PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801899

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801899

Smart Faucet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

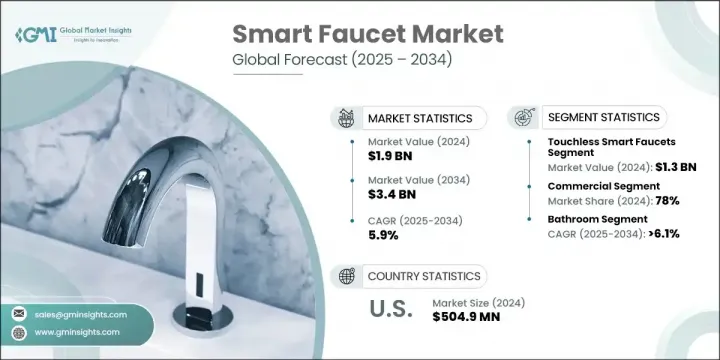

The Global Smart Faucet Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 3.4 billion by 2034. This growth is being fueled by rising concerns around water efficiency and the increasing push for eco-conscious solutions. Consumers and businesses alike are prioritizing technologies that help minimize water waste while supporting sustainability goals. Smart faucets have become a sought-after innovation, delivering water-saving features combined with user-friendly control and intelligent automation. The integration of sensor-based systems, voice-enabled commands, and IoT capabilities enhances convenience and aligns with the expanding smart home trend.

The rising demand is also linked to heightened hygiene awareness, with touch-free operation becoming a critical feature across residential, commercial, and healthcare environments. These faucets offer a cleaner, safer user experience by eliminating physical contact. Urbanization and ongoing construction activity continue to elevate demand for smart water fixtures in modern residential and commercial developments. Property owners are increasingly turning to premium, tech-enabled solutions that help conserve resources while also enhancing the value of built environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 5.9% |

The touchless smart faucets generated USD 1.3 billion in 2024 and is anticipated to grow at a CAGR of 6.1% throughout 2034. This segment leads the market thanks to its hygiene-first design, which appeals to users prioritizing health safety. These systems activate water flow automatically using motion sensors, eliminating physical interaction and reducing cross-contamination. With cleanliness now a critical factor in both public and private spaces, hands-free faucet systems are being adopted widely, supporting their continued dominance in the market.

The commercial sector held 78% share in 2024 and is projected to grow at a CAGR of 5.8% through 2034. Smart faucets in commercial applications help facilities reduce operating costs by controlling water usage and lowering energy consumption. Businesses in high-traffic spaces such as hotels, public restrooms, office buildings, and hospitals are adopting these systems to enhance efficiency while improving user experience. These faucets help prevent leaks, optimize maintenance, and offer long-term cost savings-making them a practical upgrade across commercial operations.

United States Smart Faucet Market accounted for 77% share and generated USD 504.9 million in 2024. Growth in the U.S. is supported by strong consumer interest in home automation, robust infrastructure, and favorable regulatory initiatives. A high level of smart home integration has positioned the country at the forefront of adoption, with homeowners embracing intelligent water fixtures as part of their connected living environments. Features such as voice activation, remote app monitoring, and water usage analytics continue to drive consumer interest and strengthen market penetration.

Key manufacturers in the Global Smart Faucet Market include LIXIL, Delta Faucet, TOTO, Moen, Hansgrohe, Masco, Kohler, Roca Sanitario, ASSA ABLOY, House of Rohl, KWC, Oras, BRIZO Kitchen & Bath, Gessi, and Villeroy & Boch. Top companies in the smart faucet market are focusing on innovation, design, and smart technology integration to expand their market share. Investments in AI, motion sensors, and voice control capabilities are central to product development strategies. Leading players are also strengthening brand presence through partnerships with real estate developers, hospitality chains, and public infrastructure projects. Product lines are increasingly being tailored to offer energy efficiency, water conservation, and ease of installation-catering to both end consumers and commercial buyers.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 By type

- 2.2.3 By material

- 2.2.4 By application

- 2.2.5 By end use

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Touchless smart faucets

- 5.3 Touch-enabled smart faucets

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Metallic

- 6.3 Plastic

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Million Units)

- 7.1 Bathroom

- 7.2 Kitchen

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Hotels & restaurants

- 8.3.2 Hospitals

- 8.3.3 Corporate offices

- 8.3.4 Public washrooms

- 8.3.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Supermarkets/hypermarket

- 9.3.2 Specialty retail stores

- 9.3.3 Others (independent retailer etc.)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ASSA ABLOY

- 11.2 BRIZO Kitchen & Bath

- 11.3 Delta Faucet

- 11.4 Gessi

- 11.5 Hansgrohe

- 11.6 House of Rohl

- 11.7 Kohler

- 11.8 KWC

- 11.9 LIXIL

- 11.10 Masco

- 11.11 Moen

- 11.12 Oras

- 11.13 Roca Sanitario

- 11.14 TOTO

- 11.15 Villeroy & Boch