PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716449

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716449

Companion Animal Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

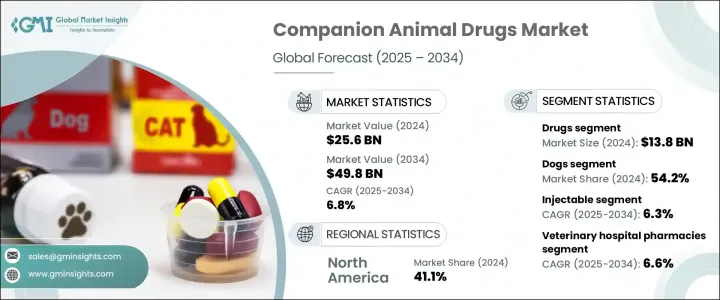

The Global Companion Animal Drugs Market was valued at USD 25.6 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2034. The increasing adoption of companion animals, the rising prevalence of chronic diseases in pets, and the growing willingness of pet owners to invest in advanced treatments and veterinary care are fueling this growth. Pet owners increasingly perceive their animals as family members, prompting them to spend on preventive care, vaccinations, and medications to ensure their well-being. This shift in attitude has contributed significantly to the expansion of the market. As veterinary science continues to advance, innovative formulations, targeted therapies, and improved drug delivery methods are enhancing treatment efficacy and compliance among pet owners, thereby accelerating market growth.

The drugs segment, which accounted for the highest market share of USD 13.8 billion in 2024, continues to dominate the market due to the rising incidence of chronic diseases and infections in pets. Increased pet ownership and the growing trend of pet humanization have boosted the demand for antibiotics, anti-inflammatory drugs, and parasiticides. Pharmaceutical companies are actively investing in research and development to introduce novel formulations such as chewable tablets and flavored medications, making administration easier and improving compliance. Regulatory approvals and innovations in veterinary medicine have also played a pivotal role in driving the sustained growth of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $25.6 Billion |

| Forecast Value | $49.8 Billion |

| CAGR | 6.8% |

By animal type, the dogs segment maintained the largest revenue share of 54.2% in 2024, driven by high adoption rates and increased spending on dog care. Growing awareness of chronic diseases among dogs, such as cancer and diabetes, has led to a higher demand for advanced treatments and medications. The rising prevalence of these conditions highlights the need for effective therapies, encouraging pharmaceutical companies to develop specialized drugs targeting canine health. The availability of comprehensive healthcare options and increased expenditure by pet owners further bolster segment growth.

The injectable route of administration, which held the largest market share in 2024, is anticipated to witness significant growth at a CAGR of 6.3% during the forecast period. Injectable drugs, including vaccines, antibiotics, and analgesics, offer rapid onset of action and precise dosing, making them ideal for emergency treatments. Advancements in injectable drug delivery technologies and the introduction of needle-free injectors have enhanced convenience and reduced stress for both pets and their owners, contributing to the growing preference for this route.

Veterinary hospital pharmacies dominated the distribution channel in 2024 and are projected to grow at a CAGR of 6.6% from 2025 to 2034. These pharmacies offer a wide range of animal healthcare products, including prescription drugs, vaccines, and supplements, making them a reliable source for pet owners. Their established reputation, quality assurance, and expertise in dispensing medications drive their continued dominance in the market.

North America accounted for the largest market share of 41.1% in 2024, with the U.S. generating USD 9.1 billion in revenue. The region benefits from a well-developed veterinary healthcare system, high pet ownership rates, and increased spending on pet healthcare, supporting the continuous growth of the companion animal drugs market. The presence of leading pharmaceutical companies further ensures a steady supply of innovative and effective drugs, driving the expansion of the market in this region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surging demand for pet insurance policies worldwide

- 3.2.1.2 Rising rate of obesity in companion animals

- 3.2.1.3 Increasing government support for pet care across the globe

- 3.2.1.4 Growing demand for online veterinary pharmacies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with companion animal drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 GAP analysis

- 3.6 Consumer behaviour trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Drugs

- 5.2.1 Antiparasitic

- 5.2.2 Anti-inflammatory

- 5.2.3 Anti-infectives

- 5.2.4 Corticosteroids

- 5.2.5 Tranquilizers

- 5.2.6 Cardiovascular drugs

- 5.2.7 Gastrointestinal drugs

- 5.3 Vaccines

- 5.3.1 Modified live vaccines (MLV)

- 5.3.2 Killed inactivated vaccines

- 5.3.3 Recombinant vaccines

- 5.4 Medicated feed additives

- 5.4.1 Antibiotics

- 5.4.2 Vitamins

- 5.4.3 Amino acids

- 5.4.4 Enzymes

- 5.4.5 Antioxidants

- 5.4.6 Prebiotics and probiotics

- 5.4.7 Minerals

- 5.4.8 Carbohydrates

- 5.4.9 Propandiol

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Horses

- 6.5 Other animal types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

- 7.4 Topical

- 7.5 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 E-commerce

- 8.4 Retail pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Poland

- 9.3.7 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Taiwan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 GCC Countries

- 9.6.3 Israel

Chapter 10 Company Profiles

- 10.1 Agrolabo

- 10.2 Boehringer Ingelheim International

- 10.3 Ceva Sante Animale

- 10.4 Chanelle Pharma

- 10.5 Dechra Pharmaceuticals

- 10.6 Elanco Animal Health Incorporated

- 10.7 Endovac Animal Health

- 10.8 HIPRA

- 10.9 Indian Immunologicals

- 10.10 Merck.

- 10.11 Norbrook

- 10.12 Symrise

- 10.13 Vetoquinol

- 10.14 Virbac

- 10.15 Zoetis