PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833623

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833623

U.S. Intrauterine Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

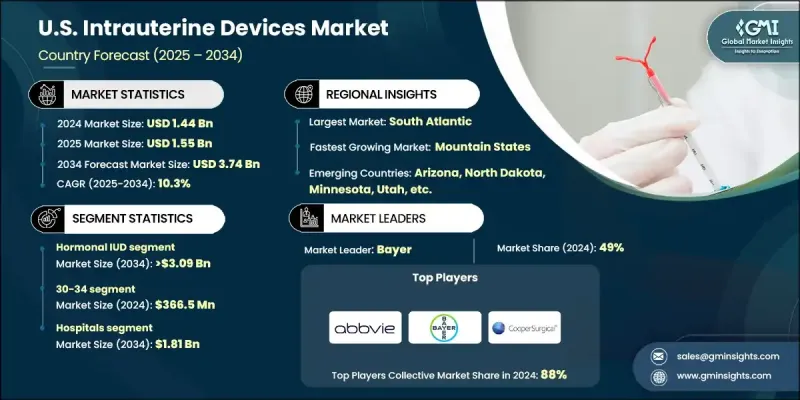

U.S. Intrauterine Devices Market was valued at USD 1.44 billion in 2024 and is estimated to grow at a CAGR of 10.3% to reach USD 3.74 billion by 2034.

Market growth is supported by favorable regulatory measures, growing awareness among women regarding contraceptive options, and the increasing rate of unintended pregnancies. Intrauterine devices are widely recognized as a reliable, reversible, and long-term form of contraception, making them an important component of reproductive healthcare. Their effectiveness and minimal maintenance have made them a preferred choice, while continuing research and technological progress have further enhanced safety and patient experience. The shift toward personalized care and expanding access through healthcare systems is also supporting the steady expansion of this market. Increasing provider training, wider acceptance of long-acting reversible contraception, and supportive public health programs continue to create opportunities for higher adoption across diverse demographics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.44 Billion |

| Forecast Value | $3.74 Billion |

| CAGR | 10.3% |

Advancements in product design have been significant, with softer and more flexible materials introduced to improve comfort and reduce complications during insertion. Updated designs with streamlined shapes and easier insertion tools have also enhanced accessibility for both patients and healthcare professionals. The development of hormonal intrauterine devices has reshaped contraceptive care by offering localized hormone release, which minimizes systemic side effects and provides additional health benefits.

The hormonal IUD segment held an 83% share in 2024, supported by high effectiveness, extended protection, and benefits such as lighter menstrual bleeding and reduced cramps. Many users also experience reduced or absent menstruation, which provides therapeutic relief for those with heavy or painful cycles. Healthcare providers favor hormonal options due to their proven safety profile compared to systemic contraceptive methods.

The hospitals segment held a 48.9% share in 2024 and is projected to generate USD 1.81 billion through 2034. Hospitals play a vital role in delivering long-acting contraceptive care, with trained specialists ensuring safe insertion and removal procedures. The increasing adoption of same-day IUD placement, especially postpartum, has expanded access while helping reduce unintended pregnancies nationwide.

South Atlantic Intrauterine Devices Market held 20.1% share in 2024, driven by a strong healthcare network and the availability of specialized centers for women's health. The region benefits from higher training levels in long-acting contraception, with support from national organizations and regional health programs that emphasize accessibility and quality of care.

Key players active in the U.S. Intrauterine Devices Industry include AbbVie, Sebela Pharmaceuticals, Bayer, Medicines360, DKT, and CooperSurgical. To strengthen their foothold in the U.S. intrauterine devices market, companies are focusing on several strategies. Major players are investing heavily in R&D to design next-generation devices with improved comfort, safety, and long-term efficacy. They are expanding collaborations with healthcare providers to promote awareness and adoption of IUDs, while also enhancing distribution networks to ensure better access across hospitals and clinics. Educational initiatives targeted at both physicians and patients are being prioritized to dispel misconceptions and highlight the advantages of long-acting contraception.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.3.2 Zone/State

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Product trends

- 2.2.3 Age group trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favorable regulatory scenario

- 3.2.1.2 Rising awareness among women regarding various IUD applications

- 3.2.1.3 High number of unintended pregnancies

- 3.2.1.4 Government initiatives for the prevention of unwanted abortions and pregnancies

- 3.2.1.5 Growing inclination towards planned delayed pregnancy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the device

- 3.2.2.2 Risk of several health issues

- 3.2.2.3 Variability in insurance coverage and access

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for long-term contraception

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.5.1 Current technologies

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Reimbursement scenario

- 3.8 Consumer behaviour and trends

- 3.9 Brand analysis

- 3.10 Pipeline analysis

- 3.11 U.S. intrauterine device units sold, by brand, 2021 - 2034

- 3.12 Therapeutic applications beyond contraception

- 3.13 Pricing analysis, 2024

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

- 3.16 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Copper IUD

- 5.3 Hormonal IUD

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 15-19

- 6.3 20-24

- 6.4 25-29

- 6.5 30-34

- 6.6 35-39

- 6.7 40-44

- 6.8 45+

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Gynecology clinics

- 7.4 Community health care centers

Chapter 8 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 East North Central

- 8.2.1 Illinois

- 8.2.2 Indiana

- 8.2.3 Michigan

- 8.2.4 Ohio

- 8.2.5 Wisconsin

- 8.3 West South Central

- 8.3.1 Arkansas

- 8.3.2 Louisiana

- 8.3.3 Oklahoma

- 8.3.4 Texas

- 8.4 South Atlantic

- 8.4.1 Delaware

- 8.4.2 Florida

- 8.4.3 Georgia

- 8.4.4 Maryland

- 8.4.5 North Carolina

- 8.4.6 South Carolina

- 8.4.7 Virginia

- 8.4.8 West Virginia

- 8.4.9 Washington, D.C.

- 8.5 Northeast

- 8.5.1 Connecticut

- 8.5.2 Maine

- 8.5.3 Massachusetts

- 8.5.4 New Hampshire

- 8.5.5 Rhode Island

- 8.5.6 Vermont

- 8.5.7 New Jersey

- 8.5.8 New York

- 8.5.9 Pennsylvania

- 8.6 East South Central

- 8.6.1 Alabama

- 8.6.2 Kentucky

- 8.6.3 Mississippi

- 8.6.4 Tennessee

- 8.7 West North Central

- 8.7.1 Iowa

- 8.7.2 Kansas

- 8.7.3 Minnesota

- 8.7.4 Missouri

- 8.7.5 Nebraska

- 8.7.6 North Dakota

- 8.7.7 South Dakota

- 8.8 Pacific Central

- 8.8.1 Alaska

- 8.8.2 California

- 8.8.3 Hawaii

- 8.8.4 Oregon

- 8.8.5 Washington

- 8.9 Mountain States

- 8.9.1 Arizona

- 8.9.2 Colorado

- 8.9.3 Utah

- 8.9.4 Nevada

- 8.9.5 New Mexico

- 8.9.6 Idaho

- 8.9.7 Montana

- 8.9.8 Wyoming

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Bayer

- 9.3 CooperSurgical

- 9.4 DKT

- 9.5 Medicines360

- 9.6 Sebela Pharmaceuticals