PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822620

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822620

U.S. Commercial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

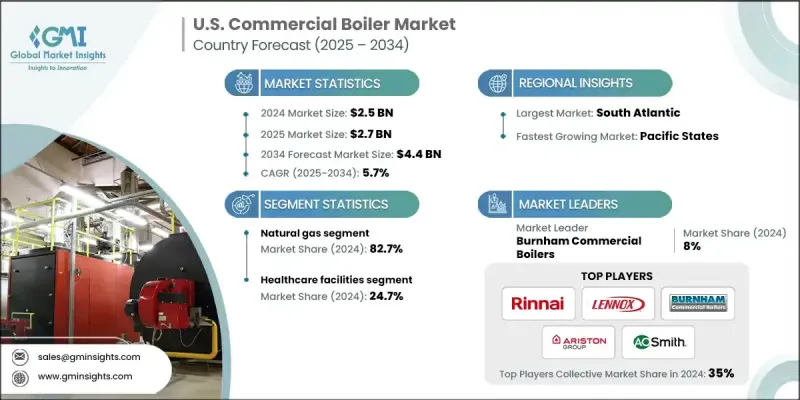

U.S. commercial boiler market was estimated at USD 2.5 billion in 2024 and is expected to grow from USD 2.7 billion in 2025 to USD 4.4 billion by 2034, at a CAGR of 5.7%, according to the latest report published by Global Market Insights Inc.

The growing emphasis on energy conservation and cost reduction is significantly influencing the U.S. commercial boiler market. As energy prices fluctuate and operational budgets tighten, businesses are prioritizing heating systems that offer long-term savings through improved efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 5.7% |

Rising Adoption of Natural Gas

The natural gas segment generated a notable share in 2024 owing to its combination of cost-efficiency, cleaner combustion, and widespread availability. Commercial establishments ranging from schools to office buildings are increasingly opting for natural gas-fired boilers to reduce emissions and meet state and federal efficiency standards. These systems offer faster heating capabilities, lower maintenance demands, and seamless integration with smart building technologies.

Healthcare Facilities to Gain Traction

The healthcare facilities held a significant share in 2024, driven by strict indoor air quality and temperature standards, making commercial boilers an essential component. The need for uninterrupted hot water, sterilization, and space heating has made high-efficiency boilers a key investment across the sector. With rising patient volumes and expanding medical campuses, many hospitals and clinics are upgrading to modular, low-emission boiler systems that offer redundancy and scalability. These systems help reduce operational costs while ensuring compliance with energy regulations, which is critical in environments where reliability and performance are non-negotiable.

South Atlantic to Emerge as a Lucrative Region

South Atlantic commercial boiler market held a sizeable share in 2024, driven by ongoing expansion in healthcare, education, and hospitality sectors. As the region's milder climate reduces heating demands compared to northern states, there remains a strong need for efficient boiler systems in large commercial and institutional buildings. Growth in urban development and population centers has created opportunities for new installations and retrofits alike.

Major players in the U.S. commercial boiler market held PB Heat, Hurst Boiler & Welding, Bosch Thermotechnology, Rinnai America, NTI Boilers, Clayton Industries, Lochinvar, Viessmann, Cleaver-Brooks, Columbia Heating Products, Thermal Solutions, Lennox International, U.S. Boiler Company, Miura America, Ariston Holding, Parker Boiler, A.O. Smith, Bradford White Corporation, Daikin Industries, Energy Kinetics, WM Technologies, Burnham Commercial Boilers, Fulton, Precision Boilers, AERCO, Navien, P.M. Lattner Manufacturing, Rentech Boiler Systems, Babcock & Wilcox Enterprises, and HTP.

To strengthen their foothold in the U.S. commercial boiler market, companies are prioritizing product innovation, energy efficiency, and digital integration. Many manufacturers are expanding their portfolio to include condensing and modular boiler systems that align with evolving emissions standards and deliver lower lifecycle costs. Partnerships with HVAC contractors and facility managers are also becoming more common, enabling faster deployment and tailored maintenance programs. In addition, firms are investing in training programs and regional distribution networks to improve customer service and technical support. By leveraging smart controls and IoT-enabled features, companies are positioning themselves as forward-thinking providers in a market increasingly driven by sustainability and system intelligence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research and validation

- 1.4 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

- 1.5.1.3 Sources, by region

- 1.5.1 Secondary

- 1.6 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Fuel trends

- 2.4 Capacity trends

- 2.5 Technology trends

- 2.6 Product trends

- 2.7 Application trends

- 2.8 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of commercial boilers

- 3.8 Price trend analysis

- 3.8.1 By capacity

- 3.8.2 By fuel

- 3.9 Future market outlook & emerging opportunities

- 3.10 Technology trends & innovations

- 3.10.1 Smart boiler integration & IoT connectivity

- 3.10.2 Advanced materials & durability improvements

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.2.1 Major M&A activities

- 4.2.2 Key partnerships and collaborations

- 4.2.3 Product innovations and launches

- 4.2.4 Market expansion strategies

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 Natural gas

- 5.3 Oil

- 5.4 Coal

- 5.5 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 ≤ 0.3 - 2.5 MMBTU/hr

- 6.3 > 2.5 - 10 MMBTU/hr

- 6.4 > 10 - 50 MMBTU/hr

- 6.5 > 50 - 100 MMBTU/hr

- 6.6 > 100 - 250 MMBTU/hr

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Hot water

- 8.3 Steam

Chapter 9 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 Offices

- 9.3 Healthcare facilities

- 9.4 Educational institutions

- 9.5 Lodgings

- 9.6 Retail stores

- 9.7 Others

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 10.1 Key trends

- 10.2 East North Central

- 10.2.1 Illinois

- 10.2.2 Indiana

- 10.2.3 Michigan

- 10.2.4 Ohio

- 10.2.5 Wisconsin

- 10.3 West South Central

- 10.3.1 Arkansas

- 10.3.2 Louisiana

- 10.3.3 Oklahoma

- 10.3.4 Texas

- 10.4 South Atlantic

- 10.4.1 Delaware

- 10.4.2 Florida

- 10.4.3 Georgia

- 10.4.4 Maryland

- 10.4.5 North Carolina

- 10.4.6 South Carolina

- 10.4.7 Virginia

- 10.4.8 West Virginia

- 10.4.9 Washington D.C.

- 10.5 North East

- 10.5.1 Connecticut

- 10.5.2 Maine

- 10.5.3 Massachusetts

- 10.5.4 New Hampshire

- 10.5.5 Rhode Island

- 10.5.6 Vermont

- 10.5.7 New Jersey

- 10.5.8 New York

- 10.5.9 Pennsylvania

- 10.6 East South Central

- 10.6.1 Alabama

- 10.6.2 Kentucky

- 10.6.3 Mississippi

- 10.6.4 Tennessee

- 10.7 West North Central

- 10.7.1 Iowa

- 10.7.2 Kansas

- 10.7.3 Minnesota

- 10.7.4 Missouri

- 10.7.5 Nebraska

- 10.7.6 North Dakota

- 10.7.7 South Dakota

- 10.8 Pacific States

- 10.8.1 Alaska

- 10.8.2 California

- 10.8.3 Hawaii

- 10.8.4 Oregon

- 10.8.5 Washington

- 10.9 Mountain States

- 10.9.1 Arizona

- 10.9.2 Colorado

- 10.9.3 Utah

- 10.9.4 Nevada

- 10.9.5 New Mexico

- 10.9.6 Idaho

- 10.9.7 Montana

- 10.9.8 Wyoming

Chapter 11 Company Profiles

- 11.1 A.O. Smith

- 11.2 AERCO

- 11.3 Ariston Holding

- 11.4 Babcock & Wilcox Enterprises

- 11.5 Bosch Thermotechnology

- 11.6 Bradford White Corporation

- 11.7 Burnham Commercial Boilers

- 11.8 Clayton Industries

- 11.9 Cleaver-Brooks

- 11.10 Columbia Heating Products

- 11.11 Daikin Industries

- 11.12 Energy Kinetics

- 11.13 Fulton

- 11.14 HTP

- 11.15 Hurst Boiler & Welding

- 11.16 Lennox International

- 11.17 Lochinvar

- 11.18 Miura America

- 11.19 Navien

- 11.20 NTI Boilers

- 11.21 P.M. Lattner Manufacturing

- 11.22 Parker Boiler

- 11.23 PB Heat

- 11.24 Precision Boilers

- 11.25 Rentech Boiler Systems

- 11.26 Rinnai America

- 11.27 Thermal Solutions

- 11.28 U.S. Boiler Company

- 11.29 Viessmann

- 11.30 WM Technologies