming critical competitive differentiators. Together, these factors are positioning 4K UHD panels as a core technology underpinning modern digital viewing, entertainment, and professional display ecosystems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $39.7 Billion |

| Forecast Value | $104 Billion |

| CAGR | 10.2% |

The LCD segment generated USD 16.1 billion in 2025. Its leadership is supported by manufacturing scalability, consistent visual output, and cost efficiency, which continue to make it a preferred choice for high-volume production across a wide range of screen sizes.

The residential segment reached USD 15.1 billion in 2025. Demand is being supported by widespread household adoption of advanced display solutions that elevate everyday viewing and interactive experiences. Continuous upgrades in home entertainment ecosystems and the replacement of older displays are sustaining long-term growth.

United States Ultra-High-Definition Panel 4K Market is expected to account for 83% share, generating USD 12.2 billion in 2025. The region is anticipated to record the highest global CAGR of 11% from 2026 to 2035, driven by strong demand across premium consumer, hospitality, and commercial applications.

Key companies active in the Global Ultra-High-Definition Panel 4K Market include Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., AU Optronics Corp., TCL Technology, Sharp Corporation, Sony Corporation, Innolux Corporation, CSOT (China Star Optoelectronics Technology Co., Ltd.), Panasonic Corporation, Skyworth Group, Hisense Group, Japan Display Inc., Tianma Microelectronics Co., Ltd., ViewSonic Corporation, Vizio Inc., Xiaomi Corporation, Philips (TPV Technology), Haier Group, and Changhong Electric Co., Ltd. Companies in the Global Ultra-High-Definition Panel 4K Market are reinforcing their market position through sustained investment in next-generation display technologies, capacity expansion, and yield optimization. Strategic emphasis is placed on improving panel efficiency, enhancing visual performance, and reducing production costs through automation and advanced process control. Many players are strengthening partnerships with device manufacturers to secure long-term supply agreements and accelerate product integration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of 4K/UHD content & streaming services

- 3.2.1.2 Rapid growth in premium and large-format displays

- 3.2.1.3 Expansion of the gaming and esports market

- 3.2.1.4 Integration of smart home & AI features

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital expenditure (CapEx) for advanced fabs

- 3.2.2.2 Excess capacity and price erosion in commodity LCD

- 3.2.3 Opportunities

- 3.2.3.1 Advanced panel technologies (OLED, QD-OLED, mini-LED)

- 3.2.3.2 New application verticals (Automotive, IT)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Technology

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Consumer electronics

- 5.2.1 Televisions

- 5.2.2 Monitors

- 5.2.3 Laptops

- 5.2.4 Smartphones

- 5.2.5 Tablets

- 5.3 Commercial

- 5.3.1 Digital signage

- 5.3.2 Display walls

- 5.3.3 Advertising displays

- 5.4 Healthcare

- 5.4.1 Medical imaging displays

- 5.5 Education

- 5.5.1 Interactive whiteboards

- 5.5.2 Projectors

- 5.6 Automotive

- 5.6.1 In-car displays

- 5.6.2 Infotainment systems

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2022- 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 LCD (liquid crystal display)

- 6.2.1 LED-backlit LCD

- 6.2.2 Quantum dot (QLED)

- 6.3 OLED (organic light emitting diode)

- 6.3.1 Flexible OLED

- 6.3.2 Rigid OLED

- 6.4 MicroLED

- 6.4.1 Direct-view LED

- 6.4.2 Mini LED

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Resolution, 2022- 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 4K UHD (3840 x 2160 pixels)

- 7.3 8K UHD (7680 x 4320 pixels)

Chapter 8 Market Estimates and Forecast, By Size, 2022- 2035 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Below 40 inches

- 8.3 40-60 inches

- 8.4 Above 60 inches

Chapter 9 Market Estimates and Forecast, By End use, 2022- 2035 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2022- 2035 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 Italy

- 11.3.4 France

- 11.3.5 Russia

- 11.3.6 Belgium

- 11.3.7 Poland

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Indonesia

- 11.4.6 Malaysia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Century Plyboards

- 12.2 AU Optronics Corp. (AUO)

- 12.3 BOE Technology Group Co., Ltd.

- 12.4 Changhong Electric Co., Ltd.

- 12.5 CSOT (China Star Optoelectronics Technology Co., Ltd.)

- 12.6 Haier Group

- 12.7 Hisense Group

- 12.8 Innolux Corporation

- 12.9 Japan Display Inc.

- 12.10 LG Display Co., Ltd.

- 12.11 Panasonic Corporation

- 12.12 Philips (TPV Technology)

- 12.13 Samsung Display Co., Ltd.

- 12.14 Sharp Corporation

- 12.15 Skyworth Group

- 12.16 Sony Corporation

- 12.17 TCL Technology

- 12.18 Tianma Microelectronics Co., Ltd.

- 12.19 ViewSonic Corporation

- 12.20 Vizio Inc.

- 12.21 Xiaomi Corporation